| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112909010 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112303000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112303000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112909010 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112303000 | Doc | 80.0% | CN | US | 2025-05-12 |

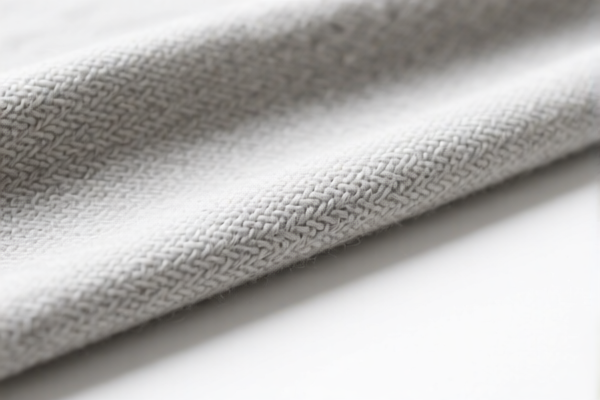

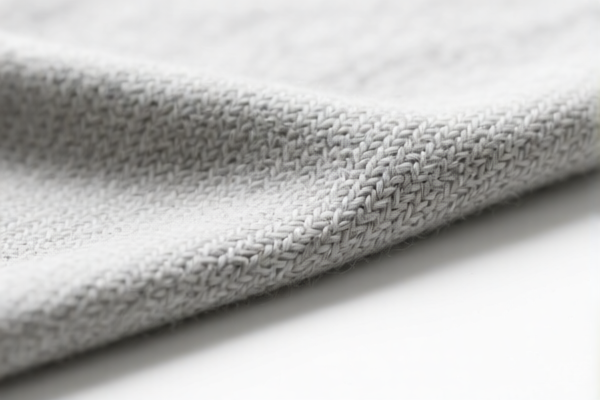

Product Name: Cotton Mixed Combed Wool Fabric for Clothing

HS CODEs Identified:

- 5112909010

- 5112303000

🔍 HS Code Classification Summary

- 5112909010

- Description: Woven fabrics of combed wool or combed fine animal hair, mainly or solely blended with cotton.

-

Applicable if: The fabric is primarily composed of combed wool and cotton, with no other fibers involved.

-

5112303000

- Description: Woven fabrics of combed wool or combed fine animal hair, mainly or solely blended with man-made short staple fibers.

- Applicable if: The fabric includes man-made short fibers (e.g., polyester, rayon) in addition to combed wool.

📊 Tariff Overview (As of Now)

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Total Tariff Rate: 80.0% (25% + 25% + 30% after April 11, 2025)

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff:

-

A 30% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

-

Anti-dumping duties:

- Not applicable for this product category (no mention of anti-dumping duties on iron or aluminum).

📌 Proactive Advice for Importers

- Verify Material Composition:

-

Confirm the exact fiber composition (e.g., percentage of cotton, wool, and any man-made fibers). This will determine the correct HS code.

-

Check Unit Price and Certification:

-

Ensure the product meets any required certifications (e.g., textile standards, origin documentation).

-

Monitor Tariff Changes:

-

Keep track of the April 11, 2025 deadline to avoid unexpected cost increases.

-

Consult Customs Broker:

- For accurate classification and compliance, especially if the product contains multiple fiber types.

✅ Summary Table

| HS Code | Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tariff |

|---|---|---|---|---|---|

| 5112909010 | Wool/cotton blend fabric | 25.0% | 25.0% | 30.0% (after 4/11/2025) | 80.0% |

| 5112303000 | Wool/man-made fiber blend fabric | 25.0% | 25.0% | 30.0% (after 4/11/2025) | 80.0% |

If you have more details about the fabric composition or intended use (e.g., for clothing vs. home textiles), I can provide a more tailored classification.

Product Name: Cotton Mixed Combed Wool Fabric for Clothing

HS CODEs Identified:

- 5112909010

- 5112303000

🔍 HS Code Classification Summary

- 5112909010

- Description: Woven fabrics of combed wool or combed fine animal hair, mainly or solely blended with cotton.

-

Applicable if: The fabric is primarily composed of combed wool and cotton, with no other fibers involved.

-

5112303000

- Description: Woven fabrics of combed wool or combed fine animal hair, mainly or solely blended with man-made short staple fibers.

- Applicable if: The fabric includes man-made short fibers (e.g., polyester, rayon) in addition to combed wool.

📊 Tariff Overview (As of Now)

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Total Tariff Rate: 80.0% (25% + 25% + 30% after April 11, 2025)

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff:

-

A 30% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

-

Anti-dumping duties:

- Not applicable for this product category (no mention of anti-dumping duties on iron or aluminum).

📌 Proactive Advice for Importers

- Verify Material Composition:

-

Confirm the exact fiber composition (e.g., percentage of cotton, wool, and any man-made fibers). This will determine the correct HS code.

-

Check Unit Price and Certification:

-

Ensure the product meets any required certifications (e.g., textile standards, origin documentation).

-

Monitor Tariff Changes:

-

Keep track of the April 11, 2025 deadline to avoid unexpected cost increases.

-

Consult Customs Broker:

- For accurate classification and compliance, especially if the product contains multiple fiber types.

✅ Summary Table

| HS Code | Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tariff |

|---|---|---|---|---|---|

| 5112909010 | Wool/cotton blend fabric | 25.0% | 25.0% | 30.0% (after 4/11/2025) | 80.0% |

| 5112303000 | Wool/man-made fiber blend fabric | 25.0% | 25.0% | 30.0% (after 4/11/2025) | 80.0% |

If you have more details about the fabric composition or intended use (e.g., for clothing vs. home textiles), I can provide a more tailored classification.

Customer Reviews

No reviews yet.