| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3903110000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3903190000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3903905000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921110000 | Doc | 60.3% | CN | US | 2025-05-12 |

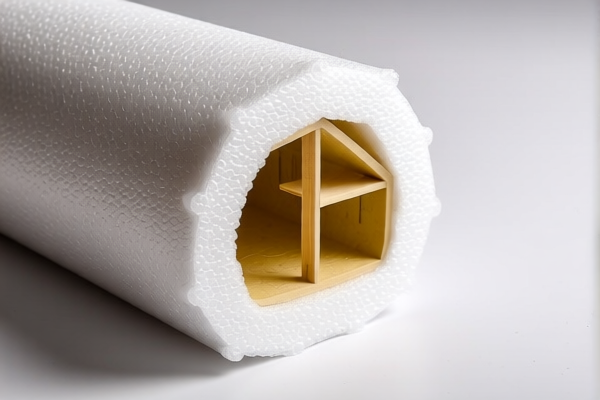

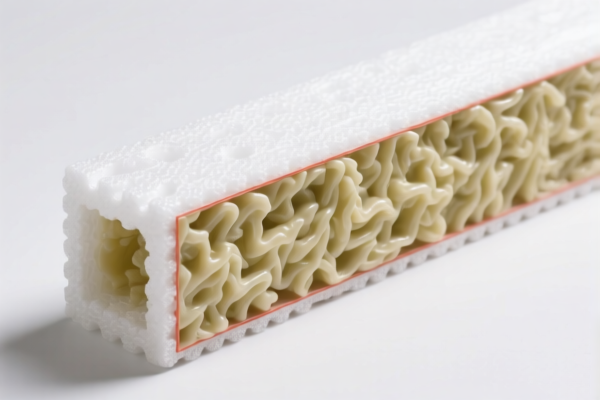

✅ Product Classification: Expandable Polystyrene Resin for Building Insulation

Based on the provided HS codes and descriptions, Expandable Polystyrene Resin for Building Insulation falls under Chapter 39 (Plastics and articles thereof), specifically HS Code 3903 (Polymers of styrene, whether or not modified, in primary forms).

Below is a structured breakdown of the applicable HS codes, tariff rates, and customs compliance considerations:

📌 HS Code Details and Tax Rates

1. HS Code: 3903110000

- Description: Expandable Polystyrene Resin for Building Insulation (primary form of styrene polymer)

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (special additional tariff)

2. HS Code: 3903190000

- Description: Expandable Polystyrene Resin for Building Insulation (other primary forms of styrene polymer)

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (special additional tariff)

3. HS Code: 3903905000

- Description: Expandable Polystyrene Resin for Building Insulation (other primary forms of styrene polymer)

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (special additional tariff)

4. HS Code: 3921110000

- Description: Expandable Polystyrene Resin for Building Insulation (classified under a different subheading, possibly due to specific formulation or form)

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (special additional tariff)

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations.

-

Anti-Dumping Duties: Not applicable for this product (no mention of anti-dumping duties on polystyrene resins in the provided data).

-

Material and Certification Requirements:

- Verify the exact chemical composition and form of the polystyrene resin (e.g., expanded vs. extruded).

- Confirm if certifications (e.g., fire resistance, environmental compliance) are required for import into the destination country.

📌 Proactive Advice for Importers

- Double-check the HS code based on the specific formulation and physical form of the product (e.g., beads, sheets, blocks).

- Review the April 11, 2025 tariff change and factor it into your costing and pricing strategy.

- Consult with customs brokers or trade compliance experts to ensure accurate classification and avoid delays in customs clearance.

- Maintain documentation such as material safety data sheets (MSDS), certificates of conformity, and technical specifications for customs inspections.

Let me know if you need help with customs declaration forms, tariff calculation tools, or HS code verification for specific product samples.

✅ Product Classification: Expandable Polystyrene Resin for Building Insulation

Based on the provided HS codes and descriptions, Expandable Polystyrene Resin for Building Insulation falls under Chapter 39 (Plastics and articles thereof), specifically HS Code 3903 (Polymers of styrene, whether or not modified, in primary forms).

Below is a structured breakdown of the applicable HS codes, tariff rates, and customs compliance considerations:

📌 HS Code Details and Tax Rates

1. HS Code: 3903110000

- Description: Expandable Polystyrene Resin for Building Insulation (primary form of styrene polymer)

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (special additional tariff)

2. HS Code: 3903190000

- Description: Expandable Polystyrene Resin for Building Insulation (other primary forms of styrene polymer)

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (special additional tariff)

3. HS Code: 3903905000

- Description: Expandable Polystyrene Resin for Building Insulation (other primary forms of styrene polymer)

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (special additional tariff)

4. HS Code: 3921110000

- Description: Expandable Polystyrene Resin for Building Insulation (classified under a different subheading, possibly due to specific formulation or form)

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (special additional tariff)

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations.

-

Anti-Dumping Duties: Not applicable for this product (no mention of anti-dumping duties on polystyrene resins in the provided data).

-

Material and Certification Requirements:

- Verify the exact chemical composition and form of the polystyrene resin (e.g., expanded vs. extruded).

- Confirm if certifications (e.g., fire resistance, environmental compliance) are required for import into the destination country.

📌 Proactive Advice for Importers

- Double-check the HS code based on the specific formulation and physical form of the product (e.g., beads, sheets, blocks).

- Review the April 11, 2025 tariff change and factor it into your costing and pricing strategy.

- Consult with customs brokers or trade compliance experts to ensure accurate classification and avoid delays in customs clearance.

- Maintain documentation such as material safety data sheets (MSDS), certificates of conformity, and technical specifications for customs inspections.

Let me know if you need help with customs declaration forms, tariff calculation tools, or HS code verification for specific product samples.

Customer Reviews

No reviews yet.