| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8442300150 | Doc | 55.0% | CN | US | 2025-05-12 |

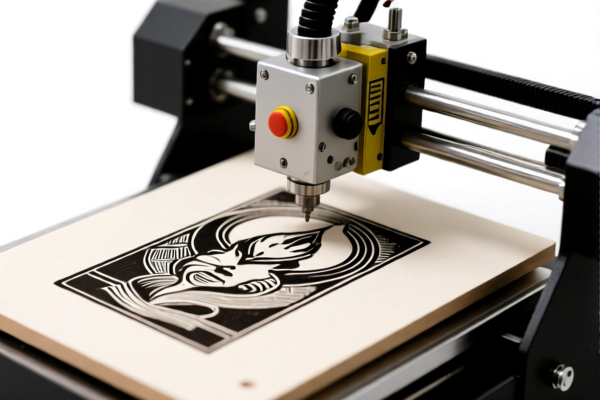

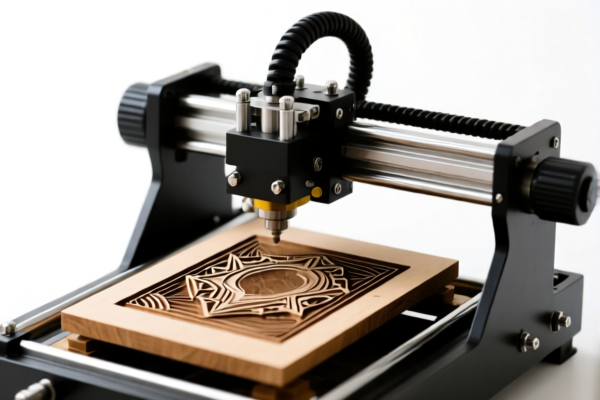

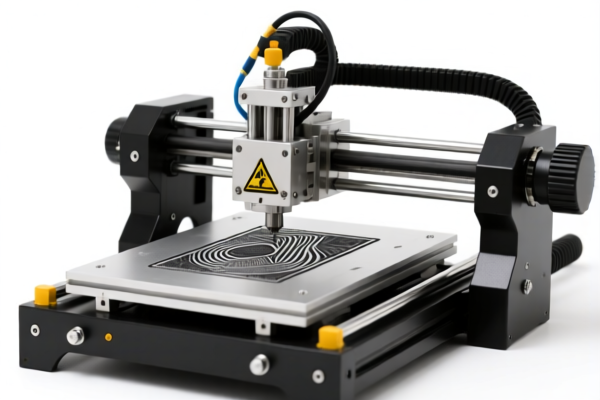

Engraving Machine - HS Code 8442.30.01.50 - Customs Classification & Considerations

This document details the customs classification, tariff implications, and important considerations for importing an “Engraving Machine” under HS Code 8442.30.01.50.

1. HS Code Breakdown & Definition

HS Code 8442.30.01.50 falls under Chapter 84 of the Harmonized System (HS), which covers “Machinery and mechanical appliances.” Let's break down the code:

- 84: Machinery and mechanical appliances; parts thereof. This broadly defines the category.

- 8442: Machinery, apparatus and equipment (other than the machines of headings 8456 to 8465), for preparing or making plates, cylinders or other printing components; plates, cylinders and other printing components; plates, cylinders and lithographic stones, prepared for printing purposes (for example, planed, grained or polished); parts thereof. This specifies the equipment is related to printing component preparation.

- 8442.30: Other machinery, apparatus and equipment. This further narrows down the classification to "other" types of machinery within the printing component preparation category.

- 8442.30.01: Specifically for engraving machines.

- 8442.30.01.50: This is the most specific code, likely denoting a particular type or specification of engraving machine (details may vary by country's implementation).

In essence, this HS code is assigned to machines used for engraving, etching, or otherwise preparing printing plates, cylinders, or similar components. This excludes machines specifically covered in headings 8456-8465 (which cover other types of printing, textile, and similar machinery).

2. Tariff Implications (Based on Provided Data)

- Basic Duty: 0.0% - Currently, there is no basic import duty applied to this product.

- Additional Duty (Currently): 25.0% - A 25% additional duty is currently in effect.

- Additional Duty (Post April 2, 2025): 30.0% - Effective April 2, 2025, the additional duty will increase to 30%.

- Total Tax: 55.0% - This represents the combined effect of the basic duty and the additional duty.

Important Note: Tariff rates are subject to change based on trade agreements, country-specific regulations, and updates to the HS code. Always verify the latest rates with your customs broker or the relevant customs authority.

3. Key Considerations & Required Documentation

- Material Composition: The material used in the construction of the engraving machine can impact tariff classification. Specifically, the presence of certain materials might trigger additional duties or require specific certifications.

- Single Unit Price: The declared value of the engraving machine is crucial for duty calculation. Ensure accurate valuation.

- Functionality & Specifications: Provide detailed specifications of the machine's functionality. Is it solely for engraving, or does it have other capabilities? This helps ensure correct classification.

- Certifications: Depending on the destination country, you may need to provide certifications such as:

- CE Marking (Europe): If the machine meets European safety standards.

- Safety Certifications: Demonstrating compliance with relevant safety regulations.

- Origin Certificate: To benefit from preferential tariff rates under trade agreements.

- Commercial Invoice: A detailed commercial invoice is essential, including:

- Accurate description of the goods.

- HS Code.

- Quantity.

- Unit price.

- Total value.

- Country of origin.

- Packing List: A detailed packing list outlining the contents of each shipment.

- Bill of Lading/Air Waybill: Shipping documents.

4. Recommendations

- Consult a Customs Broker: Engaging a qualified customs broker is highly recommended. They can provide expert guidance on classification, documentation, and compliance.

- Verify Tariff Rates: Confirm the latest tariff rates with your customs broker or the relevant customs authority before importing.

- Accurate Documentation: Ensure all documentation is accurate, complete, and consistent.

- Prepare for Increased Duties (Post April 2, 2025): Factor the potential 30% additional duty into your cost calculations.

Disclaimer: This information is for general guidance only and does not constitute professional advice. Customs regulations are complex and subject to change. Always consult with a qualified customs broker or the relevant customs authority for specific guidance on your import situation.

Customer Reviews

The information on the additional duty increase after April 2, 2025, was a real eye-opener. I’ll definitely need to factor that into my budget, but the site made it easy to understand.

This is the best resource I’ve found for HS Code 8442.30.01.50. The breakdown of the code and the tariff implications were incredibly helpful for my business.

The document provided clear details about the 55% tariff rate and the increase coming in April. I wish there were more examples of similar HS codes, but overall very informative.

Great breakdown of HS Code 8442.30.01.50 for engraving machines. The tariff info and upcoming changes were exactly what I needed for my import planning.