Found 3 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3911901000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

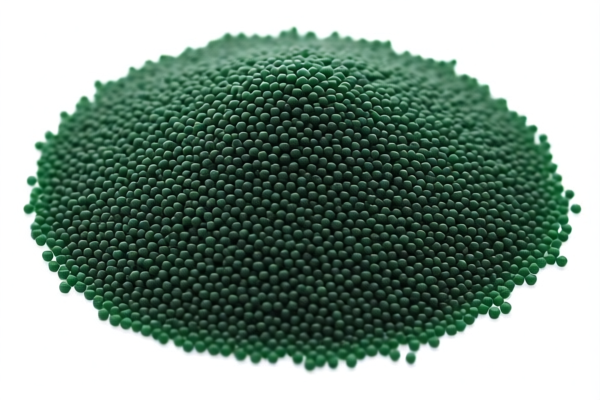

Product Name: Elastomeric Petroleum Resin Granules

Classification HS Code: 3911901000, 3911902500, 3911909110

🔍 HS Code Classification Overview

- 3911901000: Covers elastomeric petroleum resin granules in their primary form.

- 3911902500: Covers petroleum resin granules (general category).

- 3911909110: Covers thermoplastic petroleum resin granules.

📊 Tariff Summary (as of now)

1. 3911901000

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

2. 3911902500

- Base Tariff Rate: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.1%

3. 3911909110

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-Dumping Duties: No specific anti-dumping duties are currently listed for this product category.

- No Special Tariffs on Iron/Aluminum: These are not applicable for petroleum resin granules.

📌 Proactive Advice for Importers

- Verify Material Specifications: Confirm whether the product is elastomeric, thermoplastic, or general petroleum resin to ensure correct HS code classification.

- Check Unit Price and Packaging: Tariff rates may vary based on product form (e.g., granules vs. pellets).

- Certifications Required: Ensure compliance with any customs documentation, product standards, or environmental regulations applicable in the destination country.

- Monitor Tariff Updates: Keep track of April 11, 2025 deadline to avoid unexpected cost increases.

Let me know if you need help with customs documentation, certification requirements, or tariff calculation tools.

Product Name: Elastomeric Petroleum Resin Granules

Classification HS Code: 3911901000, 3911902500, 3911909110

🔍 HS Code Classification Overview

- 3911901000: Covers elastomeric petroleum resin granules in their primary form.

- 3911902500: Covers petroleum resin granules (general category).

- 3911909110: Covers thermoplastic petroleum resin granules.

📊 Tariff Summary (as of now)

1. 3911901000

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

2. 3911902500

- Base Tariff Rate: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.1%

3. 3911909110

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-Dumping Duties: No specific anti-dumping duties are currently listed for this product category.

- No Special Tariffs on Iron/Aluminum: These are not applicable for petroleum resin granules.

📌 Proactive Advice for Importers

- Verify Material Specifications: Confirm whether the product is elastomeric, thermoplastic, or general petroleum resin to ensure correct HS code classification.

- Check Unit Price and Packaging: Tariff rates may vary based on product form (e.g., granules vs. pellets).

- Certifications Required: Ensure compliance with any customs documentation, product standards, or environmental regulations applicable in the destination country.

- Monitor Tariff Updates: Keep track of April 11, 2025 deadline to avoid unexpected cost increases.

Let me know if you need help with customs documentation, certification requirements, or tariff calculation tools.

Customer Reviews

No reviews yet.