| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3906901000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3909501000 | Doc | 55.0% | CN | US | 2025-05-12 |

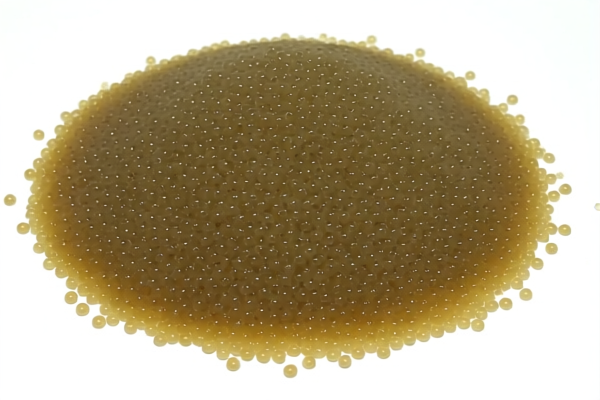

Product Classification and Customs Tariff Analysis for Elastomeric Acrylic Polymer Thermoplastic Elastomer Raw Material

Based on the provided classification, the product falls under the following HS codes and associated tariff rates. Below is a structured breakdown:

🔍 HS Code: 3906901000

Product Description:

- Elastomeric acrylic polymer raw material, granules, polymers, synthetic materials, high-performance materials, sheets, etc.

- Applicable to the primary form of acrylic resin elastomers.

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

🔍 HS Code: 3911902500

Product Description:

- Thermoplastic polyester elastomer

- Applicable to thermoplastic resins containing aromatic or modified aromatic monomer units.

Tariff Breakdown:

- Base Tariff Rate: 6.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.1%

🔍 HS Code: 3909501000

Product Description:

- Thermoplastic polyurethane elastomer material

- Applicable to elastomers in amino resins, phenolic resins, and polyurethanes.

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied to all three HS codes after April 11, 2025. This is a time-sensitive policy and should be factored into cost planning and import scheduling. -

Anti-Dumping Duties:

No specific anti-dumping duties for iron or aluminum are mentioned in the provided data. However, always verify if the product is subject to any ongoing anti-dumping or countervailing duties based on the country of origin. -

Certifications and Documentation:

Ensure that the product is accompanied by proper documentation, including: - Material Safety Data Sheet (MSDS)

- Certificate of Origin

-

Any required technical specifications or compliance certificates (e.g., REACH, RoHS, etc.)

-

Unit Price and Material Verification:

Confirm the exact material composition and unit price to ensure correct HS code classification and avoid misclassification penalties.

✅ Proactive Advice:

- Double-check the product’s chemical composition to ensure it aligns with the HS code description.

- Consult with customs brokers or classification experts if the product contains multiple components or is a blend.

- Monitor policy updates after April 11, 2025, as the special tariff may affect your import costs significantly.

Let me know if you need help with HS code verification or customs documentation. Product Classification and Customs Tariff Analysis for Elastomeric Acrylic Polymer Thermoplastic Elastomer Raw Material

Based on the provided classification, the product falls under the following HS codes and associated tariff rates. Below is a structured breakdown:

🔍 HS Code: 3906901000

Product Description:

- Elastomeric acrylic polymer raw material, granules, polymers, synthetic materials, high-performance materials, sheets, etc.

- Applicable to the primary form of acrylic resin elastomers.

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

🔍 HS Code: 3911902500

Product Description:

- Thermoplastic polyester elastomer

- Applicable to thermoplastic resins containing aromatic or modified aromatic monomer units.

Tariff Breakdown:

- Base Tariff Rate: 6.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.1%

🔍 HS Code: 3909501000

Product Description:

- Thermoplastic polyurethane elastomer material

- Applicable to elastomers in amino resins, phenolic resins, and polyurethanes.

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied to all three HS codes after April 11, 2025. This is a time-sensitive policy and should be factored into cost planning and import scheduling. -

Anti-Dumping Duties:

No specific anti-dumping duties for iron or aluminum are mentioned in the provided data. However, always verify if the product is subject to any ongoing anti-dumping or countervailing duties based on the country of origin. -

Certifications and Documentation:

Ensure that the product is accompanied by proper documentation, including: - Material Safety Data Sheet (MSDS)

- Certificate of Origin

-

Any required technical specifications or compliance certificates (e.g., REACH, RoHS, etc.)

-

Unit Price and Material Verification:

Confirm the exact material composition and unit price to ensure correct HS code classification and avoid misclassification penalties.

✅ Proactive Advice:

- Double-check the product’s chemical composition to ensure it aligns with the HS code description.

- Consult with customs brokers or classification experts if the product contains multiple components or is a blend.

- Monitor policy updates after April 11, 2025, as the special tariff may affect your import costs significantly.

Let me know if you need help with HS code verification or customs documentation.

Customer Reviews

No reviews yet.