| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3905915000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3905290000 | Doc | 59.0% | CN | US | 2025-05-12 |

| 3905911000 | Doc | 59.0% | CN | US | 2025-05-12 |

| 3905915000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3905915000 | Doc | 60.3% | CN | US | 2025-05-12 |

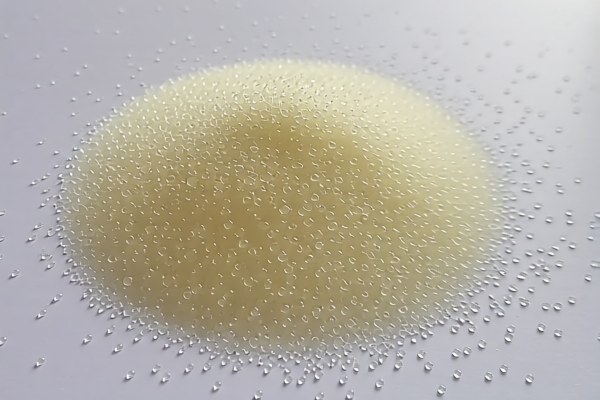

Product Name: Ethylene vinyl acetate copolymer resin for footwear

Classification: HS Code 3905 (Plastics and articles thereof; except those of heading 3901 to 3913)

✅ HS CODE: 3905915000

Description: Ethylene vinyl acetate copolymer resin for footwear, classified under Chapter 3905 as the primary form of vinyl acetate polymer or other vinyl polymers.

🔍 Tariff Breakdown (as of now):

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- No Anti-dumping duties are currently listed for this product.

- No specific anti-dumping duties on iron or aluminum are applicable here, as this is a polymer resin, not a metal product.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Ensure the product is indeed in its primary polymer form and not processed into finished goods (e.g., shoe soles or components), as this may change the HS classification.

- Check Unit Price and Composition: Confirm the exact chemical composition and whether it contains additives or fillers, which may affect classification.

- Certifications Required: Some countries may require technical specifications, safety data sheets (SDS), or environmental compliance documents for polymer imports.

- Monitor Tariff Updates: Keep an eye on April 11, 2025, as the additional tariff will increase significantly after this date.

📊 Comparison with Other HS Codes:

| HS Code | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3905915000 | Vinyl acetate copolymer, primary form | 60.3% | Highest tax rate |

| 3905290000 | Other vinyl polymers, primary form | 59.0% | Slightly lower |

| 3905911000 | Other vinyl acetate copolymer, primary form | 59.0% | Same as above |

🛠️ Recommendation:

If your product is ethylene vinyl acetate (EVA) resin in its primary polymer form, HS Code 3905915000 is likely the correct classification. However, if the product is processed or blended with other materials, you may need to re-evaluate the classification.

For accurate customs clearance, consult a customs broker or classification expert to confirm the exact HS code and applicable duties based on your product's specific composition and end use.

Product Name: Ethylene vinyl acetate copolymer resin for footwear

Classification: HS Code 3905 (Plastics and articles thereof; except those of heading 3901 to 3913)

✅ HS CODE: 3905915000

Description: Ethylene vinyl acetate copolymer resin for footwear, classified under Chapter 3905 as the primary form of vinyl acetate polymer or other vinyl polymers.

🔍 Tariff Breakdown (as of now):

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- No Anti-dumping duties are currently listed for this product.

- No specific anti-dumping duties on iron or aluminum are applicable here, as this is a polymer resin, not a metal product.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Ensure the product is indeed in its primary polymer form and not processed into finished goods (e.g., shoe soles or components), as this may change the HS classification.

- Check Unit Price and Composition: Confirm the exact chemical composition and whether it contains additives or fillers, which may affect classification.

- Certifications Required: Some countries may require technical specifications, safety data sheets (SDS), or environmental compliance documents for polymer imports.

- Monitor Tariff Updates: Keep an eye on April 11, 2025, as the additional tariff will increase significantly after this date.

📊 Comparison with Other HS Codes:

| HS Code | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3905915000 | Vinyl acetate copolymer, primary form | 60.3% | Highest tax rate |

| 3905290000 | Other vinyl polymers, primary form | 59.0% | Slightly lower |

| 3905911000 | Other vinyl acetate copolymer, primary form | 59.0% | Same as above |

🛠️ Recommendation:

If your product is ethylene vinyl acetate (EVA) resin in its primary polymer form, HS Code 3905915000 is likely the correct classification. However, if the product is processed or blended with other materials, you may need to re-evaluate the classification.

For accurate customs clearance, consult a customs broker or classification expert to confirm the exact HS code and applicable duties based on your product's specific composition and end use.

Customer Reviews

No reviews yet.