| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4820500000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3926904800 | Doc | 33.4% | CN | US | 2025-05-12 |

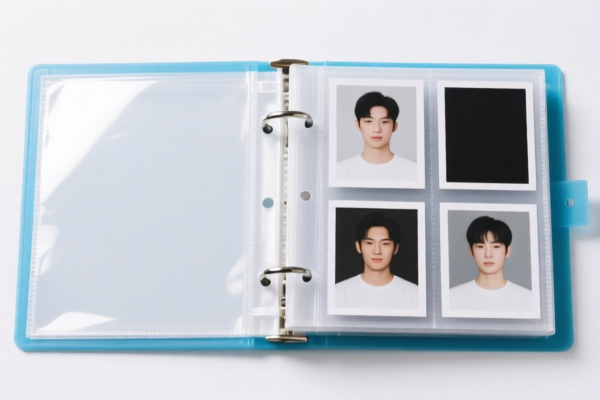

- HS CODE: 4820500000

- Product Description: Sample albums or scrapbooks made of paper or paperboard.

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

-

Notes: This classification is suitable for paper-based DIY albums or scrapbooks. Be sure to confirm the product is made entirely of paper or paperboard and not mixed with other materials.

-

HS CODE: 3926904800

- Product Description: Other plastic products and products of headings 3901 to 3914: Other: Albums.

- Base Tariff Rate: 3.4%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.4%

- Notes: This classification applies to plastic-based DIY albums. Confirm the product is primarily made of plastic and not a hybrid of materials.

Proactive Advice:

- Verify the material composition of the DIY album (e.g., paper, plastic, or mixed) to ensure correct classification.

- Check if the product includes additional components (e.g., photo inserts, frames, or decorative elements), which may affect classification.

- Be aware of the April 11, 2025 deadline for tariff changes and plan accordingly.

- If exporting to China, ensure compliance with customs documentation and product certification requirements.

- HS CODE: 4820500000

- Product Description: Sample albums or scrapbooks made of paper or paperboard.

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes: This classification is suitable for paper-based DIY albums or scrapbooks. Be sure to confirm the product is made entirely of paper or paperboard and not mixed with other materials.

- HS CODE: 3926904800

- Product Description: Other plastic products and products of headings 3901 to 3914: Other: Albums.

- Base Tariff Rate: 3.4%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.4%

- Notes: This classification applies to plastic-based DIY albums. Confirm the product is primarily made of plastic and not a hybrid of materials.

Proactive Advice: - Verify the material composition of the DIY album (e.g., paper, plastic, or mixed) to ensure correct classification. - Check if the product includes additional components (e.g., photo inserts, frames, or decorative elements), which may affect classification. - Be aware of the April 11, 2025 deadline for tariff changes and plan accordingly. - If exporting to China, ensure compliance with customs documentation and product certification requirements.

Customer Reviews

No reviews yet.