| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920940000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3909390000 | Doc | 61.5% | CN | US | 2025-05-12 |

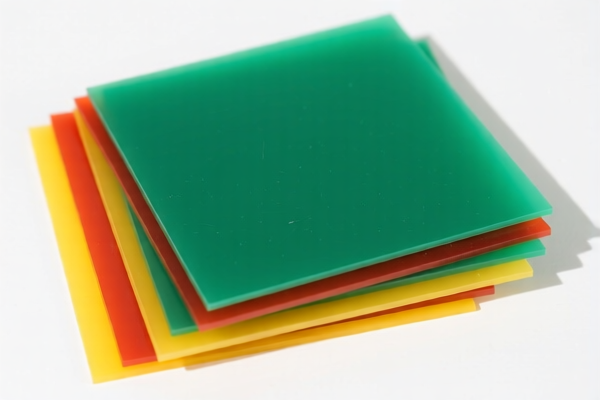

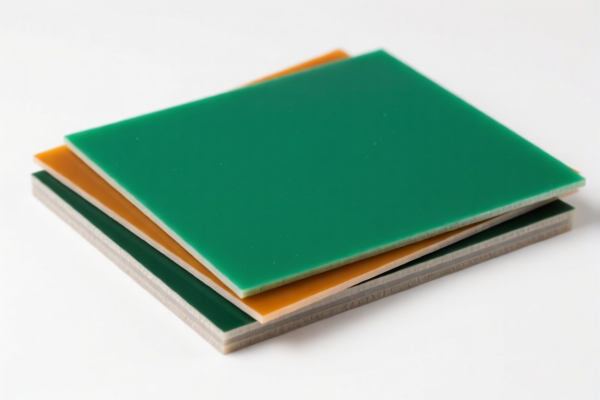

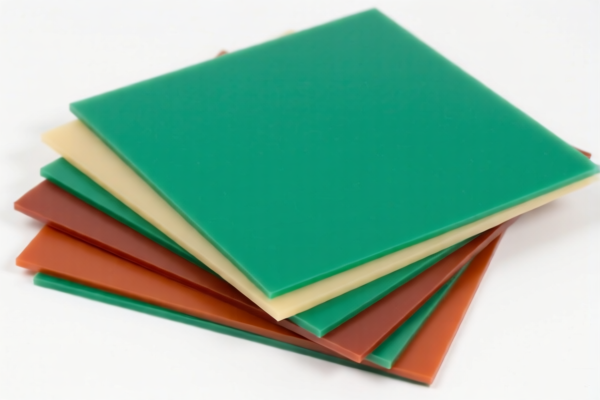

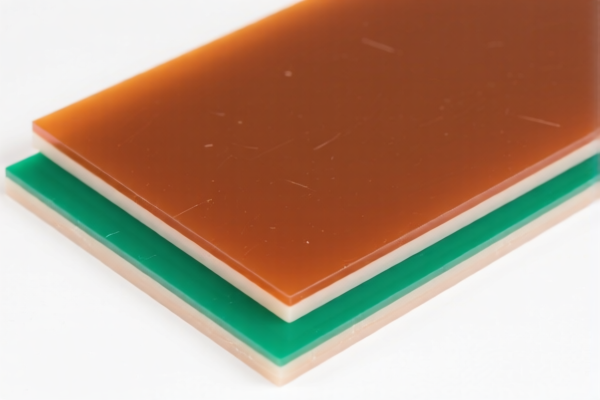

Product Name: Electrical Insulation Phenolic Resin Sheets

Classification HS Codes and Tax Details:

✅ HS Code 3920940000

Description: Other plastic sheets, plates, films, foils and strips, not cellular and not reinforced, laminated, backed or otherwise combined with other materials, especially phenolic resin-based plastics.

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

✅ HS Code 3909390000

Description: Amino resins, phenolic resins and polyurethanes, in primary form. "Phenolic resin boards" fall under this category.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: Both HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is aligned with this policy.

- Anti-Dumping Duties: Not explicitly mentioned for this product, but always verify if any anti-dumping or countervailing duties apply based on the country of origin.

- Material Verification: Confirm the exact composition and structure of the phenolic resin sheets (e.g., whether they are laminated or reinforced) to ensure correct HS code classification.

- Certifications Required: Depending on the end-use (e.g., electrical insulation), certifications such as UL, CE, or RoHS may be required for customs clearance.

📌 Proactive Advice:

- Double-check the product specifications (e.g., whether it is laminated, reinforced, or in primary form) to ensure the correct HS code is applied.

- Consult with customs brokers or classification experts if the product has multiple components or is used in specialized applications.

- Keep records of material composition and unit price for potential audits or documentation requirements.

Let me know if you need help with customs documentation or further classification clarification.

Product Name: Electrical Insulation Phenolic Resin Sheets

Classification HS Codes and Tax Details:

✅ HS Code 3920940000

Description: Other plastic sheets, plates, films, foils and strips, not cellular and not reinforced, laminated, backed or otherwise combined with other materials, especially phenolic resin-based plastics.

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

✅ HS Code 3909390000

Description: Amino resins, phenolic resins and polyurethanes, in primary form. "Phenolic resin boards" fall under this category.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: Both HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is aligned with this policy.

- Anti-Dumping Duties: Not explicitly mentioned for this product, but always verify if any anti-dumping or countervailing duties apply based on the country of origin.

- Material Verification: Confirm the exact composition and structure of the phenolic resin sheets (e.g., whether they are laminated or reinforced) to ensure correct HS code classification.

- Certifications Required: Depending on the end-use (e.g., electrical insulation), certifications such as UL, CE, or RoHS may be required for customs clearance.

📌 Proactive Advice:

- Double-check the product specifications (e.g., whether it is laminated, reinforced, or in primary form) to ensure the correct HS code is applied.

- Consult with customs brokers or classification experts if the product has multiple components or is used in specialized applications.

- Keep records of material composition and unit price for potential audits or documentation requirements.

Let me know if you need help with customs documentation or further classification clarification.

Customer Reviews

No reviews yet.