| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3901205000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901105030 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901905501 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3902900050 | Doc | 61.5% | CN | US | 2025-05-12 |

- HS CODE: 3901205000

- Product Name: Polyethylene blowing grade raw material

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This product is classified under polyethylene blowing grade raw material. Ensure the material specifications match the HS code description.

-

HS CODE: 3901105030

- Product Name: Ethylene resin for blowing

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code applies to ethylene resin specifically used for blowing. Confirm the product is not misclassified as a different polymer type.

-

HS CODE: 3901905501

- Product Name: Polyethylene copolymer blowing grade raw material

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This is for polyethylene copolymer used in blowing. Verify the polymer type and confirm it is not a homopolymer.

-

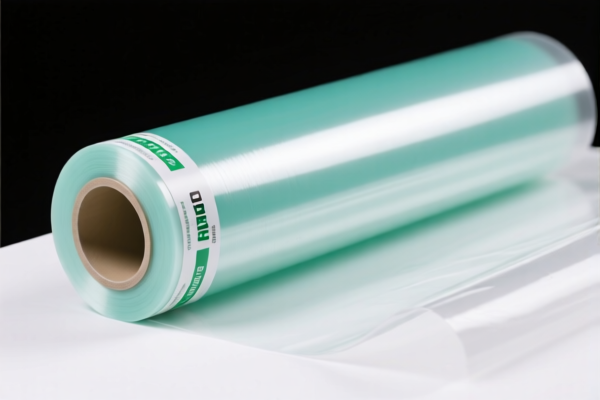

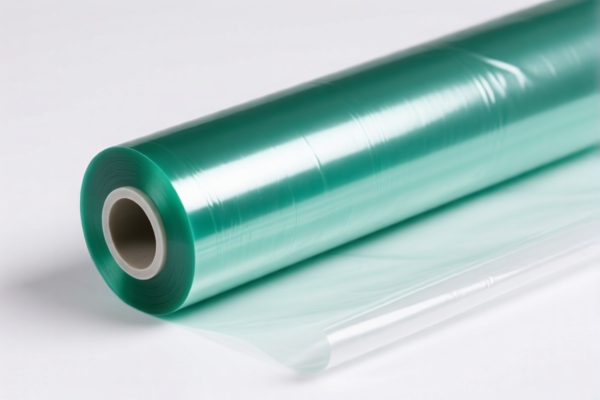

HS CODE: 3920100000

- Product Name: Polyethylene blown film

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code applies to finished blown film, not raw material. Ensure the product is not misclassified as raw material.

-

HS CODE: 3902900050

- Product Name: Polypropylene blowing material

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This is for polypropylene used in blowing. Confirm the polymer type and ensure it is not misclassified as polyethylene.

Proactive Advice:

- Verify Material Specifications: Ensure the product description and technical data align with the HS code.

- Check Unit Price and Certification: Confirm if any certifications (e.g., RoHS, REACH) are required for import.

- Monitor Tariff Changes: The additional tariffs after April 2, 2025, will increase the total tax by 5% (from 25% to 30%). Plan accordingly for cost adjustments.

- Consult Customs Broker: For complex classifications, especially if the product is a blend or has multiple uses.

- HS CODE: 3901205000

- Product Name: Polyethylene blowing grade raw material

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This product is classified under polyethylene blowing grade raw material. Ensure the material specifications match the HS code description.

-

HS CODE: 3901105030

- Product Name: Ethylene resin for blowing

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code applies to ethylene resin specifically used for blowing. Confirm the product is not misclassified as a different polymer type.

-

HS CODE: 3901905501

- Product Name: Polyethylene copolymer blowing grade raw material

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This is for polyethylene copolymer used in blowing. Verify the polymer type and confirm it is not a homopolymer.

-

HS CODE: 3920100000

- Product Name: Polyethylene blown film

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code applies to finished blown film, not raw material. Ensure the product is not misclassified as raw material.

-

HS CODE: 3902900050

- Product Name: Polypropylene blowing material

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This is for polypropylene used in blowing. Confirm the polymer type and ensure it is not misclassified as polyethylene.

Proactive Advice:

- Verify Material Specifications: Ensure the product description and technical data align with the HS code.

- Check Unit Price and Certification: Confirm if any certifications (e.g., RoHS, REACH) are required for import.

- Monitor Tariff Changes: The additional tariffs after April 2, 2025, will increase the total tax by 5% (from 25% to 30%). Plan accordingly for cost adjustments.

- Consult Customs Broker: For complex classifications, especially if the product is a blend or has multiple uses.

Customer Reviews

No reviews yet.