Found 2 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3901400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901205000 | Doc | 61.5% | CN | US | 2025-05-12 |

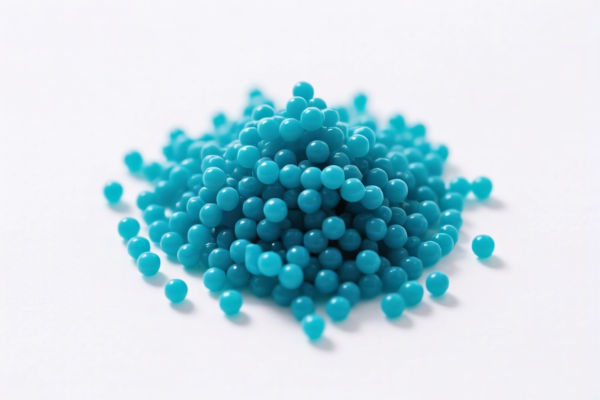

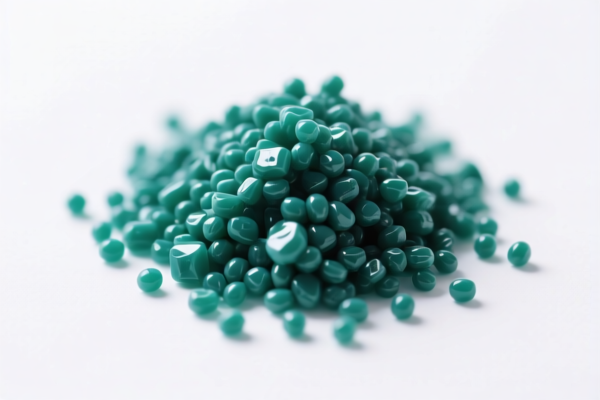

Product Name: Ethylene Polymer Granules (Packaging Grade)

HS CODE:

- 3901400000 – Packaging Grade Polyethylene Resin

- 3901205000 – Polyethylene Granules (Packaging)

🔍 Tariff Overview and Classification Notes

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff Imposed After April 11, 2025: 30.0%

- Total Tax Rate: 61.5% (6.5% + 25.0% + 30.0%)

📌 Key Points to Note

- Both HS codes fall under Chapter 39 (Plastics and articles thereof), Heading 3901 (Polyethylene).

- The difference between the two codes is primarily in the description and intended use (e.g., "resin" vs. "granules" and "packaging grade").

- Both are subject to the same tariff structure, including the additional 30% tariff after April 11, 2025.

⚠️ Time-Sensitive Policy Alert

- Additional Tariff of 30% applies only after April 11, 2025.

- Ensure your import timeline aligns with this policy to avoid unexpected costs.

📦 Customs Compliance Recommendations

- Verify Material Specifications: Confirm whether the product is classified as "resin" or "granules" and whether it is specifically for packaging use.

- Check Unit Price and Packaging: Tariff classification may vary based on the form and packaging of the product.

- Certifications Required: Ensure compliance with any required documentation (e.g., certificate of origin, product specifications, etc.).

- Consult with a Customs Broker: For complex or high-value shipments, professional guidance is recommended to avoid misclassification.

📊 Summary Table

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (After 2025.4.11) | Total Tax Rate |

|---|---|---|---|---|---|

| 3901400000 | Packaging Grade Polyethylene Resin | 6.5% | 25.0% | 30.0% | 61.5% |

| 3901205000 | Polyethylene Granules (Packaging) | 6.5% | 25.0% | 30.0% | 61.5% |

If you have further details about the product (e.g., specific use, country of origin, or packaging), I can provide more tailored guidance.

Product Name: Ethylene Polymer Granules (Packaging Grade)

HS CODE:

- 3901400000 – Packaging Grade Polyethylene Resin

- 3901205000 – Polyethylene Granules (Packaging)

🔍 Tariff Overview and Classification Notes

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff Imposed After April 11, 2025: 30.0%

- Total Tax Rate: 61.5% (6.5% + 25.0% + 30.0%)

📌 Key Points to Note

- Both HS codes fall under Chapter 39 (Plastics and articles thereof), Heading 3901 (Polyethylene).

- The difference between the two codes is primarily in the description and intended use (e.g., "resin" vs. "granules" and "packaging grade").

- Both are subject to the same tariff structure, including the additional 30% tariff after April 11, 2025.

⚠️ Time-Sensitive Policy Alert

- Additional Tariff of 30% applies only after April 11, 2025.

- Ensure your import timeline aligns with this policy to avoid unexpected costs.

📦 Customs Compliance Recommendations

- Verify Material Specifications: Confirm whether the product is classified as "resin" or "granules" and whether it is specifically for packaging use.

- Check Unit Price and Packaging: Tariff classification may vary based on the form and packaging of the product.

- Certifications Required: Ensure compliance with any required documentation (e.g., certificate of origin, product specifications, etc.).

- Consult with a Customs Broker: For complex or high-value shipments, professional guidance is recommended to avoid misclassification.

📊 Summary Table

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (After 2025.4.11) | Total Tax Rate |

|---|---|---|---|---|---|

| 3901400000 | Packaging Grade Polyethylene Resin | 6.5% | 25.0% | 30.0% | 61.5% |

| 3901205000 | Polyethylene Granules (Packaging) | 6.5% | 25.0% | 30.0% | 61.5% |

If you have further details about the product (e.g., specific use, country of origin, or packaging), I can provide more tailored guidance.

Customer Reviews

No reviews yet.