| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4819600000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4820300040 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3923900080 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3926100000 | Doc | 35.3% | CN | US | 2025-05-12 |

| 3926909400 | Doc | 55.0% | CN | US | 2025-05-12 |

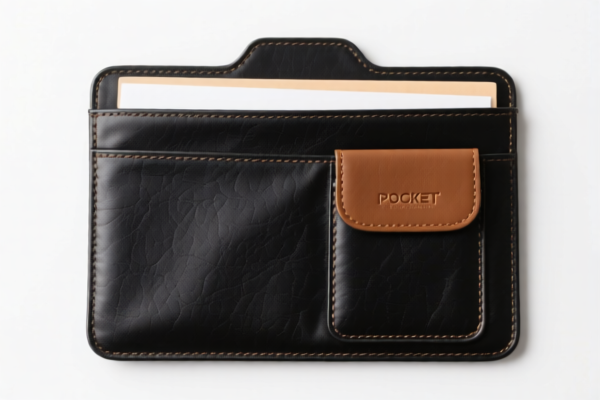

FILE POCKET HS Code Classification & Duty Information

Based on the provided reference data, here's a classification breakdown for "FILE POCKET", along with relevant duty information. The correct HS code(s) will depend on the material composition of the file pocket.

1. Paper/Paperboard File Pockets

- HS Code:

481960000048: Paper and paperboard; articles of paper pulp, paper or paperboard. (This chapter broadly covers products made from paper.)19: Boxes, cartons, cases, bags and other packing containers; paperboard boxes, cases and cartons.60: Other packing containers, of paper, paperboard, cellulose wadding or webs of cellulose fibers.- Description: This code covers file pockets specifically made of paper, paperboard, cellulose wadding, or similar materials. This includes simple folders used for organizing documents.

- Duty:

- Basic Duty: 0.0%

- Additional Duty: 25.0%

- Post 2025.4.2 Additional Duty: 30%

- Total Duty: 55.0%

2. Plastic File Pockets

- HS Code:

392390008039: Plastics and articles thereof. (This chapter covers products made from plastic.)23: Articles for the conveyance or packing of goods, of plastics.90: Other.00: Other.80: Other.- Description: This code applies to file pockets made entirely of plastic.

- Duty:

- Basic Duty: 3.0%

- Additional Duty: 25.0%

- Post 2025.4.2 Additional Duty: 30%

- Total Duty: 58.0%

3. Plastic File Pockets (Office Supplies)

- HS Code:

392610000039: Plastics and articles thereof.26: Other articles of plastics and articles of other materials of headings 3901 to 3914.10: Office or school supplies.00: Other.- Description: If the file pocket is specifically marketed and designed as an office supply (e.g., with specific features for document organization), this code may be applicable.

- Duty:

- Basic Duty: 5.3%

- Additional Duty: 0.0%

- Post 2025.4.2 Additional Duty: 30%

- Total Duty: 35.3%

Important Considerations & Recommendations:

- Material Composition: The primary material of the file pocket is crucial for correct classification. If it's a combination of materials (e.g., plastic coating on paper), the material providing the essential character will determine the HS code.

- Functionality: Consider the intended use. Is it purely for packing/conveyance, or is it specifically designed for office organization?

- Certification: Depending on the final HS code, you may need to provide specific certifications related to the material composition (e.g., lead content for plastics).

- Pricing: Please verify the unit price of the goods.

- Post 2025.4.2 Duty Changes: Be aware of the additional duty increases scheduled for April 2, 2025.

- Detailed Invoice: Ensure your commercial invoice clearly specifies the material composition, intended use, and unit price of the file pockets.

- Customs Ruling: If you are unsure about the correct classification, it is recommended to obtain a binding customs ruling from the relevant customs authority.

Customer Reviews

The site gives a good overview of HS Code classifications for file pockets. I would have liked more examples of material composition impacts, but it's still a solid resource.

I found the explanation of HS Code 3926100000 very helpful for office supply file pockets. The duty breakdown was clear and easy to understand.

The tariff info for 3923900080 was exactly what I needed for plastic file pockets. Great detail on the duty rates.

This site has a clear breakdown of HS Code 4819600000 for paper file pockets. Perfect for exporting to the US.