| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5210292090 | Doc | 65.3% | CN | US | 2025-05-12 |

| 5311003090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5210392090 | Doc | 65.0% | CN | US | 2025-05-12 |

| 5211202940 | Doc | 63.4% | CN | US | 2025-05-12 |

| 5311003070 | Doc | 55.0% | CN | US | 2025-05-12 |

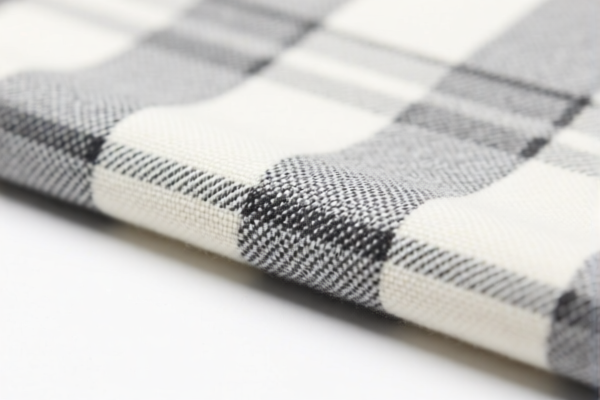

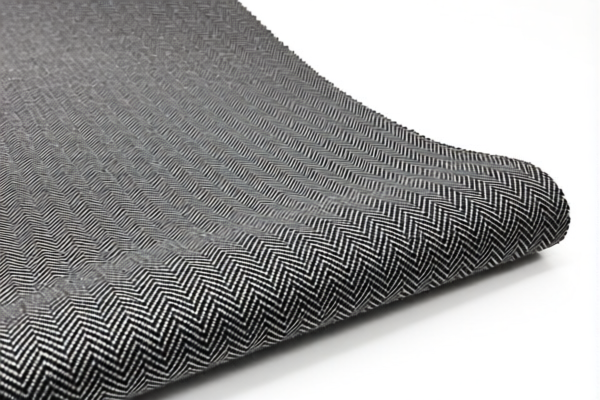

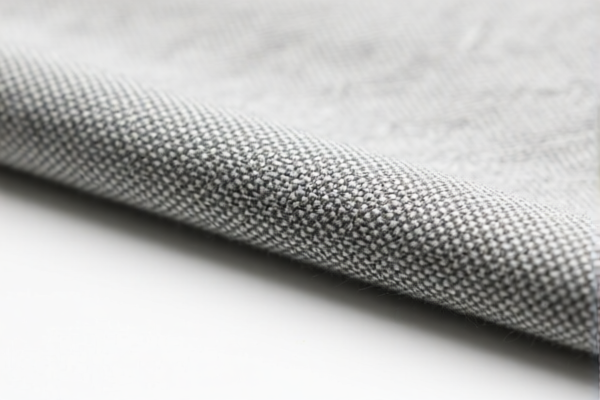

Product Name: Cotton Mixed Combed Wool Twill Fabric

Classification HS Code Analysis:

Below are the HS codes and corresponding tax details for the declared product, based on the provided data:

✅ HS CODE: 5210292090

Description: Cotton mixed twill fabric with cotton content less than 85%

- Base Tariff Rate: 10.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 65.3%

- Key Notes:

- This is the most likely code for your product, as it specifically refers to cotton mixed twill fabric with less than 85% cotton.

- Ensure the fabric is indeed a twill weave and cotton content is below 85%.

✅ HS CODE: 5311003090

Description: Other plant fiber fabrics containing cotton and man-made fibers

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- This code applies to fabrics made of cotton and man-made fibers, but not specifically twill.

- If the fabric is not twill, this may be an alternative, but it's less specific than 5210292090.

✅ HS CODE: 5210392090

Description: Cotton mixed fabrics with twill structure

- Base Tariff Rate: 10.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 65.0%

- Key Notes:

- This code is for cotton mixed fabrics with a twill structure.

- Similar to 5210292090, but with a slightly different description. Confirm the exact weave type.

✅ HS CODE: 5211202940

Description: Cotton woven fabrics with cotton content less than 85%, mainly or solely mixed with man-made fibers, weight over 200g/m²

- Base Tariff Rate: 8.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 63.4%

- Key Notes:

- This code applies to heavier fabrics (over 200g/m²).

- If your fabric is heavier, this may be a valid option, but it's less likely for a typical twill fabric.

✅ HS CODE: 5311003070

Description: Cotton and man-made fiber mixed fabrics, twill weave, woven

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- This code is for twill woven fabrics with cotton and man-made fibers.

