Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3901400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901905501 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901105030 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901905501 | Doc | 61.5% | CN | US | 2025-05-12 |

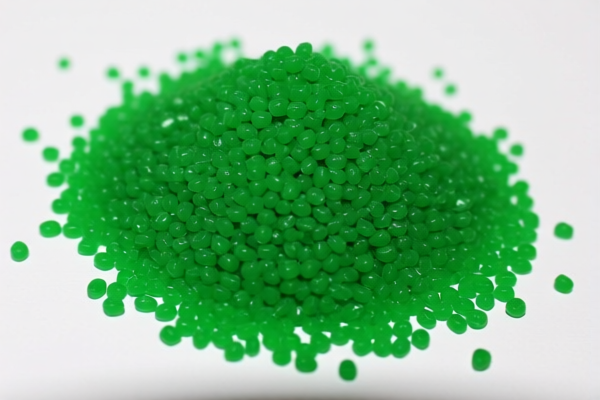

Product Name: Ethylene Alpha Olefin Copolymer Granules

HS CODEs Identified:

- 3901400000

- 3901905501

- 3901105030

🔍 Classification Summary:

- 3901400000: Applies to ethylene-α-olefin copolymer granules with a specific gravity less than 0.94. This is the most specific code for this product type.

- 3901905501 & 3901105030: Apply to ethylene polymer in its primary form, which may include granules. These codes are broader and may apply if the product is not clearly defined as a copolymer.

📊 Tariff Overview (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 2, 2025): 30.0%

- Total Tariff Rate: 61.5% (6.5% + 25.0% + 30.0%)

⏱️ Time-Sensitive Policy Alert:

- April 2, 2025: A special additional tariff of 30.0% will be imposed on this product.

- This is a critical date for customs clearance and cost estimation.

- Ensure your import timeline accounts for this increase.

🛑 Anti-Dumping Duties:

- Not applicable for this product category (ethylene alpha olefin copolymer granules).

- No known anti-dumping duties are currently in effect for this HS code.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Confirm the specific gravity and chemical composition of the product to ensure correct HS code classification.

- Check Unit Price: The final tariff cost depends on the quantity and value of the goods. Ensure accurate pricing for customs valuation.

- Certifications Required: Confirm if technical documentation, material safety data sheets (MSDS), or origin certificates are needed for customs clearance.

- Consult a Customs Broker: For complex cases, especially if the product is borderline between multiple HS codes.

✅ Summary Table:

| HS CODE | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.2) | Total Tariff |

|---|---|---|---|---|---|

| 3901400000 | Ethylene-α-olefin copolymer granules (<0.94) | 6.5% | 25.0% | 30.0% | 61.5% |

| 3901905501 | Ethylene polymer (primary form) | 6.5% | 25.0% | 30.0% | 61.5% |

| 3901105030 | Ethylene polymer (primary form) | 6.5% | 25.0% | 30.0% | 61.5% |

If you have more details about the product (e.g., specific gravity, exact chemical structure, or country of origin), I can help refine the classification further.

Product Name: Ethylene Alpha Olefin Copolymer Granules

HS CODEs Identified:

- 3901400000

- 3901905501

- 3901105030

🔍 Classification Summary:

- 3901400000: Applies to ethylene-α-olefin copolymer granules with a specific gravity less than 0.94. This is the most specific code for this product type.

- 3901905501 & 3901105030: Apply to ethylene polymer in its primary form, which may include granules. These codes are broader and may apply if the product is not clearly defined as a copolymer.

📊 Tariff Overview (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 2, 2025): 30.0%

- Total Tariff Rate: 61.5% (6.5% + 25.0% + 30.0%)

⏱️ Time-Sensitive Policy Alert:

- April 2, 2025: A special additional tariff of 30.0% will be imposed on this product.

- This is a critical date for customs clearance and cost estimation.

- Ensure your import timeline accounts for this increase.

🛑 Anti-Dumping Duties:

- Not applicable for this product category (ethylene alpha olefin copolymer granules).

- No known anti-dumping duties are currently in effect for this HS code.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Confirm the specific gravity and chemical composition of the product to ensure correct HS code classification.

- Check Unit Price: The final tariff cost depends on the quantity and value of the goods. Ensure accurate pricing for customs valuation.

- Certifications Required: Confirm if technical documentation, material safety data sheets (MSDS), or origin certificates are needed for customs clearance.

- Consult a Customs Broker: For complex cases, especially if the product is borderline between multiple HS codes.

✅ Summary Table:

| HS CODE | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.2) | Total Tariff |

|---|---|---|---|---|---|

| 3901400000 | Ethylene-α-olefin copolymer granules (<0.94) | 6.5% | 25.0% | 30.0% | 61.5% |

| 3901905501 | Ethylene polymer (primary form) | 6.5% | 25.0% | 30.0% | 61.5% |

| 3901105030 | Ethylene polymer (primary form) | 6.5% | 25.0% | 30.0% | 61.5% |

If you have more details about the product (e.g., specific gravity, exact chemical structure, or country of origin), I can help refine the classification further.

Customer Reviews

No reviews yet.