| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112909010 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112909090 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5111209000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5801100000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5801210000 | Doc | 75.2% | CN | US | 2025-05-12 |

| 5802109000 | Doc | 64.4% | CN | US | 2025-05-12 |

| 5802200090 | Doc | 69.0% | CN | US | 2025-05-12 |

| 5803001000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5803002000 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5806103020 | Doc | 58.8% | CN | US | 2025-05-12 |

| 5806310000 | Doc | 63.8% | CN | US | 2025-05-12 |

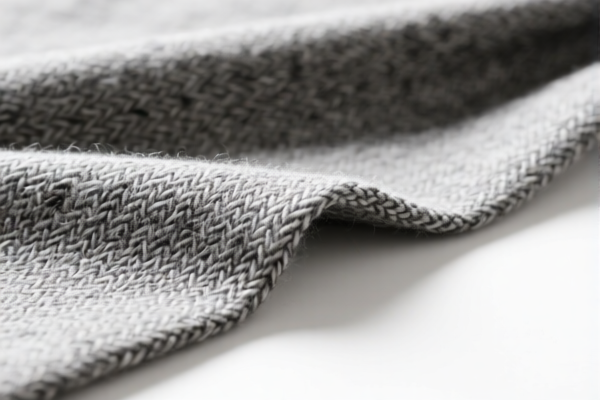

Customs Classification and Tariff Analysis for "Cotton Mixed Combed Wool Fabric for Crafts"

Based on the provided HS codes and descriptions, the most likely classification for "Cotton Mixed Combed Wool Fabric for Crafts" is:

✅ HS CODE: 5112909010

Description: Woven fabrics of combed wool or of combed fine animal hair: Other: Other: Other Mixed mainly or solely with cotton (410)

🔍 Tariff Breakdown (as of now)

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 80.0%

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-dumping duties are currently listed for this product category.

- No specific duties on iron or aluminum apply here, as this is a textile product.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the fabric is "combed wool mixed mainly or solely with cotton" to confirm it falls under HS 5112909010.

- Check Unit Price and Certification: Some countries may require textile certifications (e.g., origin, sustainability, etc.) for import compliance.

- Monitor Tariff Changes: Keep track of the April 11, 2025 deadline to avoid unexpected cost increases.

- Consult with Customs Broker: For accurate classification and to avoid misdeclaration penalties.

📊 Comparison with Other Similar HS Codes

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.2) | Total Tariff |

|---|---|---|---|---|---|

| 5112909010 | Combed wool + cotton (mainly) | 25.0% | 25.0% | 30.0% | 80.0% |

| 5112909090 | Combed wool + other (not cotton) | 25.0% | 25.0% | 30.0% | 80.0% |

| 5111209000 | Carded wool + man-made filaments | 25.0% | 25.0% | 30.0% | 80.0% |

| 5801100000 | Wool pile fabrics (not 5802/5806) | 0.0% | 25.0% | 30.0% | 55.0% |

| 5801210000 | Cotton pile fabrics (uncut weft) | 20.2% | 25.0% | 30.0% | 75.2% |

| 5802109000 | Cotton terry toweling (other) | 9.4% | 25.0% | 30.0% | 64.4% |

| 5802200090 | Other terry toweling (non-cotton) | 14.0% | 25.0% | 30.0% | 69.0% |

| 5803001000 | Cotton gauze | 0.0% | 25.0% | 30.0% | 55.0% |

| 5803002000 | Wool gauze (≤140g/m²) | 7.0% | 25.0% | 30.0% | 62.0% |

| 5806103020 | Narrow wool pile fabric | 3.8% | 25.0% | 30.0% | 58.8% |

| 5806310000 | Narrow cotton fabric | 8.8% | 25.0% | 30.0% | 63.8% |

📌 Conclusion

For "Cotton Mixed Combed Wool Fabric for Crafts", the most accurate HS code is 5112909010, with a total tariff rate of 80.0%, including a 30.0% special tariff after April 11, 2025. Ensure proper classification and compliance with customs regulations to avoid delays or penalties.

Customs Classification and Tariff Analysis for "Cotton Mixed Combed Wool Fabric for Crafts"

Based on the provided HS codes and descriptions, the most likely classification for "Cotton Mixed Combed Wool Fabric for Crafts" is:

✅ HS CODE: 5112909010

Description: Woven fabrics of combed wool or of combed fine animal hair: Other: Other: Other Mixed mainly or solely with cotton (410)

🔍 Tariff Breakdown (as of now)

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 80.0%

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-dumping duties are currently listed for this product category.

- No specific duties on iron or aluminum apply here, as this is a textile product.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the fabric is "combed wool mixed mainly or solely with cotton" to confirm it falls under HS 5112909010.

- Check Unit Price and Certification: Some countries may require textile certifications (e.g., origin, sustainability, etc.) for import compliance.

- Monitor Tariff Changes: Keep track of the April 11, 2025 deadline to avoid unexpected cost increases.

- Consult with Customs Broker: For accurate classification and to avoid misdeclaration penalties.

📊 Comparison with Other Similar HS Codes

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.2) | Total Tariff |

|---|---|---|---|---|---|

| 5112909010 | Combed wool + cotton (mainly) | 25.0% | 25.0% | 30.0% | 80.0% |

| 5112909090 | Combed wool + other (not cotton) | 25.0% | 25.0% | 30.0% | 80.0% |

| 5111209000 | Carded wool + man-made filaments | 25.0% | 25.0% | 30.0% | 80.0% |

| 5801100000 | Wool pile fabrics (not 5802/5806) | 0.0% | 25.0% | 30.0% | 55.0% |

| 5801210000 | Cotton pile fabrics (uncut weft) | 20.2% | 25.0% | 30.0% | 75.2% |

| 5802109000 | Cotton terry toweling (other) | 9.4% | 25.0% | 30.0% | 64.4% |

| 5802200090 | Other terry toweling (non-cotton) | 14.0% | 25.0% | 30.0% | 69.0% |

| 5803001000 | Cotton gauze | 0.0% | 25.0% | 30.0% | 55.0% |

| 5803002000 | Wool gauze (≤140g/m²) | 7.0% | 25.0% | 30.0% | 62.0% |

| 5806103020 | Narrow wool pile fabric | 3.8% | 25.0% | 30.0% | 58.8% |

| 5806310000 | Narrow cotton fabric | 8.8% | 25.0% | 30.0% | 63.8% |

📌 Conclusion

For "Cotton Mixed Combed Wool Fabric for Crafts", the most accurate HS code is 5112909010, with a total tariff rate of 80.0%, including a 30.0% special tariff after April 11, 2025. Ensure proper classification and compliance with customs regulations to avoid delays or penalties.

Customer Reviews

No reviews yet.