- It is a good fit if the fabric is a twill weave and contains both cotton and synthetic fibers.

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact cotton content and the type of man-made fibers used (e.g., polyester, rayon). This will help in selecting the most accurate HS code.

- Check Fabric Weight: If the fabric is over 200g/m², consider HS code 5211202940.

- Confirm Weave Type: Ensure the fabric is a twill weave, as this is a key factor in classification.

- Check for Certifications: Some countries may require certifications (e.g., textile origin, environmental compliance) for import.

- April 11, 2025, Tariff Alert: Be aware that an additional 30% tariff will apply after this date for all the listed codes. Plan accordingly for cost estimation.

📊 Summary of Tax Rates (after April 11, 2025):

| HS Code | Total Tax Rate | Base Tariff | Additional Tariff | Special Tariff |

|---|---|---|---|---|

| 5210292090 | 65.3% | 10.3% | 25.0% | 30.0% |

| 5311003090 | 55.0% | 0.0% | 25.0% | 30.0% |

| 5210392090 | 65.0% | 10.0% | 25.0% | 30.0% |

| 5211202940 | 63.4% | 8.4% | 25.0% | 30.0% |

| 5311003070 | 55.0% | 0.0% | 25.0% | 30.0% |

If you have more details about the fabric (e.g., exact composition, weight, and end use), I can help you further narrow down the most accurate HS code.

Product Name: Cotton Mixed Combed Wool Twill Fabric

Classification HS Code Analysis:

Below are the HS codes and corresponding tax details for the declared product, based on the provided data:

✅ HS CODE: 5210292090

Description: Cotton mixed twill fabric with cotton content less than 85%

- Base Tariff Rate: 10.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 65.3%

- Key Notes:

- This is the most likely code for your product, as it specifically refers to cotton mixed twill fabric with less than 85% cotton.

- Ensure the fabric is indeed a twill weave and cotton content is below 85%.

✅ HS CODE: 5311003090

Description: Other plant fiber fabrics containing cotton and man-made fibers

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- This code applies to fabrics made of cotton and man-made fibers, but not specifically twill.

- If the fabric is not twill, this may be an alternative, but it's less specific than 5210292090.

✅ HS CODE: 5210392090

Description: Cotton mixed fabrics with twill structure

- Base Tariff Rate: 10.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 65.0%

- Key Notes:

- This code is for cotton mixed fabrics with a twill structure.

- Similar to 5210292090, but with a slightly different description. Confirm the exact weave type.

✅ HS CODE: 5211202940

Description: Cotton woven fabrics with cotton content less than 85%, mainly or solely mixed with man-made fibers, weight over 200g/m²

- Base Tariff Rate: 8.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 63.4%

- Key Notes:

- This code applies to heavier fabrics (over 200g/m²).

- If your fabric is heavier, this may be a valid option, but it's less likely for a typical twill fabric.

✅ HS CODE: 5311003070

Description: Cotton and man-made fiber mixed fabrics, twill weave, woven

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- This code is for twill woven fabrics with cotton and man-made fibers.

- It is a good fit if the fabric is a twill weave and contains both cotton and synthetic fibers.

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact cotton content and the type of man-made fibers used (e.g., polyester, rayon). This will help in selecting the most accurate HS code.

- Check Fabric Weight: If the fabric is over 200g/m², consider HS code 5211202940.

- Confirm Weave Type: Ensure the fabric is a twill weave, as this is a key factor in classification.

- Check for Certifications: Some countries may require certifications (e.g., textile origin, environmental compliance) for import.

- April 11, 2025, Tariff Alert: Be aware that an additional 30% tariff will apply after this date for all the listed codes. Plan accordingly for cost estimation.

📊 Summary of Tax Rates (after April 11, 2025):

| HS Code | Total Tax Rate | Base Tariff | Additional Tariff | Special Tariff |

|---|---|---|---|---|

| 5210292090 | 65.3% | 10.3% | 25.0% | 30.0% |

| 5311003090 | 55.0% | 0.0% | 25.0% | 30.0% |

| 5210392090 | 65.0% | 10.0% | 25.0% | 30.0% |

| 5211202940 | 63.4% | 8.4% | 25.0% | 30.0% |

| 5311003070 | 55.0% | 0.0% | 25.0% | 30.0% |

If you have more details about the fabric (e.g., exact composition, weight, and end use), I can help you further narrow down the most accurate HS code.

Customer Reviews

No reviews yet.