| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904302000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3901302000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3901905501 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901905501 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904302000 | Doc | 55.0% | CN | US | 2025-05-12 |

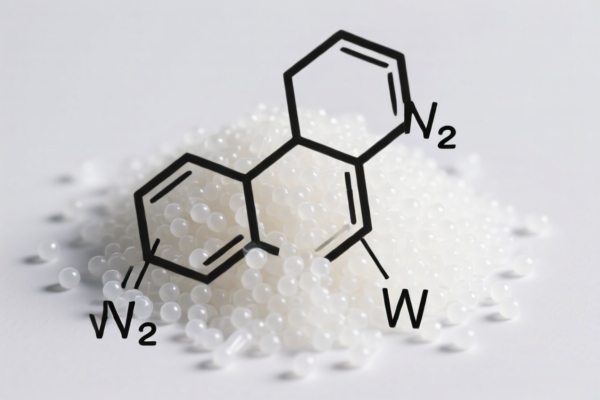

Product Name: Ethylene vinyl acetate vinyl chloride terpolymer

Classification: Based on the provided HS codes and descriptions, the product falls under the following classifications:

🔍 HS CODE: 3904302000

Description: Ethylene-vinyl acetate-vinyl chloride terpolymer (resin)

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Other Additional Tariffs: None specified

🔍 HS CODE: 3901302000

Description: Ethylene-vinyl acetate-vinyl chloride ternary copolymer particles

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Other Additional Tariffs: None specified

🔍 HS CODE: 3901905501

Description: Ethylene vinyl chloride copolymer or Ethylene vinyl acetate copolymer

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Other Additional Tariffs: None specified

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Base Tariff Differences: The base tariff for 3901905501 is 6.5%, while the others have a base tariff of 0.0%.

- Material Clarification: Ensure the product is correctly classified based on its chemical structure (terpolymer vs. copolymer) and physical form (resin vs. particles).

- Certifications: Confirm if any customs documentation or certifications (e.g., Material Safety Data Sheet, product specifications) are required for import compliance.

✅ Proactive Advice:

- Verify the exact chemical composition of the product to ensure correct HS code classification.

- Check the unit price and total value to determine if any preferential tariff rates apply.

- Consult with customs brokers or legal advisors if the product is being imported in large quantities or under special trade agreements.

- Monitor the April 11, 2025 deadline to avoid unexpected cost increases due to the special tariff.

Product Name: Ethylene vinyl acetate vinyl chloride terpolymer

Classification: Based on the provided HS codes and descriptions, the product falls under the following classifications:

🔍 HS CODE: 3904302000

Description: Ethylene-vinyl acetate-vinyl chloride terpolymer (resin)

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Other Additional Tariffs: None specified

🔍 HS CODE: 3901302000

Description: Ethylene-vinyl acetate-vinyl chloride ternary copolymer particles

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Other Additional Tariffs: None specified

🔍 HS CODE: 3901905501

Description: Ethylene vinyl chloride copolymer or Ethylene vinyl acetate copolymer

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Other Additional Tariffs: None specified

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Base Tariff Differences: The base tariff for 3901905501 is 6.5%, while the others have a base tariff of 0.0%.

- Material Clarification: Ensure the product is correctly classified based on its chemical structure (terpolymer vs. copolymer) and physical form (resin vs. particles).

- Certifications: Confirm if any customs documentation or certifications (e.g., Material Safety Data Sheet, product specifications) are required for import compliance.

✅ Proactive Advice:

- Verify the exact chemical composition of the product to ensure correct HS code classification.

- Check the unit price and total value to determine if any preferential tariff rates apply.

- Consult with customs brokers or legal advisors if the product is being imported in large quantities or under special trade agreements.

- Monitor the April 11, 2025 deadline to avoid unexpected cost increases due to the special tariff.

Customer Reviews

No reviews yet.