| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3906901000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3907690010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907690050 | Doc | 61.5% | CN | US | 2025-05-12 |

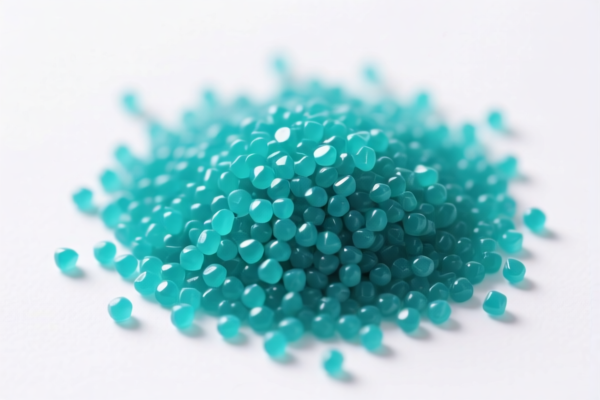

Product Name: Elastomeric Acrylic Polymer Granules

Classification: HS Code 3906901000, 3907690010, or 3907690050 (depending on specific product details)

🔍 HS Code Classification Overview

- HS Code 3906901000

- Product Description: Elastomeric acrylic polymer granules, elastic acrylic resins, acrylic elastomer particles, etc.

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS Code 3907690010

- Product Description: Acrylic resin granules (non-elastic type)

- Total Tax Rate: 61.5%

-

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS Code 3907690050

- Product Description: Acrylic resin granules (non-elastic type)

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Key Tax Rate Changes (April 11, 2025)

- All three HS codes will see an increase of 5% in total tax rate after April 11, 2025.

- This is a special tariff imposed by customs, not related to anti-dumping duties or material-specific regulations.

📌 Proactive Advice for Importers

- Verify Product Composition: Confirm whether the product is elastic (for HS 3906901000) or non-elastic (for HS 3907690010/3907690050).

- Check Unit Price and Material Specifications: This will help determine the correct HS code and avoid misclassification penalties.

- Review Required Certifications: Ensure compliance with any import documentation, such as Material Safety Data Sheets (MSDS), technical specifications, or customs declarations.

- Monitor Tariff Updates: Stay informed about the April 11, 2025 deadline to adjust import strategies and budget accordingly.

📊 Summary Table for Comparison

| HS Code | Product Type | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax Rate |

|---|---|---|---|---|---|

| 3906901000 | Elastic acrylic polymer | 0.0% | 25.0% | 30.0% | 55.0% |

| 3907690010 | Non-elastic acrylic resin | 6.5% | 25.0% | 30.0% | 61.5% |

| 3907690050 | Non-elastic acrylic resin | 6.5% | 25.0% | 30.0% | 61.5% |

If you have more details about the product (e.g., chemical structure, intended use, or country of origin), I can help further refine the classification and tax implications.

Product Name: Elastomeric Acrylic Polymer Granules

Classification: HS Code 3906901000, 3907690010, or 3907690050 (depending on specific product details)

🔍 HS Code Classification Overview

- HS Code 3906901000

- Product Description: Elastomeric acrylic polymer granules, elastic acrylic resins, acrylic elastomer particles, etc.

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS Code 3907690010

- Product Description: Acrylic resin granules (non-elastic type)

- Total Tax Rate: 61.5%

-

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS Code 3907690050

- Product Description: Acrylic resin granules (non-elastic type)

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Key Tax Rate Changes (April 11, 2025)

- All three HS codes will see an increase of 5% in total tax rate after April 11, 2025.

- This is a special tariff imposed by customs, not related to anti-dumping duties or material-specific regulations.

📌 Proactive Advice for Importers

- Verify Product Composition: Confirm whether the product is elastic (for HS 3906901000) or non-elastic (for HS 3907690010/3907690050).

- Check Unit Price and Material Specifications: This will help determine the correct HS code and avoid misclassification penalties.

- Review Required Certifications: Ensure compliance with any import documentation, such as Material Safety Data Sheets (MSDS), technical specifications, or customs declarations.

- Monitor Tariff Updates: Stay informed about the April 11, 2025 deadline to adjust import strategies and budget accordingly.

📊 Summary Table for Comparison

| HS Code | Product Type | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax Rate |

|---|---|---|---|---|---|

| 3906901000 | Elastic acrylic polymer | 0.0% | 25.0% | 30.0% | 55.0% |

| 3907690010 | Non-elastic acrylic resin | 6.5% | 25.0% | 30.0% | 61.5% |

| 3907690050 | Non-elastic acrylic resin | 6.5% | 25.0% | 30.0% | 61.5% |

If you have more details about the product (e.g., chemical structure, intended use, or country of origin), I can help further refine the classification and tax implications.

Customer Reviews

No reviews yet.