| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103210 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103210 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103210 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103210 | Doc | 61.5% | CN | US | 2025-05-12 |

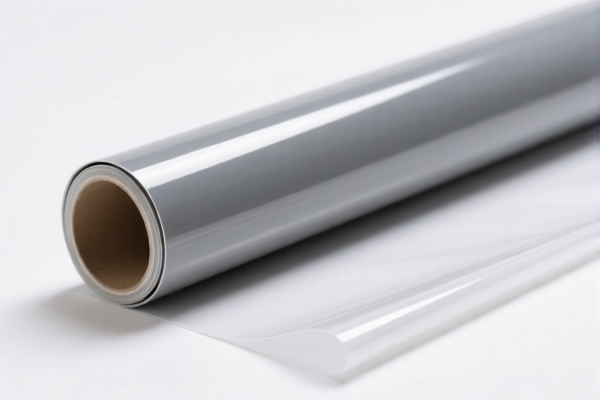

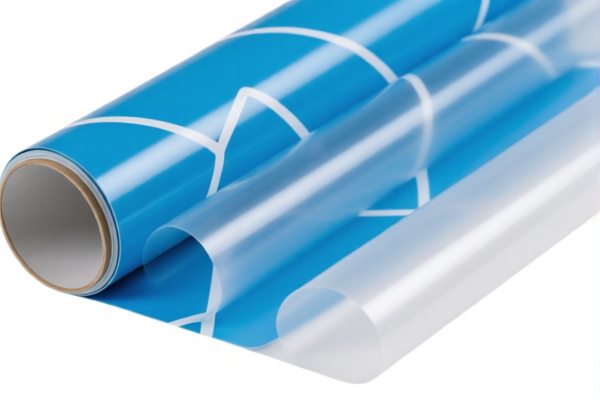

Product Classification: Custom Printed PVC Wall Covering Film (Synthetic Fiber Backing)

HS CODE: 3918.10.32.50 and 3918.10.32.10 (multiple entries with identical tax details)

🔍 Classification Summary:

- HS CODE 3918.10.32.50 and 3918.10.32.10 both apply to Custom Printed PVC Wall Covering Film with Synthetic Fiber Backing.

- These codes fall under Chapter 39 (Plastics and articles thereof) and Heading 3918 (Plastic wall coverings, floor coverings, and similar articles, not elsewhere specified or included).

📊 Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Note: The 30.0% additional tariff applies after April 2, 2025. This is a time-sensitive policy and may significantly increase the total import cost.

📌 Key Considerations:

- Material Verification: Confirm that the product is indeed PVC-based with synthetic fiber backing. Any deviation in material composition may lead to misclassification.

- Unit Price: Ensure the unit price is correctly declared, as customs may use this to determine if the product is subject to anti-dumping or countervailing duties.

- Certifications: Check if any certifications (e.g., environmental, safety, or import permits) are required for the product in the destination country.

- Documentation: Maintain proper commercial invoices, packing lists, and product specifications to support the HS code classification.

📢 Proactive Advice:

- Double-check the HS code with a customs broker or classification service to avoid penalties.

- Monitor policy updates after April 2, 2025, as the special tariff may change.

- Consider alternative materials or suppliers if the tariff burden is too high.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Classification: Custom Printed PVC Wall Covering Film (Synthetic Fiber Backing)

HS CODE: 3918.10.32.50 and 3918.10.32.10 (multiple entries with identical tax details)

🔍 Classification Summary:

- HS CODE 3918.10.32.50 and 3918.10.32.10 both apply to Custom Printed PVC Wall Covering Film with Synthetic Fiber Backing.

- These codes fall under Chapter 39 (Plastics and articles thereof) and Heading 3918 (Plastic wall coverings, floor coverings, and similar articles, not elsewhere specified or included).

📊 Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Note: The 30.0% additional tariff applies after April 2, 2025. This is a time-sensitive policy and may significantly increase the total import cost.

📌 Key Considerations:

- Material Verification: Confirm that the product is indeed PVC-based with synthetic fiber backing. Any deviation in material composition may lead to misclassification.

- Unit Price: Ensure the unit price is correctly declared, as customs may use this to determine if the product is subject to anti-dumping or countervailing duties.

- Certifications: Check if any certifications (e.g., environmental, safety, or import permits) are required for the product in the destination country.

- Documentation: Maintain proper commercial invoices, packing lists, and product specifications to support the HS code classification.

📢 Proactive Advice:

- Double-check the HS code with a customs broker or classification service to avoid penalties.

- Monitor policy updates after April 2, 2025, as the special tariff may change.

- Consider alternative materials or suppliers if the tariff burden is too high.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.