| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112203000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5212131020 | Doc | 71.5% | CN | US | 2025-05-12 |

| 5212231020 | Doc | 71.5% | CN | US | 2025-05-12 |

| 5205220020 | Doc | 62.3% | CN | US | 2025-05-12 |

| 5112203000 | Doc | 80.0% | CN | US | 2025-05-12 |

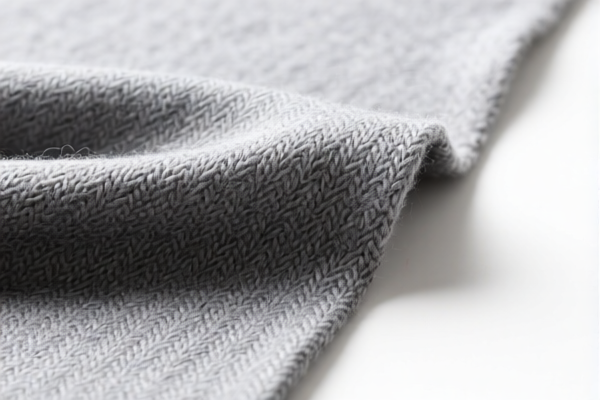

Product Name: Cotton Mixed Combed Wool Apparel Fabric

Classification HS Code Analysis:

✅ HS CODE: 5112203000

Description: Mixed combed wool woven fabric for apparel (suiting fabric)

Total Tax Rate: 80.0%

Tax Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This is the most common HS code for mixed combed wool fabric used in clothing.

- The high tax rate is due to the combination of wool and cotton, which is subject to higher import duties.

- Alert: The additional 30% tariff applies after April 11, 2025. Ensure compliance with updated regulations.

✅ HS CODE: 5212131020

Description: Combed cotton mixed with wool, woven fabric for apparel

Total Tax Rate: 71.5%

Tax Breakdown:

- Base Tariff: 16.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to fabrics with a higher proportion of cotton compared to wool.

- The base tariff is lower than 5112203000, but the total tax is still high due to the additional and special tariffs.

- Alert: The 30% special tariff applies after April 11, 2025.

✅ HS CODE: 5212231020

Description: Combed cotton mixed with wool, woven fabric for apparel

Total Tax Rate: 71.5%

Tax Breakdown:

- Base Tariff: 16.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Similar to 5212131020, this code is for cotton-wool blends used in apparel.

- The tax structure is identical to 5212131020.

- Alert: The 30% special tariff applies after April 11, 2025.

✅ HS CODE: 5205220020

Description: Combed cotton yarn for woven fabric

Total Tax Rate: 62.3%

Tax Breakdown:

- Base Tariff: 7.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for raw cotton yarn used in fabric production, not finished apparel fabric.

- The base tariff is significantly lower, but the total tax is still high due to the additional and special tariffs.

- Alert: The 30% special tariff applies after April 11, 2025.

✅ HS CODE: 5112203000 (Duplicate Entry)

Description: Mixed combed wool woven fabric for apparel

Total Tax Rate: 80.0%

Tax Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This is a duplicate entry of the first HS code. Ensure that the product is correctly classified and not double-counted in documentation.

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm the exact percentage of cotton and wool in the fabric to ensure correct HS code classification.

- Check Unit Price: High tax rates may affect the final product cost. Consider sourcing or pricing strategies.

- Certifications Required: Some countries may require specific certifications (e.g., origin, textile standards) for import compliance.

- Monitor Tariff Changes: The 30% special tariff after April 11, 2025, is time-sensitive. Ensure your import timeline aligns with these regulations.

- Consult Customs Broker: For complex classifications, seek professional advice to avoid delays or penalties.

Let me know if you need help with customs documentation or tariff calculation tools.

Product Name: Cotton Mixed Combed Wool Apparel Fabric

Classification HS Code Analysis:

✅ HS CODE: 5112203000

Description: Mixed combed wool woven fabric for apparel (suiting fabric)

Total Tax Rate: 80.0%

Tax Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This is the most common HS code for mixed combed wool fabric used in clothing.

- The high tax rate is due to the combination of wool and cotton, which is subject to higher import duties.

- Alert: The additional 30% tariff applies after April 11, 2025. Ensure compliance with updated regulations.

✅ HS CODE: 5212131020

Description: Combed cotton mixed with wool, woven fabric for apparel

Total Tax Rate: 71.5%

Tax Breakdown:

- Base Tariff: 16.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to fabrics with a higher proportion of cotton compared to wool.

- The base tariff is lower than 5112203000, but the total tax is still high due to the additional and special tariffs.

- Alert: The 30% special tariff applies after April 11, 2025.

✅ HS CODE: 5212231020

Description: Combed cotton mixed with wool, woven fabric for apparel

Total Tax Rate: 71.5%

Tax Breakdown:

- Base Tariff: 16.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Similar to 5212131020, this code is for cotton-wool blends used in apparel.

- The tax structure is identical to 5212131020.

- Alert: The 30% special tariff applies after April 11, 2025.

✅ HS CODE: 5205220020

Description: Combed cotton yarn for woven fabric

Total Tax Rate: 62.3%

Tax Breakdown:

- Base Tariff: 7.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for raw cotton yarn used in fabric production, not finished apparel fabric.

- The base tariff is significantly lower, but the total tax is still high due to the additional and special tariffs.

- Alert: The 30% special tariff applies after April 11, 2025.

✅ HS CODE: 5112203000 (Duplicate Entry)

Description: Mixed combed wool woven fabric for apparel

Total Tax Rate: 80.0%

Tax Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This is a duplicate entry of the first HS code. Ensure that the product is correctly classified and not double-counted in documentation.

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm the exact percentage of cotton and wool in the fabric to ensure correct HS code classification.

- Check Unit Price: High tax rates may affect the final product cost. Consider sourcing or pricing strategies.

- Certifications Required: Some countries may require specific certifications (e.g., origin, textile standards) for import compliance.

- Monitor Tariff Changes: The 30% special tariff after April 11, 2025, is time-sensitive. Ensure your import timeline aligns with these regulations.

- Consult Customs Broker: For complex classifications, seek professional advice to avoid delays or penalties.

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.