| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3901400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901105030 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3903905000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3903190000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907992000 | Doc | 55.0% | CN | US | 2025-05-12 |

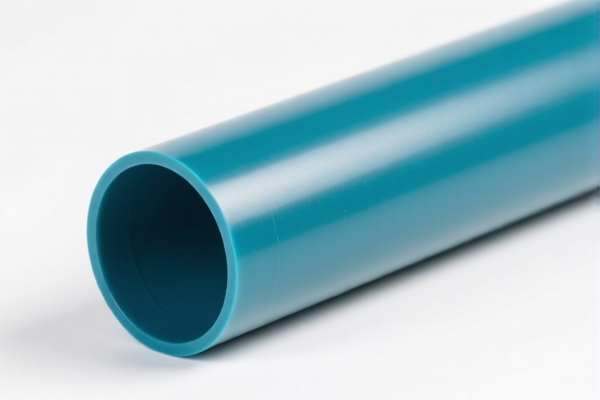

Product Classification: Extrusion Grade HDPE (High-Density Polyethylene)

HS CODE: 3901400000

🔍 Tariff Overview (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes on Tariff Changes:

-

April 11, 2025 Special Tariff:

Starting from April 11, 2025, an additional 30.0% tariff will be applied on top of the base and general tariffs. This is a significant increase from the current 25.0% additional tariff. -

No Anti-Dumping Duties:

As of now, there are no specific anti-dumping duties reported for this product category (HDPE extrusion grade).

📌 Proactive Advice for Importers:

-

Verify Material Specifications:

Ensure the product is indeed HDPE (High-Density Polyethylene) and not a different polymer (e.g., LDPE, MDPE, or LLDPE), as this can affect the HS code and applicable tariffs. -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or customs documentation) are required for import compliance. -

Monitor Tariff Updates:

Keep track of tariff changes after April 11, 2025, as this will significantly increase the import cost. Consider adjusting pricing or sourcing strategies accordingly. -

Consult Customs Broker:

For complex or high-value shipments, it is advisable to consult a customs broker to ensure full compliance and avoid delays or penalties.

📊 Comparison with Other Similar Products:

| HS CODE | Product Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3901400000 | Extrusion Grade HDPE Resin | 61.5% | Standard HDPE |

| 3901105030 | MDPE Extrusion Grade Resin | 61.5% | Medium-Density Polyethylene |

| 3903905000 | Extrusion Grade Polystyrene Resin | 61.5% | Polystyrene |

| 3903190000 | Extrusion Grade Polystyrene Granules | 61.5% | Polystyrene granules |

| 3907992000 | Extrusion Grade Liquid Crystal Polyester | 55.0% | Lower base tariff |

✅ Summary:

- HS CODE: 3901400000

- Total Tax Rate: 61.5% (6.5% base + 25.0% general + 30.0% special after April 11, 2025)

- Action Required: Verify product type, prepare documentation, and plan for increased tariffs after April 11, 2025.

Product Classification: Extrusion Grade HDPE (High-Density Polyethylene)

HS CODE: 3901400000

🔍 Tariff Overview (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes on Tariff Changes:

-

April 11, 2025 Special Tariff:

Starting from April 11, 2025, an additional 30.0% tariff will be applied on top of the base and general tariffs. This is a significant increase from the current 25.0% additional tariff. -

No Anti-Dumping Duties:

As of now, there are no specific anti-dumping duties reported for this product category (HDPE extrusion grade).

📌 Proactive Advice for Importers:

-

Verify Material Specifications:

Ensure the product is indeed HDPE (High-Density Polyethylene) and not a different polymer (e.g., LDPE, MDPE, or LLDPE), as this can affect the HS code and applicable tariffs. -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or customs documentation) are required for import compliance. -

Monitor Tariff Updates:

Keep track of tariff changes after April 11, 2025, as this will significantly increase the import cost. Consider adjusting pricing or sourcing strategies accordingly. -

Consult Customs Broker:

For complex or high-value shipments, it is advisable to consult a customs broker to ensure full compliance and avoid delays or penalties.

📊 Comparison with Other Similar Products:

| HS CODE | Product Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3901400000 | Extrusion Grade HDPE Resin | 61.5% | Standard HDPE |

| 3901105030 | MDPE Extrusion Grade Resin | 61.5% | Medium-Density Polyethylene |

| 3903905000 | Extrusion Grade Polystyrene Resin | 61.5% | Polystyrene |

| 3903190000 | Extrusion Grade Polystyrene Granules | 61.5% | Polystyrene granules |

| 3907992000 | Extrusion Grade Liquid Crystal Polyester | 55.0% | Lower base tariff |

✅ Summary:

- HS CODE: 3901400000

- Total Tax Rate: 61.5% (6.5% base + 25.0% general + 30.0% special after April 11, 2025)

- Action Required: Verify product type, prepare documentation, and plan for increased tariffs after April 11, 2025.

Customer Reviews

No reviews yet.