| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3901909000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901306000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3901205000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 8544606000 | Doc | 58.2% | CN | US | 2025-05-12 |

| 8544491000 | Doc | 55.0% | CN | US | 2025-05-12 |

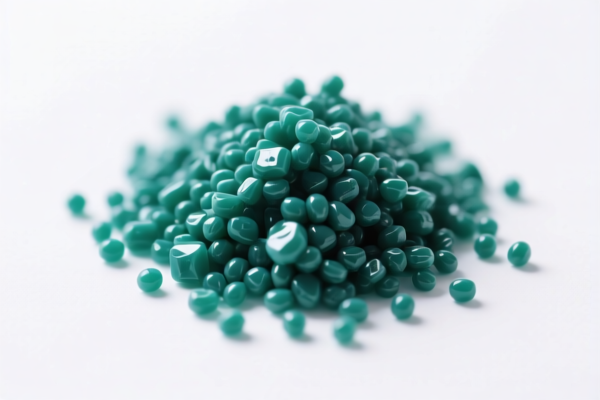

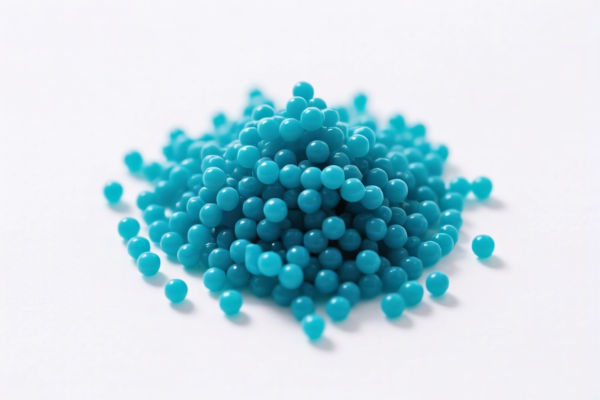

Product Name: Ethylene Polymer Mixture - Cable Grade

Classification: Polymer material used in cable manufacturing

✅ HS CODE Classification Overview

Below are the HS codes and associated tariff details for Ethylene Polymer Mixture - Cable Grade. These classifications are based on the product's chemical composition and intended use in cable manufacturing.

🔢 HS CODE: 3901909000

Description: Ethylene Polymer Mixture - Cable Grade (General category for other ethylene polymers in primary form)

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

Notes:

- This is a general category for other ethylene polymers in primary form.

- Cable-grade materials are considered primary forms of polymers.

🔢 HS CODE: 3901306000

Description: Ethylene Polymer Mixture - Cable Grade (Ethylene-vinyl acetate copolymer, other)

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

Notes:

- Specifically for ethylene-vinyl acetate copolymers.

- Cable-grade materials may fall under this category if they are made from this specific polymer.

🔢 HS CODE: 3901205000

Description: Ethylene Polymer Mixture - Cable Grade (Polyethylene with density ≥ 0.94, other)

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

Notes:

- For polyethylene with a density of 0.94 or higher.

- Cable-grade polyethylene may fall under this category.

🔢 HS CODE: 8544606000

Description: Ethylene Polymer Mixture - Cable Grade (Insulated cable, voltage > 1000V)

Total Tax Rate: 58.2%

Tariff Breakdown:

- Base Tariff: 3.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

Notes:

- This is a finished product category (cable).

- Applicable if the product is used as insulated cable with voltage exceeding 1000V.

🔢 HS CODE: 8544491000

Description: Ethylene Polymer Mixture - Cable Grade (Insulated cable, voltage ≤ 1000V, other)

Total Tax Rate: 58.2%

Tariff Breakdown:

- Base Tariff: 3.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

Notes:

- For insulated cables with voltage up to 1000V.

- Further细分 for cables with voltage ≤ 80V used for telecommunications.

⚠️ Important Notes and Recommendations

- Tariff Increase Alert: A 30% additional tariff will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact chemical composition and density of the polymer to determine the correct HS code.

- Certifications: Check if customs documentation (e.g., material safety data sheets, polymer specifications) are required for compliance.

- Unit Price: Verify the unit price and product form (raw material vs. finished cable) to ensure correct classification and tax calculation.

📌 Proactive Advice

- If the product is raw polymer, use HS codes 3901xx.

- If the product is finished cable, use HS codes 8544xx.

- Always consult with customs authorities or a certified customs broker for final classification and compliance.

Let me know if you need help with customs documentation or tariff calculation tools.

Product Name: Ethylene Polymer Mixture - Cable Grade

Classification: Polymer material used in cable manufacturing

✅ HS CODE Classification Overview

Below are the HS codes and associated tariff details for Ethylene Polymer Mixture - Cable Grade. These classifications are based on the product's chemical composition and intended use in cable manufacturing.

🔢 HS CODE: 3901909000

Description: Ethylene Polymer Mixture - Cable Grade (General category for other ethylene polymers in primary form)

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

Notes:

- This is a general category for other ethylene polymers in primary form.

- Cable-grade materials are considered primary forms of polymers.

🔢 HS CODE: 3901306000

Description: Ethylene Polymer Mixture - Cable Grade (Ethylene-vinyl acetate copolymer, other)

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

Notes:

- Specifically for ethylene-vinyl acetate copolymers.

- Cable-grade materials may fall under this category if they are made from this specific polymer.

🔢 HS CODE: 3901205000

Description: Ethylene Polymer Mixture - Cable Grade (Polyethylene with density ≥ 0.94, other)

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

Notes:

- For polyethylene with a density of 0.94 or higher.

- Cable-grade polyethylene may fall under this category.

🔢 HS CODE: 8544606000

Description: Ethylene Polymer Mixture - Cable Grade (Insulated cable, voltage > 1000V)

Total Tax Rate: 58.2%

Tariff Breakdown:

- Base Tariff: 3.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

Notes:

- This is a finished product category (cable).

- Applicable if the product is used as insulated cable with voltage exceeding 1000V.

🔢 HS CODE: 8544491000

Description: Ethylene Polymer Mixture - Cable Grade (Insulated cable, voltage ≤ 1000V, other)

Total Tax Rate: 58.2%

Tariff Breakdown:

- Base Tariff: 3.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

Notes:

- For insulated cables with voltage up to 1000V.

- Further细分 for cables with voltage ≤ 80V used for telecommunications.

⚠️ Important Notes and Recommendations

- Tariff Increase Alert: A 30% additional tariff will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact chemical composition and density of the polymer to determine the correct HS code.

- Certifications: Check if customs documentation (e.g., material safety data sheets, polymer specifications) are required for compliance.

- Unit Price: Verify the unit price and product form (raw material vs. finished cable) to ensure correct classification and tax calculation.

📌 Proactive Advice

- If the product is raw polymer, use HS codes 3901xx.

- If the product is finished cable, use HS codes 8544xx.

- Always consult with customs authorities or a certified customs broker for final classification and compliance.

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.