| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904302000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3905915000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3905290000 | Doc | 59.0% | CN | US | 2025-05-12 |

| 3905915000 | Doc | 60.3% | CN | US | 2025-05-12 |

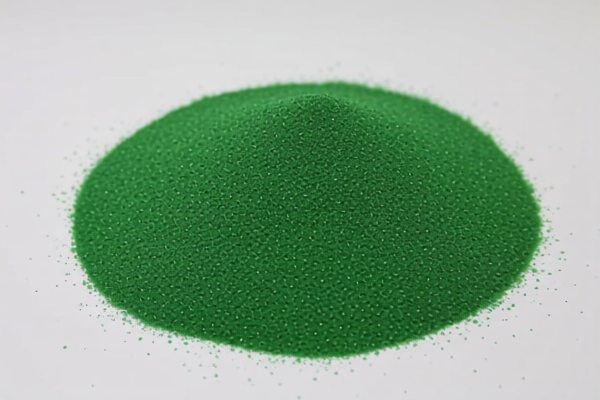

Product Name: Ethylene vinyl acetate vinyl chloride copolymer resin

Classification: Based on the provided HS codes and descriptions, the product falls under the category of synthetic resins derived from vinyl chloride and vinyl acetate monomers.

✅ HS CODES AND TAX DETAILS

Below are the relevant HS codes and their associated tax rates for Ethylene vinyl acetate vinyl chloride copolymer resin:

1. HS CODE: 3904302000

Description: Ethylene-vinyl acetate-vinyl chloride terpolymer resin

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most specific code for a terpolymer (three monomers: ethylene, vinyl acetate, and vinyl chloride).

2. HS CODE: 3904400000

Description: Vinyl chloride-vinyl acetate copolymer resin

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to copolymers of vinyl chloride and vinyl acetate only (no ethylene).

3. HS CODE: 3905915000

Description: Ethylene vinyl acetate chlor乙烯 copolymer (various formulations)

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to ethylene-vinyl acetate-chlor乙烯 copolymers, depending on the exact composition.

4. HS CODE: 3905290000

Description: Ethylene vinyl acetate copolymer resin

- Total Tax Rate: 59.0%

- Breakdown:

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to ethylene-vinyl acetate copolymers only (no chlor乙烯).

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-dumping duties:

No specific anti-dumping duties are listed for this product in the provided data. However, it is advisable to check for any anti-dumping or countervailing duties that may apply based on the country of origin and product composition.

📌 Proactive Advice for Importers

-

Verify Material Composition:

Ensure the exact chemical composition of the resin (e.g., whether it is a terpolymer or copolymer) to select the correct HS code. -

Check Unit Price and Certification Requirements:

Confirm the unit price and whether any certifications (e.g., REACH, RoHS, or customs documentation) are required for import. -

Monitor Tariff Changes:

Keep track of tariff updates, especially the April 11, 2025 deadline, to avoid unexpected costs. -

Consult a Customs Broker:

For complex or high-value shipments, consider engaging a customs broker or compliance expert to ensure accurate classification and duty calculation.

Let me know if you need help determining the correct HS code based on a product specification sheet or certificate of analysis.

Product Name: Ethylene vinyl acetate vinyl chloride copolymer resin

Classification: Based on the provided HS codes and descriptions, the product falls under the category of synthetic resins derived from vinyl chloride and vinyl acetate monomers.

✅ HS CODES AND TAX DETAILS

Below are the relevant HS codes and their associated tax rates for Ethylene vinyl acetate vinyl chloride copolymer resin:

1. HS CODE: 3904302000

Description: Ethylene-vinyl acetate-vinyl chloride terpolymer resin

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most specific code for a terpolymer (three monomers: ethylene, vinyl acetate, and vinyl chloride).

2. HS CODE: 3904400000

Description: Vinyl chloride-vinyl acetate copolymer resin

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to copolymers of vinyl chloride and vinyl acetate only (no ethylene).

3. HS CODE: 3905915000

Description: Ethylene vinyl acetate chlor乙烯 copolymer (various formulations)

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to ethylene-vinyl acetate-chlor乙烯 copolymers, depending on the exact composition.

4. HS CODE: 3905290000

Description: Ethylene vinyl acetate copolymer resin

- Total Tax Rate: 59.0%

- Breakdown:

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to ethylene-vinyl acetate copolymers only (no chlor乙烯).

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-dumping duties:

No specific anti-dumping duties are listed for this product in the provided data. However, it is advisable to check for any anti-dumping or countervailing duties that may apply based on the country of origin and product composition.

📌 Proactive Advice for Importers

-

Verify Material Composition:

Ensure the exact chemical composition of the resin (e.g., whether it is a terpolymer or copolymer) to select the correct HS code. -

Check Unit Price and Certification Requirements:

Confirm the unit price and whether any certifications (e.g., REACH, RoHS, or customs documentation) are required for import. -

Monitor Tariff Changes:

Keep track of tariff updates, especially the April 11, 2025 deadline, to avoid unexpected costs. -

Consult a Customs Broker:

For complex or high-value shipments, consider engaging a customs broker or compliance expert to ensure accurate classification and duty calculation.

Let me know if you need help determining the correct HS code based on a product specification sheet or certificate of analysis.

Customer Reviews

No reviews yet.