| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3901905501 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3905911000 | Doc | 59.0% | CN | US | 2025-05-12 |

| 3901105030 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901306000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3905290000 | Doc | 59.0% | CN | US | 2025-05-12 |

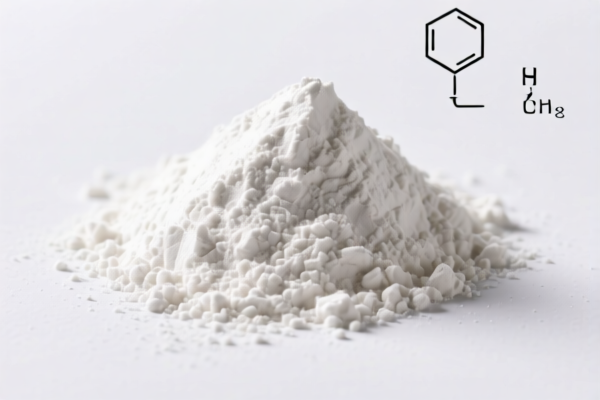

Product Name: Ethylene Copolymer Powder

Classification Analysis and Tax Information:

- HS CODE: 3901905501

- Description: Ethylene copolymer powder, classified under HS code 39019090, falls under the category of primary forms of ethylene polymers, specifically other ethylene copolymers.

- Total Tax Rate: 61.5%

-

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3905911000

- Description: Vinyl copolymer resin powder, classified under HS code 3905, includes "vinyl copolymer" and is categorized as a primary form of copolymer.

- Total Tax Rate: 59.0%

-

Tax Breakdown:

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3901105030

- Description: Ethylene copolymer granules, classified under HS code 3901, fall under the category of primary forms of ethylene polymers.

- Total Tax Rate: 61.5%

-

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3901306000

- Description: Ethylene-vinyl acetate copolymer powder, classified under HS code 39019090, falls under the category of ethylene-vinyl acetate copolymer.

- Total Tax Rate: 60.3%

-

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3905290000

- Description: Ethylene-vinyl acetate copolymer powder, classified under HS code 3905, falls under the category of primary forms of copolymers.

- Total Tax Rate: 59.0%

- Tax Breakdown:

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after this date for all the above HS codes. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not applicable for this product category.

- Certifications Required: Verify if any specific certifications (e.g., REACH, RoHS, or customs documentation) are required for import.

- Material and Unit Price: Confirm the exact material composition and unit price to ensure correct classification and tax calculation.

Proactive Advice:

- Double-check the product's chemical composition and physical form (e.g., powder vs. granules) to ensure accurate HS code classification.

- Consult with a customs broker or regulatory authority if the product contains additives or is blended with other materials.

Product Name: Ethylene Copolymer Powder

Classification Analysis and Tax Information:

- HS CODE: 3901905501

- Description: Ethylene copolymer powder, classified under HS code 39019090, falls under the category of primary forms of ethylene polymers, specifically other ethylene copolymers.

- Total Tax Rate: 61.5%

-

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3905911000

- Description: Vinyl copolymer resin powder, classified under HS code 3905, includes "vinyl copolymer" and is categorized as a primary form of copolymer.

- Total Tax Rate: 59.0%

-

Tax Breakdown:

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3901105030

- Description: Ethylene copolymer granules, classified under HS code 3901, fall under the category of primary forms of ethylene polymers.

- Total Tax Rate: 61.5%

-

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3901306000

- Description: Ethylene-vinyl acetate copolymer powder, classified under HS code 39019090, falls under the category of ethylene-vinyl acetate copolymer.

- Total Tax Rate: 60.3%

-

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3905290000

- Description: Ethylene-vinyl acetate copolymer powder, classified under HS code 3905, falls under the category of primary forms of copolymers.

- Total Tax Rate: 59.0%

- Tax Breakdown:

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after this date for all the above HS codes. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not applicable for this product category.

- Certifications Required: Verify if any specific certifications (e.g., REACH, RoHS, or customs documentation) are required for import.

- Material and Unit Price: Confirm the exact material composition and unit price to ensure correct classification and tax calculation.

Proactive Advice:

- Double-check the product's chemical composition and physical form (e.g., powder vs. granules) to ensure accurate HS code classification.

- Consult with a customs broker or regulatory authority if the product contains additives or is blended with other materials.

Customer Reviews

No reviews yet.