Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902900050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911909150 | Doc | 61.5% | CN | US | 2025-05-12 |

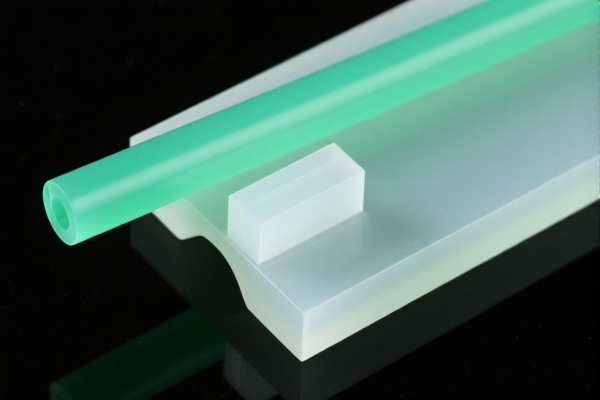

Product Classification: Engineering Plastic Polyacetal Resin

HS CODE: 3907100000

🔍 Classification Summary

- Product Name: Engineering Plastic Polyacetal Resin

- HS CODE: 3907100000

- Description: Matches the description of "polyacetal" under HS CODE 3907.30.00.

- Tariff Summary: 61.5% total tax rate

📊 Tariff Breakdown

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

⚠️ Important Notes

- Anti-dumping duties: Not applicable for this product category.

- Special Tariff Alert: The 30.0% additional tariff applies after April 11, 2025.

- Material Verification: Confirm the exact chemical composition and whether it is indeed polyacetal (polyoxymethylene) to ensure correct classification.

- Certifications: Check if any specific certifications (e.g., REACH, RoHS) are required for import into the destination country.

📌 Proactive Advice

- Verify Material Specifications: Ensure the product is indeed polyacetal and not a blend or modified version that may fall under a different HS code.

- Check Unit Price: Tariff calculations may depend on the declared value and unit price.

- Consult Customs Broker: For complex cases, seek assistance from a customs broker or regulatory expert to avoid misclassification and penalties.

📌 Alternative HS Codes for Reference

- 3908902000 – Polyamide (nylon) resins, other copolymers

- 3907290000 – Other polyether resins

- 3902900050 – Polypropylene resins, engineering grade

- 3911909150 – Thermosetting polycarbonate resins

These codes may apply to similar engineering plastics, but 3907100000 is the most accurate for polyacetal resin.

Product Classification: Engineering Plastic Polyacetal Resin

HS CODE: 3907100000

🔍 Classification Summary

- Product Name: Engineering Plastic Polyacetal Resin

- HS CODE: 3907100000

- Description: Matches the description of "polyacetal" under HS CODE 3907.30.00.

- Tariff Summary: 61.5% total tax rate

📊 Tariff Breakdown

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

⚠️ Important Notes

- Anti-dumping duties: Not applicable for this product category.

- Special Tariff Alert: The 30.0% additional tariff applies after April 11, 2025.

- Material Verification: Confirm the exact chemical composition and whether it is indeed polyacetal (polyoxymethylene) to ensure correct classification.

- Certifications: Check if any specific certifications (e.g., REACH, RoHS) are required for import into the destination country.

📌 Proactive Advice

- Verify Material Specifications: Ensure the product is indeed polyacetal and not a blend or modified version that may fall under a different HS code.

- Check Unit Price: Tariff calculations may depend on the declared value and unit price.

- Consult Customs Broker: For complex cases, seek assistance from a customs broker or regulatory expert to avoid misclassification and penalties.

📌 Alternative HS Codes for Reference

- 3908902000 – Polyamide (nylon) resins, other copolymers

- 3907290000 – Other polyether resins

- 3902900050 – Polypropylene resins, engineering grade

- 3911909150 – Thermosetting polycarbonate resins

These codes may apply to similar engineering plastics, but 3907100000 is the most accurate for polyacetal resin.

Customer Reviews

No reviews yet.