| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 4409100500 | Doc | 58.2% | CN | US | 2025-05-12 |

| 7616995190 | Doc | 82.5% | CN | US | 2025-05-12 |

| 7419800900 | Doc | 58.0% | CN | US | 2025-05-12 |

| 7326908688 | Doc | 82.9% | CN | US | 2025-05-12 |

| 5808109000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 5905009000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6914108000 | Doc | 64.0% | CN | US | 2025-05-12 |

| 7003300000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 7004905000 | Doc | 60.0% | CN | US | 2025-05-12 |

| 7005290810 | Doc | 18.7¢/m<sup>2</sup>+55.0% | CN | US | 2025-05-12 |

| 4814900200 | Doc | 37.5% | CN | US | 2025-05-12 |

| 9602004000 | Doc | 39.3% | CN | US | 2025-05-12 |

| 3503005550 | Doc | 2.8¢/kg + 3.8%+37.5% | CN | US | 2025-05-12 |

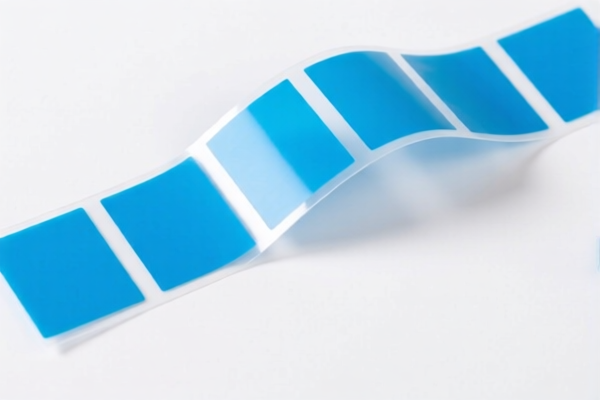

海关申报商品归类分析报告 - DECORATIVE STRIPS

您申报的商品为“DECORATIVE STRIPS”,以下是对您提供的HS编码及其关税规则的详细分析,旨在帮助您理解商品分类、税率计算及清关注意事项。

重要提示: 由于“DECORATIVE STRIPS”涵盖范围较广,不同材质、成分、用途的商品归类可能不同。请务必仔细核对商品实际情况,确保选择正确的HS编码。

HS编码及关税分析

以下按照HS编码顺序进行分析:

1. 3926.90.99.89 - Other articles of plastics and articles of other materials of headings 3901 to 3914: Other: Other Other

- 含义: 塑料制成的其他制品,不属于3901-3914章的其他制品。

- 税率: 基础关税 5.3%,加征关税 7.5%,2025.4.2后加征关税 30%。总税率 42.8%。

- 注意事项: 确认商品是否确实由塑料制成,以及是否属于3901-3914章的范围。

2. 4409.10.05.00 - Wood (including strips and friezes for parquet flooring, not assembled) continuously shaped (tongued, grooved, rebated, chamfered, V-jointed, beaded, molded, rounded or the like) along any of its edges, ends or faces, whether or not planed, sanded or end-jointed: Coniferous: Wood continuously shaped along any of its ends, whether or not also continuously shaped along any of its edges or faces, all the foregoing whether or not planed, sanded or end-jointed

- 含义: 软木(包括镶木地板条和边框,未组装)沿任何边缘、端部或表面连续成型(带榫、槽、倒角、V型接缝、珠状接缝、模制、圆形等),无论是否刨过、打磨过或端部接合。

- 税率: 基础关税 3.2%,加征关税 25.0%,2025.4.2后加征关税 30%。总税率 58.2%。

- 注意事项: 确认商品是否为软木,以及是否经过连续成型处理。

3. 7616.99.51.90 - Other articles of aluminum: Other: Other: Other Other: Other: Other

- 含义: 铝制其他制品。

- 税率: 基础关税 2.5%,加征关税 25.0%,2025.4.2后加征关税 30%。总税率 82.5%。

- 注意事项: 确认商品是否为铝制,以及是否属于其他铝制品。

4. 7419.80.09.00 - Other articles of copper: Other: Cloth (including endless bands), grill and netting, of copper wire; expanded metal of copper: Other

- 含义: 铜制其他制品。

- 税率: 基础关税 3.0%,加征关税 25.0%,2025.4.2后加征关税 30%。总税率 58.0%。

- 注意事项: 确认商品是否为铜制,以及是否属于其他铜制品。

5. 7326.90.86.88 - Other articles of iron or steel: Other: Other: Other Other

- 含义: 铁或钢制其他制品。

- 税率: 基础关税 2.9%,加征关税 25.0%,2025.4.2后加征关税 30%。总税率 82.9%。

- 注意事项: 确认商品是否为铁或钢制,以及是否属于其他铁或钢制品。

6. 5808.10.90.00 - Braids in the piece; ornamental trimmings in the piece, without embroidery, other than knitted or crocheted; tassels, pompons and similar articles: Other Other

- 含义: 片状辫子;无刺绣的片状装饰性饰边,非针织或钩织;流苏、绒球及类似品。

- 税率: 基础关税 4.2%,加征关税 25.0%,2025.4.2后加征关税 30%。总税率 59.2%。

- 注意事项: 确认商品是否为片状辫子或装饰性饰边,以及是否无刺绣且非针织或钩织。

7. 5905.00.90.00 - Textile wall coverings: Other (229)

