| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4412514100 | Doc | 63.0% | CN | US | 2025-05-12 |

| 4412513105 | Doc | 63.0% | CN | US | 2025-05-12 |

| 4418790100 | Doc | 58.2% | CN | US | 2025-05-12 |

| 4418999195 | Doc | 58.2% | CN | US | 2025-05-12 |

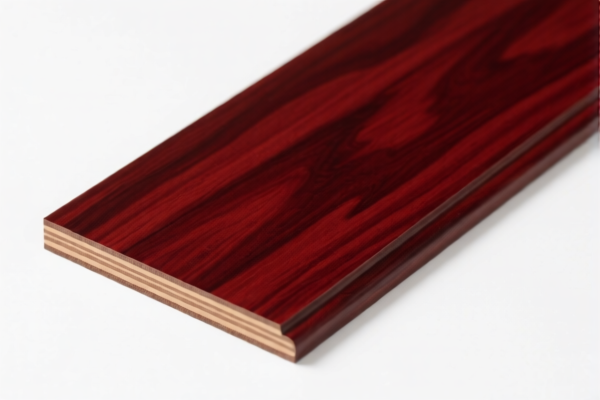

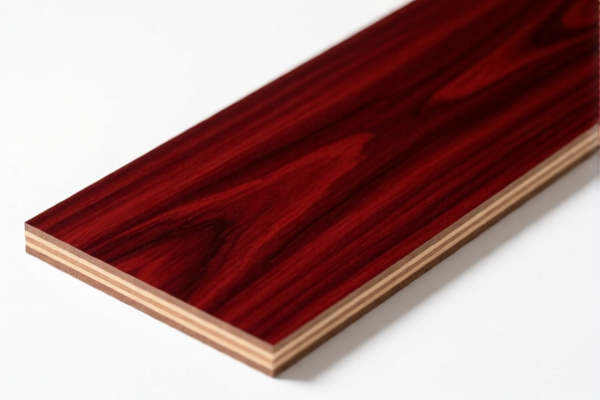

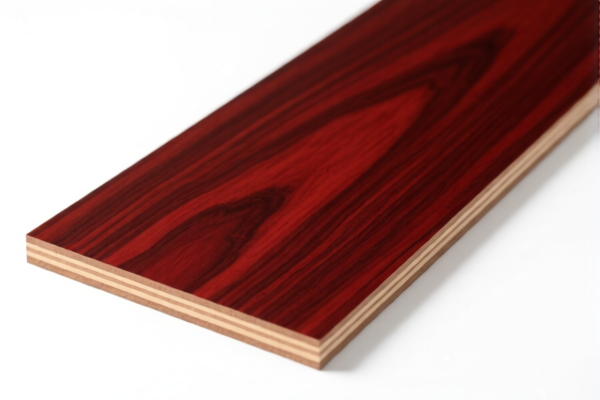

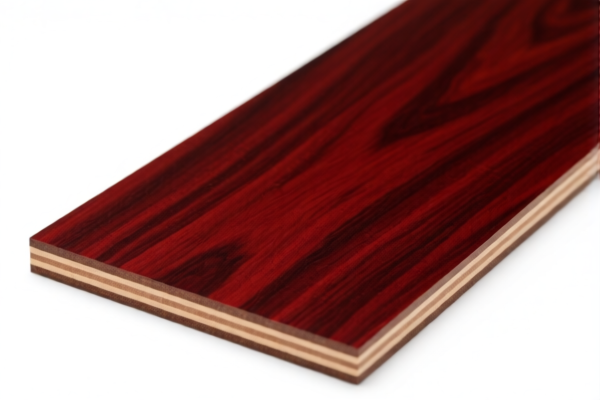

Customs Compliance Analysis for "Dark Red Meranti Veneered Plywood (Unsurfaced)"

Based on your product description and the provided HS codes, the most likely classification is HS Code 4412513105. Below is a detailed breakdown of the customs compliance considerations:

✅ HS CODE: 4412513105

Description:

Plywood, veneered panels and similar laminated wood: Blockboard, laminboard and battenboard: With at least one outer ply of tropical wood: Plywood: Not surface covered, or surface covered with a clear or transparent material which does not obscure the grain, texture or markings of the face ply: Wood flooring

🔍 Tariff Breakdown (as of now)

- Base Tariff Rate: 8.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 63.0% (8.0% + 25.0% + 30.0%)

⚠️ Important Note: The 30.0% additional tariff will apply after April 11, 2025. If your goods are imported after this date, the total tariff will be 63.0%.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm that the outer ply is made of tropical wood (e.g., Dark Red Meranti), as this is a key criterion for classification under HS 4412.51.

