| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3824910000 | Doc | 60.0% | CN | US | 2025-05-12 |

| 3824999330 | Doc | 60.0% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

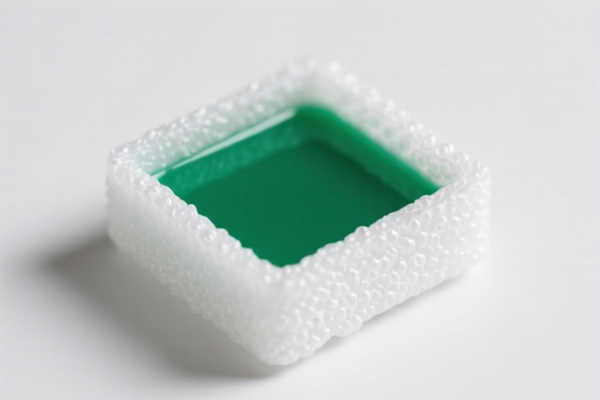

Product Name: Fast Curing Polystyrene Resin

Classification Options and Tax Details:

✅ HS CODE: 3907995050

Description:

- Includes fast-curing polyester resin particles, curing agents for polyester resins, and curing agents for polyether resins.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

Notes: - This classification is suitable if the product is a curing agent or related particle for polyester or polyether resins. - Ensure the product is not classified under a more specific code (e.g., 3907290000 for polyether resin curing agents).

✅ HS CODE: 3824910000

Description:

- Includes fast-curing phosphate ester adhesives and other fast-curing adhesives.

Tariff Breakdown:

- Base Tariff Rate: 5.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.0%

Notes: - This code is ideal for fast-curing adhesives, especially those based on phosphate esters. - Confirm the product is not classified under a more specific code (e.g., 3824999330).

✅ HS CODE: 3824999330

Description:

- Includes fast-curing adhesives and other chemical preparations not classified elsewhere.

Tariff Breakdown:

- Base Tariff Rate: 5.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.0%

Notes: - This is a catch-all code for fast-curing adhesives that do not fit into more specific categories. - Ensure the product is not classified under a more specific code (e.g., 3824910000).

✅ HS CODE: 3907290000

Description:

- Includes curing agents for polyether resins.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

Notes: - This code is specific to curing agents for polyether resins. - If the product is a curing agent for polyether resins, this is the most accurate classification.

📌 Proactive Advice:

- Verify Material Composition: Confirm whether the product is a curing agent, adhesive, or resin particle.

- Check Unit Price and Certification: Some products may require specific certifications (e.g., REACH, RoHS) for customs clearance.

- Monitor Tariff Changes: The additional tariffs after April 11, 2025, will increase the total tax by 5% (from 55% to 60% or 56.5% to 61.5%).

- Consult Customs Authority: For high-value or complex products, it is recommended to consult with customs or a professional customs broker for accurate classification.

Let me know if you need help determining the most accurate HS code for your specific product.

Product Name: Fast Curing Polystyrene Resin

Classification Options and Tax Details:

✅ HS CODE: 3907995050

Description:

- Includes fast-curing polyester resin particles, curing agents for polyester resins, and curing agents for polyether resins.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

Notes: - This classification is suitable if the product is a curing agent or related particle for polyester or polyether resins. - Ensure the product is not classified under a more specific code (e.g., 3907290000 for polyether resin curing agents).

✅ HS CODE: 3824910000

Description:

- Includes fast-curing phosphate ester adhesives and other fast-curing adhesives.

Tariff Breakdown:

- Base Tariff Rate: 5.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.0%

Notes: - This code is ideal for fast-curing adhesives, especially those based on phosphate esters. - Confirm the product is not classified under a more specific code (e.g., 3824999330).

✅ HS CODE: 3824999330

Description:

- Includes fast-curing adhesives and other chemical preparations not classified elsewhere.

Tariff Breakdown:

- Base Tariff Rate: 5.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.0%

Notes: - This is a catch-all code for fast-curing adhesives that do not fit into more specific categories. - Ensure the product is not classified under a more specific code (e.g., 3824910000).

✅ HS CODE: 3907290000

Description:

- Includes curing agents for polyether resins.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

Notes: - This code is specific to curing agents for polyether resins. - If the product is a curing agent for polyether resins, this is the most accurate classification.

📌 Proactive Advice:

- Verify Material Composition: Confirm whether the product is a curing agent, adhesive, or resin particle.

- Check Unit Price and Certification: Some products may require specific certifications (e.g., REACH, RoHS) for customs clearance.

- Monitor Tariff Changes: The additional tariffs after April 11, 2025, will increase the total tax by 5% (from 55% to 60% or 56.5% to 61.5%).

- Consult Customs Authority: For high-value or complex products, it is recommended to consult with customs or a professional customs broker for accurate classification.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.