| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9404909670 | Doc | 37.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3926305000 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 4823901000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4823908000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4818900080 | Doc | 37.5% | CN | US | 2025-05-12 |

| 6304910120 | Doc | 43.3% | CN | US | 2025-05-12 |

| 6304920000 | Doc | 36.3% | CN | US | 2025-05-12 |

| 6307909885 | Doc | 37.0% | CN | US | 2025-05-12 |

| 6307909887 | Doc | 37.0% | CN | US | 2025-05-12 |

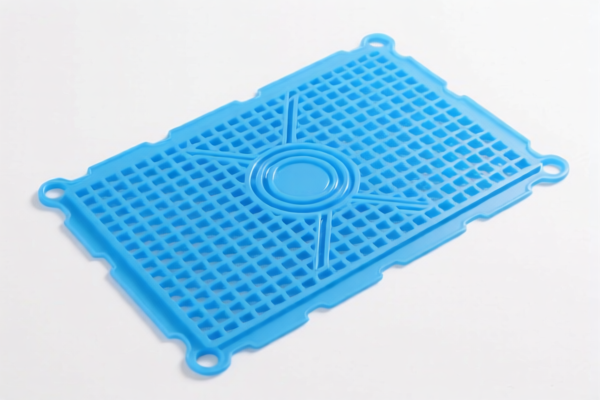

Furniture Mat Classification & Tariff Information

Based on the provided reference data, classifying "FURNITURE MAT" requires careful consideration of material composition. Here's a breakdown of potential HS codes and associated tariffs, categorized by likely material types:

1. Cotton Furniture Mats (HS 6304910120)

- HS Code:

6304910120 - Breakdown:

63: Linens, etc. (Broad category for textile articles)04: Made up articles; other articles of textile materials91: Knitted or crocheted01: Of cotton20: Other

- Tariff:

- Basic Duty: 5.8%

- Additional Duty: 7.5%

- Post 2025.4.2 Additional Duty: 30%

- Total Tariff: 43.3%

- Notes: This applies specifically to furniture mats made of cotton and knitted or crocheted.

2. Non-Knitted/Crocheted Cotton Furniture Mats (HS 6304920000)

- HS Code:

6304920000 - Breakdown:

63: Linens, etc.04: Made up articles; other articles of textile materials92: Not knitted or crocheted00: Other

- Tariff:

- Basic Duty: 6.3%

- Additional Duty: 0.0%

- Post 2025.4.2 Additional Duty: 30%

- Total Tariff: 36.3%

- Notes: This applies to furniture mats made of cotton that are not knitted or crocheted.

3. Furniture Movers' Pads of Cotton (HS 6307909885)

- HS Code:

6307909885 - Breakdown:

63: Linens, etc.07: Other made up articles; dress patterns90: Other98: Other85: Furniture movers' pads of cotton

- Tariff:

- Basic Duty: 7.0%

- Additional Duty: 0.0%

- Post 2025.4.2 Additional Duty: 30%

- Total Tariff: 37.0%

- Notes: Specifically for furniture movers’ pads made of cotton.

4. Furniture Movers' Pads of Man-Made Fibers (HS 6307909887)

- HS Code:

6307909887 - Breakdown:

63: Linens, etc.07: Other made up articles; dress patterns90: Other98: Other87: Furniture movers' pads of man-made fibers

- Tariff:

- Basic Duty: 7.0%

- Additional Duty: 0.0%

- Post 2025.4.2 Additional Duty: 30%

- Total Tariff: 37.0%

- Notes: Specifically for furniture movers’ pads made of man-made fibers.

5. Other Furnishing Articles (HS 6304910120 & HS 6304920000)

- HS Code:

6304910120or6304920000(depending on knitted/crocheted status) - Tariff: Refer to the tariff details under points 1 and 2.

- Notes: This is a broader category.

Important Considerations & Recommendations:

- Material Composition: Crucially, determine the exact material(s) used in the furniture mat. Is it 100% cotton, a blend, or made of synthetic fibers? This dictates the correct HS code.

- Construction: Is the mat knitted, crocheted, woven, or another construction method?

- Function: Is the mat primarily for protection during moving (pad), or is it a decorative furnishing item?

- Certification: Depending on the material and intended use, you may need to provide specific certifications (e.g., fiber content, flammability).

- Post-2025.4.2 Tariffs: Be aware of the increased additional duties taking effect after April 2, 2025.

- Seek Professional Advice: For complex cases or high-value shipments, it is always recommended to consult with a licensed customs broker or consultant to ensure accurate classification and compliance.

Customer Reviews

The information is thorough, but I found the list of HS codes a bit overwhelming. Maybe a filter or search function would help with the 12 results.

The detailed tariff breakdown for HS code 6307909885 was exactly what I needed. I didn’t know there was a specific code for furniture movers' pads made of cotton.

I appreciated the clear explanation of the difference between HS codes 6304910120 and 6304920000. It made it easier to choose the right classification for my product.

The breakdown of HS code 6304910120 for cotton furniture mats was super helpful. I was able to find the right tariff quickly for my export to the US.