- 含义: 纺织墙纸。

- 税率: 基础关税 0.0%,加征关税 25.0%,2025.4.2后加征关税 30%。总税率 55.0%。

- 注意事项: 确认商品是否为纺织墙纸。

8. 6914.10.80.00 - Other ceramic articles: Of porcelain or china: Other

- 含义: 其他陶瓷制品。

- 税率: 基础关税 9.0%,加征关税 25.0%,2025.4.2后加征关税 30%。总税率 64.0%。

- 注意事项: 确认商品是否为陶瓷制品。

9. 7003.30.00.00 - Cast glass and rolled glass, in sheets or profiles, whether or not having an absorbent, reflecting or non-reflecting layer, but not otherwise worked: Profiles

- 含义: 铸玻璃和轧制玻璃,以片材或型材形式存在,无论是否具有吸收层、反射层或非反射层,但未进行其他加工:型材。

- 税率: 基础关税 6.3%,加征关税 25.0%,2025.4.2后加征关税 30%。总税率 61.3%。

- 注意事项: 确认商品是否为铸玻璃或轧制玻璃,以及是否为型材。

10. 7004.90.50.00 - Drawn glass and blown glass, in sheets, whether or not having an absorbent, reflecting or non-reflecting layer, but not otherwise worked: Other glass: Other

- 含义: 拉制玻璃和吹制玻璃,以片材形式存在,无论是否具有吸收层、反射层或非反射层,但未进行其他加工:其他玻璃。

- 税率: 基础关税 5.0%,加征关税 25.0%,2025.4.2后加征关税 30%。总税率 60.0%。

- 注意事项: 确认商品是否为拉制玻璃或吹制玻璃,以及是否为其他玻璃。

11. 7005.29.08.10 - Float glass and surface ground or polished glass, in sheets, whether or not having an absorbent, reflecting or non-reflecting layer, but not otherwise worked: Other nonwired glass: Other: Measuring less than 10 mm in thickness: Measuring not over 0.65 m in area: Other Measuring not over 0.26 m2 in area

- 含义: 浮法玻璃和表面磨制或抛光玻璃,以片材形式存在,无论是否具有吸收层、反射层或非反射层,但未进行其他加工:其他非钢化玻璃。

- 税率: 基础关税 18.7¢/m2,加征关税 25.0%,2025.4.2后加征关税 30%。总税率 18.7¢/m2+55.0%。

- 注意事项: 确认商品是否为浮法玻璃或表面磨制或抛光玻璃,以及是否为其他非钢化玻璃。

12. 4814.90.02.00 - Wallpaper and similar wallcoverings; window transparencies of paper: Other

- 含义: 壁纸和类似墙纸;纸制窗户透明材料。

- 税率: 基础关税 0.0%,加征关税 7.5%,2025.4.2后加征关税 30%。总税率 37.5%。

- 注意事项: 确认商品是否为壁纸或类似墙纸。

13. 9602.00.40.00 - Worked vegetable or mineral carving material and articles of these materials; molded or carved articles of wax, of stearin, of natural gums or natural resins, of modeling pastes, and other molded or carved articles, not elsewhere specified or included; worked, unhardened gelatin (except gelatin of heading 3503) and articles of unhardened gelatin: Molded or carved articles of wax

- 含义: 加工过的蔬菜或矿物雕刻材料和这些材料的制品;模制或雕刻过的蜡制品、硬脂酸制品、天然胶制品或天然树脂制品、造型膏制品以及其他模制或雕刻过的制品,未在其他地方明确规定或包括;加工过的未硬化明胶(不包括3503章的明胶)和未硬化明胶制品:模制或雕刻过的蜡制品。

- 税率: 基础关税 1.8%,加征关税 7.5%,2025.4.2后加征关税 30%。总税率 39.3%。

- 注意事项: 确认商品是否为加工过的蔬菜或矿物雕刻材料制品,以及是否为模制或雕刻过的蜡制品。

14. 3503.00.55.50 - Gelatin (including gelatin in rectangular (including square) sheets, whether or not surfaceworked or colored) and gelatin derivatives; isinglass; other glues of animal origin, excluding casein glues of heading 3501: Other Other

- 含义: 明胶(包括矩形(包括方形)片状明胶,无论是否经过表面处理或着色)和明胶衍生物;鱼胶;其他动物胶,不包括3501章的酪蛋白胶:其他。

- 税率: 基础关税 2.8¢/kg + 3.8%,加征关税 7.5%,2025.4.2后加征关税 30%。总税率 2.8¢/kg + 3.8%+37.5%。

- 注意事项: 确认商品是否为明胶或明胶衍生物,以及是否为其他动物胶。

重要提醒:

- 材质: 务必准确判断商品的材质,不同材质归类差异很大。

- 成分: 确认商品的主要成分,以及是否含有其他成分。

- 用途: 明确商品的主要用途,不同用途可能影响归类。

- 单价: 某些HS编码的税率可能与单价有关。

- 认证: 某些商品可能需要提供特定的认证才能清关。

建议:

- 提供更详细的商品信息: 为了更准确地归类,请提供商品的详细信息,包括材质、成分、用途、规格、图片等。

- 咨询专业报关行: 建议咨询专业的报关行,以确保商品归类准确无误。

- 关注海关政策变化: 海关政策可能会发生变化,请及时关注海关的最新政策。

希望以上分析对您有所帮助!

Customer Reviews

No reviews yet.