- Surface Treatment: The product must be unsurfaced or covered with a clear or transparent material that does not obscure the grain or texture of the face ply. This is critical for correct classification.

- Certifications: Ensure that the product meets any required wood certification standards (e.g., CITES, FSC, or other environmental or trade compliance requirements).

- Documentation: Provide accurate product descriptions, material specifications, and certifications to avoid misclassification or delays at customs.

📌 Proactive Advice for Importers

- Verify Material and Unit Price: Confirm the exact composition and pricing of the product to ensure it aligns with the HS code and tariff rates.

- Check for Anti-Dumping Duties: While not currently applicable to this product, be aware of any anti-dumping or countervailing duties that may apply to wood products from specific countries.

- Monitor Tariff Changes: Keep an eye on April 11, 2025, as the additional tariff will increase significantly after this date.

- Consult a Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure full compliance and avoid penalties.

📌 Alternative HS Codes (for Reference)

- 4412514100: For veneered plywood with at least one outer ply of tropical wood, but not unsurfaced or with transparent covering.

- 4418790100 / 4418999195: For assembled flooring panels or other joinery, but not for veneered plywood.

📌 Summary of Tax Rate Changes

| Tariff Type | Rate | Effective Date |

|---|---|---|

| Base Tariff | 8.0% | Always applicable |

| General Additional Tariff | 25.0% | Always applicable |

| Special Tariff (April 11, 2025) | 30.0% | After April 11, 2025 |

| Total Tariff | 63.0% | After April 11, 2025 |

If you have further details about the product (e.g., country of origin, exact specifications), I can provide a more tailored compliance review.

Customs Compliance Analysis for "Dark Red Meranti Veneered Plywood (Unsurfaced)"

Based on your product description and the provided HS codes, the most likely classification is HS Code 4412513105. Below is a detailed breakdown of the customs compliance considerations:

✅ HS CODE: 4412513105

Description:

Plywood, veneered panels and similar laminated wood: Blockboard, laminboard and battenboard: With at least one outer ply of tropical wood: Plywood: Not surface covered, or surface covered with a clear or transparent material which does not obscure the grain, texture or markings of the face ply: Wood flooring

🔍 Tariff Breakdown (as of now)

- Base Tariff Rate: 8.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 63.0% (8.0% + 25.0% + 30.0%)

⚠️ Important Note: The 30.0% additional tariff will apply after April 11, 2025. If your goods are imported after this date, the total tariff will be 63.0%.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm that the outer ply is made of tropical wood (e.g., Dark Red Meranti), as this is a key criterion for classification under HS 4412.51.

- Surface Treatment: The product must be unsurfaced or covered with a clear or transparent material that does not obscure the grain or texture of the face ply. This is critical for correct classification.

- Certifications: Ensure that the product meets any required wood certification standards (e.g., CITES, FSC, or other environmental or trade compliance requirements).

- Documentation: Provide accurate product descriptions, material specifications, and certifications to avoid misclassification or delays at customs.

📌 Proactive Advice for Importers

- Verify Material and Unit Price: Confirm the exact composition and pricing of the product to ensure it aligns with the HS code and tariff rates.

- Check for Anti-Dumping Duties: While not currently applicable to this product, be aware of any anti-dumping or countervailing duties that may apply to wood products from specific countries.

- Monitor Tariff Changes: Keep an eye on April 11, 2025, as the additional tariff will increase significantly after this date.

- Consult a Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure full compliance and avoid penalties.

📌 Alternative HS Codes (for Reference)

- 4412514100: For veneered plywood with at least one outer ply of tropical wood, but not unsurfaced or with transparent covering.

- 4418790100 / 4418999195: For assembled flooring panels or other joinery, but not for veneered plywood.

📌 Summary of Tax Rate Changes

| Tariff Type | Rate | Effective Date |

|---|---|---|

| Base Tariff | 8.0% | Always applicable |

| General Additional Tariff | 25.0% | Always applicable |

| Special Tariff (April 11, 2025) | 30.0% | After April 11, 2025 |

| Total Tariff | 63.0% | After April 11, 2025 |

If you have further details about the product (e.g., country of origin, exact specifications), I can provide a more tailored compliance review.

Customer Reviews

No reviews yet.