| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3901205000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3901105030 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901101000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901905501 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the structured and professional breakdown of the HS codes and associated tariff information for Ethylene Polymer Blow Film Raw Material:

✅ HS CODE: 3901205000

Product Description: Polyethylene blow film raw material

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This product is classified under polyethylene raw materials specifically for blow film production.

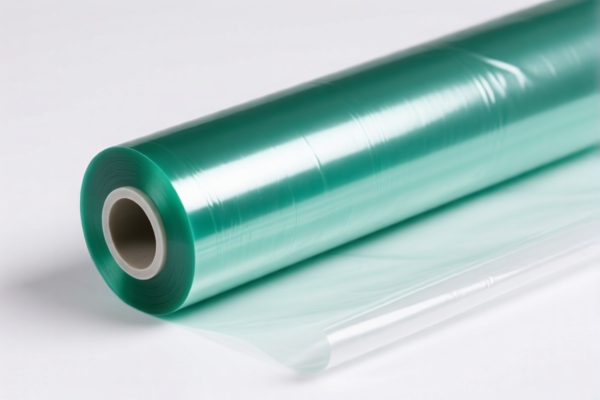

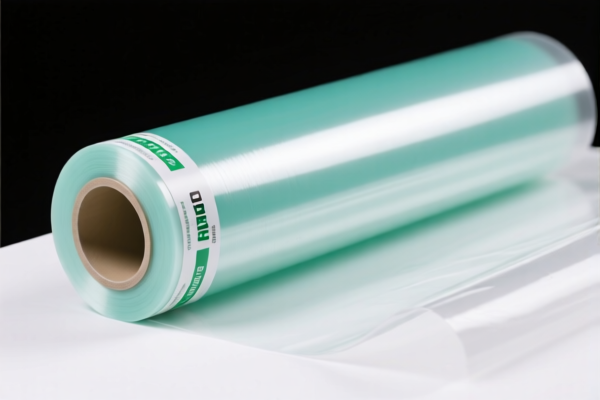

✅ HS CODE: 3920100000

Product Description: Polyethylene blow film

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to the finished blow film product, not the raw material. Tax rate is slightly lower than raw material due to different classification.

✅ HS CODE: 3901105030

Product Description: Ethylene resin for blow molding

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a specific type of ethylene resin used in blow molding, similar to other polyethylene raw materials.

✅ HS CODE: 3901101000

Product Description: Polyethylene blow molding raw material

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is another variant of polyethylene raw material intended for blow molding.

✅ HS CODE: 3901905501

Product Description: Polyethylene copolymer blow molding raw material

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to polyethylene copolymers used in blow molding, which may have different chemical properties than homopolymers.

📌 Important Notes and Recommendations:

- Tariff Increase Alert: A 30.0% additional tariff will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact chemical composition and intended use of the material to ensure correct HS code classification.

- Certifications: Check if any customs documentation or certifications (e.g., Material Safety Data Sheet, product specifications) are required for import compliance.

- Unit Price: Be aware that tariff rates are applied to the CIF (Cost, Insurance, Freight) value, so verify the unit price and total value of the goods.

If you need further assistance with customs documentation or HS code verification, feel free to provide more details about the product specifications and origin. Here is the structured and professional breakdown of the HS codes and associated tariff information for Ethylene Polymer Blow Film Raw Material:

✅ HS CODE: 3901205000

Product Description: Polyethylene blow film raw material

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This product is classified under polyethylene raw materials specifically for blow film production.

✅ HS CODE: 3920100000

Product Description: Polyethylene blow film

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to the finished blow film product, not the raw material. Tax rate is slightly lower than raw material due to different classification.

✅ HS CODE: 3901105030

Product Description: Ethylene resin for blow molding

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a specific type of ethylene resin used in blow molding, similar to other polyethylene raw materials.

✅ HS CODE: 3901101000

Product Description: Polyethylene blow molding raw material

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is another variant of polyethylene raw material intended for blow molding.

✅ HS CODE: 3901905501

Product Description: Polyethylene copolymer blow molding raw material

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to polyethylene copolymers used in blow molding, which may have different chemical properties than homopolymers.

📌 Important Notes and Recommendations:

- Tariff Increase Alert: A 30.0% additional tariff will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact chemical composition and intended use of the material to ensure correct HS code classification.

- Certifications: Check if any customs documentation or certifications (e.g., Material Safety Data Sheet, product specifications) are required for import compliance.

- Unit Price: Be aware that tariff rates are applied to the CIF (Cost, Insurance, Freight) value, so verify the unit price and total value of the goods.

If you need further assistance with customs documentation or HS code verification, feel free to provide more details about the product specifications and origin.

Customer Reviews

No reviews yet.