Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3901400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901905501 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901400000 | Doc | 61.5% | CN | US | 2025-05-12 |

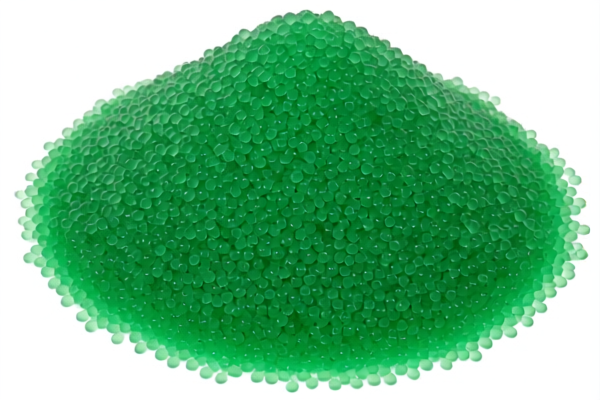

Product Name: Ethylene Alpha Olefin Copolymer Resin

Classification HS Code: 3901400000 (multiple entries apply, all under this code)

🔍 HS Code Overview:

- HS Code: 3901400000

- Description: Applies to ethylene-alpha-olefin copolymer resins with a specific gravity less than 0.94. This includes various forms such as resin, granules, film, and specific types like ethylene-octene copolymer resin (since octene is an alpha-olefin).

📊 Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 61.5% (6.5% + 25.0% + 30.0%)

⏱️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a critical date for customs clearance planning and cost estimation.

🛑 Anti-Dumping Duties:

- Not applicable for this product category (no mention of anti-dumping duties on iron or aluminum, which are unrelated to polymer resins).

📌 Proactive Advice for Importers:

- Verify Material Specifications: Ensure the product's specific gravity is less than 0.94 to qualify under HS code 3901400000.

- Check Unit Price and Form: Confirm whether the product is in resin, granules, film, or other forms, as this may affect classification (though all forms under this code are covered).

- Review Certification Requirements: Some countries may require technical specifications, safety data sheets (SDS), or polymer type certifications.

- Plan for Tariff Increases: With the 30.0% additional tariff after April 11, 2025, consider adjusting pricing or sourcing strategies in advance.

✅ Summary:

- HS Code: 3901400000

- Total Tariff: 61.5% (6.5% base + 25% general + 30% after April 11, 2025)

- Key Considerations: Specific gravity, product form, and timing of import (especially after April 11, 2025).

- Action Required: Confirm product specs, prepare documentation, and plan for tariff changes.

Product Name: Ethylene Alpha Olefin Copolymer Resin

Classification HS Code: 3901400000 (multiple entries apply, all under this code)

🔍 HS Code Overview:

- HS Code: 3901400000

- Description: Applies to ethylene-alpha-olefin copolymer resins with a specific gravity less than 0.94. This includes various forms such as resin, granules, film, and specific types like ethylene-octene copolymer resin (since octene is an alpha-olefin).

📊 Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 61.5% (6.5% + 25.0% + 30.0%)

⏱️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a critical date for customs clearance planning and cost estimation.

🛑 Anti-Dumping Duties:

- Not applicable for this product category (no mention of anti-dumping duties on iron or aluminum, which are unrelated to polymer resins).

📌 Proactive Advice for Importers:

- Verify Material Specifications: Ensure the product's specific gravity is less than 0.94 to qualify under HS code 3901400000.

- Check Unit Price and Form: Confirm whether the product is in resin, granules, film, or other forms, as this may affect classification (though all forms under this code are covered).

- Review Certification Requirements: Some countries may require technical specifications, safety data sheets (SDS), or polymer type certifications.

- Plan for Tariff Increases: With the 30.0% additional tariff after April 11, 2025, consider adjusting pricing or sourcing strategies in advance.

✅ Summary:

- HS Code: 3901400000

- Total Tariff: 61.5% (6.5% base + 25% general + 30% after April 11, 2025)

- Key Considerations: Specific gravity, product form, and timing of import (especially after April 11, 2025).

- Action Required: Confirm product specs, prepare documentation, and plan for tariff changes.

Customer Reviews

No reviews yet.