| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9703900000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 9703100000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 9706100060 | Doc | 37.5% | CN | US | 2025-05-12 |

| 9706900060 | Doc | 37.5% | CN | US | 2025-05-12 |

| 7326908688 | Doc | 82.9% | CN | US | 2025-05-12 |

| 7326908605 | Doc | 82.9% | CN | US | 2025-05-12 |

| 7325995000 | Doc | 82.9% | CN | US | 2025-05-12 |

| 7325991000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 8306290000 | Doc | 30.0% | CN | US | 2025-05-12 |

| 8306210000 | Doc | 42.0% | CN | US | 2025-05-12 |

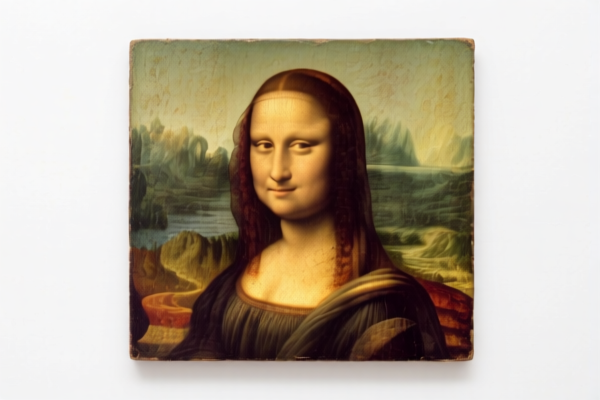

HS Code Classification for "DECORATIVE STATUE"

Based on the provided reference data, classifying "DECORATIVE STATUE" requires considering the material, age, and composition of the statue. Here's a breakdown of potential HS codes, with explanations:

-

9703.10.00.00 – Original sculptures and statuary, in any material: Of an age exceeding 100 years.

- 97: Works of art, collectors’ pieces and antiques. This chapter covers genuine artistic creations and items with historical significance.

- 03: Sculptures and statuary.

- 10: Specifically for items over 100 years old. If the statue is an antique (over 100 years old), this is a strong candidate.

- Tax Rate: 37.5% (Base: 0.0%, Additional: 7.5%, Post 2025.4.2: 30%)

-

9703.90.00.00 – Original sculptures and statuary, in any material: Other.

- 97: Works of art, collectors’ pieces and antiques.

- 03: Sculptures and statuary.

- 90: Covers sculptures not fitting the age criteria (i.e., less than 100 years old).

- Tax Rate: 37.5% (Base: 0.0%, Additional: 7.5%, Post 2025.4.2: 30%)

-

8306.29.00.00 – Bells, gongs and the like, nonelectric, of base metal; statuettes and other ornaments, of base metal; photograph, picture or similar frames, of base metal; mirrors of base metal; and base metal parts thereof: Statuettes and other ornaments, and parts thereof: Other.

- 83: Miscellaneous manufactured articles. This chapter is for items made of base metals.

- 06: Statuettes and ornaments.

- 29: Other statuettes and ornaments. If the statue is made of base metal (e.g., brass, copper, zinc alloy) and not considered a genuine artistic sculpture, this is a possibility.

- Tax Rate: 30.0% (Base: 0.0%, Additional: 0.0%, Post 2025.4.2: 30%)

-

7326.90.86.88 – Other articles of iron or steel: Other: Other: Other: Other.

- 73: Articles of iron or steel.

- 26: Other articles.

- 90: Other. If the statue is made of iron or steel and doesn't fit into more specific categories, this could apply.

- Tax Rate: 82.9% (Base: 2.9%, Additional: 25.0%, Post 2025.4.2: 30% + 25% steel/aluminum surcharge)

-

7325.99.50.00 – Other cast articles of iron or steel: Other: Other: Other.

- 73: Articles of iron or steel.

- 25: Cast articles.

- 99: Other. If the statue is a cast iron or steel statue.

- Tax Rate: 82.9% (Base: 2.9%, Additional: 25.0%, Post 2025.4.2: 30% + 25% steel/aluminum surcharge)

Important Considerations & Recommendations:

- Material: The primary material of the statue is crucial. Is it bronze, iron, steel, base metal, or another material?

- Age: If the statue is over 100 years old, codes in Chapter 97 are more appropriate.

- Artistic Value: Is the statue a genuine artistic creation, or is it more of a decorative item?

- Casting Process: Was the statue cast, carved, or manufactured using another process?

- Plating: Is the statue plated with precious metals? If so, consider HS Code

8306.21.00.00.

Actionable Steps:

- Confirm Material: Verify the exact composition of the statue.

- Determine Age: Establish the statue's age with documentation if possible.

- Assess Artistic Merit: Evaluate whether the statue qualifies as a genuine work of art.

- Consult a Licensed Customs Broker: For complex cases, professional guidance is recommended.

Customer Reviews

The information is there, but it's a little overwhelming with so many codes. The notes about considering the casting process are good, but I wish the site had a simpler way to narrow down the options, especially for non-experts like me.

Excellent resource for US import tariffs on decorative statues! I appreciate the detailed breakdown of how the material and age influence the correct HS code selection. I was able to quickly find what I needed.

The tariff rate information is very clear. I checked the code for iron/steel statues, 7326.90.86.88, and it's helpful to see the base and additional rates listed separately. It could be better if they had more examples though.

I was really struggling to find the right HS code for a decorative statue I'm importing. This site made it so much easier! The breakdown of 9703.10.00.00 for antiques was exactly what I needed.