Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3901901000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3901901000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3901901000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3901901000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3901901000 | Doc | 55.0% | CN | US | 2025-05-12 |

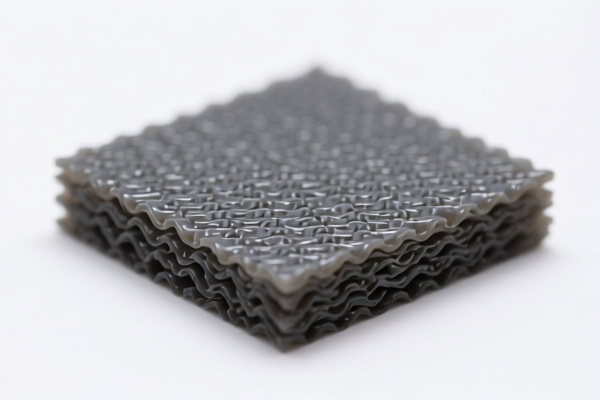

Product Name: Ethylene Elastomer Composite Material

HS CODE: 3901903000

✅ Classification Summary:

- The product "Ethylene Elastomer Composite Material" is classified under HS CODE 3901903000.

- This code falls under Chapter 39, which covers Plastics and articles thereof, and specifically under 3901, which includes Primary forms of ethylene polymers.

- The product is categorized as an elastomer, which is a type of polymer with elastic properties.

📊 Tariff Overview:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 55.0%

⏰ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a significant increase from the standard 25.0% additional tariff. - Impact: This will increase the total import cost by 5% (from 50.0% to 55.0%) after the specified date.

🛑 Anti-Dumping Duties:

- No specific anti-dumping duties are currently listed for this product.

- However, it is recommended to verify if any anti-dumping or countervailing duties apply based on the country of origin and specific product composition.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed classified as an elastomer and not a compound or finished product, which may fall under a different HS code.

- Check Unit Price and Quantity: Accurate declaration of unit price and quantity is essential for customs valuation and duty calculation.

- Certifications Required: Confirm if any technical specifications, safety certifications, or environmental compliance documents are required for import.

- Monitor Policy Updates: Stay informed about tariff changes and trade policy updates, especially around April 11, 2025, to avoid unexpected costs.

📚 Example:

If you are importing 100 kg of ethylene elastomer composite material with a FOB price of $10/kg, the total duty after April 11, 2025, would be:

- Duty amount: $10/kg × 100 kg × 55.0% = $550

- Total import cost: $1000 (FOB) + $550 (duty) = $1550

Let me know if you need help with customs documentation, certification requirements, or duty calculation tools.

Product Name: Ethylene Elastomer Composite Material

HS CODE: 3901903000

✅ Classification Summary:

- The product "Ethylene Elastomer Composite Material" is classified under HS CODE 3901903000.

- This code falls under Chapter 39, which covers Plastics and articles thereof, and specifically under 3901, which includes Primary forms of ethylene polymers.

- The product is categorized as an elastomer, which is a type of polymer with elastic properties.

📊 Tariff Overview:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 55.0%

⏰ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a significant increase from the standard 25.0% additional tariff. - Impact: This will increase the total import cost by 5% (from 50.0% to 55.0%) after the specified date.

🛑 Anti-Dumping Duties:

- No specific anti-dumping duties are currently listed for this product.

- However, it is recommended to verify if any anti-dumping or countervailing duties apply based on the country of origin and specific product composition.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed classified as an elastomer and not a compound or finished product, which may fall under a different HS code.

- Check Unit Price and Quantity: Accurate declaration of unit price and quantity is essential for customs valuation and duty calculation.

- Certifications Required: Confirm if any technical specifications, safety certifications, or environmental compliance documents are required for import.

- Monitor Policy Updates: Stay informed about tariff changes and trade policy updates, especially around April 11, 2025, to avoid unexpected costs.

📚 Example:

If you are importing 100 kg of ethylene elastomer composite material with a FOB price of $10/kg, the total duty after April 11, 2025, would be:

- Duty amount: $10/kg × 100 kg × 55.0% = $550

- Total import cost: $1000 (FOB) + $550 (duty) = $1550

Let me know if you need help with customs documentation, certification requirements, or duty calculation tools.

Customer Reviews

No reviews yet.