| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3925200020 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200091 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925305000 | Doc | 42.8% | CN | US | 2025-05-12 |

| 7308305015 | Doc | 105.0% | CN | US | 2025-05-12 |

| 7308305050 | Doc | 105.0% | CN | US | 2025-05-12 |

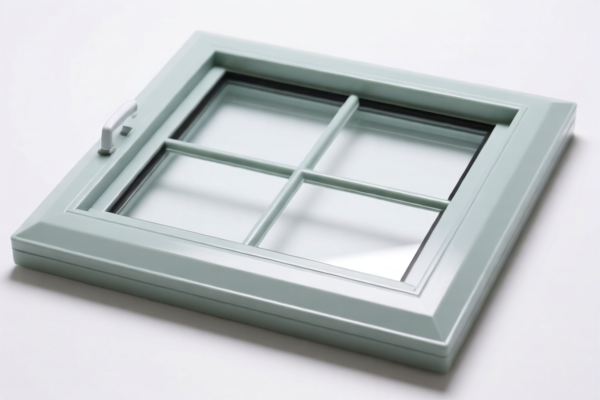

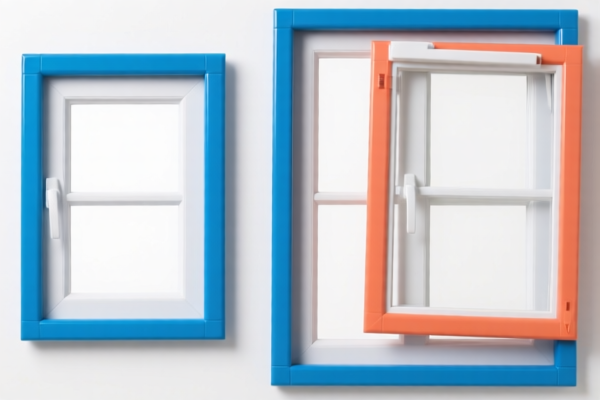

Product Classification: Fixed Plastic Windows

HS CODEs and Tax Details:

- HS CODE: 3925200020

- Description: Plastic building components, not otherwise specified or included — windows and window frames.

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Tariff after April 11, 2025: 30.0%

-

Note: This code applies specifically to plastic windows and window frames.

-

HS CODE: 3925200091

- Description: Other plastic building components not classified as plastic doors, door frames, windows, or window frames.

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Tariff after April 11, 2025: 30.0%

-

Note: This code is for plastic building components that are not specifically windows or window frames.

-

HS CODE: 3925305000

- Description: Other plastic building components — window blinds, roller shutters, and parts thereof.

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Tariff after April 11, 2025: 30.0%

-

Note: This code applies to plastic window blinds and roller shutters.

-

HS CODE: 7308305015

- Description: Structural parts of iron or steel — doors, windows, door frames, and thresholds.

- Total Tax Rate: 105.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Additional Tariff for Steel, Aluminum, Copper Products: 50.0%

-

Note: This code applies to metal windows and frames, with higher tariffs for aluminum and copper products.

-

HS CODE: 7308305050

- Description: Doors, windows, door frames, and thresholds of iron or steel.

- Total Tax Rate: 105.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Additional Tariff for Steel, Aluminum, Copper Products: 50.0%

- Note: This code applies to metal windows and frames, with higher tariffs for aluminum and copper products.

✅ Proactive Advice:

- Verify Material and Unit Price: Ensure the product is plastic and not metal (e.g., aluminum or steel), as this will significantly affect the tax rate.

- Check Certification Requirements: Some products may require import permits or certifications (e.g., fire resistance, energy efficiency).

- Monitor Tariff Changes: The April 11, 2025 tariff increase is time-sensitive and could significantly raise costs.

- Consider Anti-Dumping Duties: If the product is imported from countries with anti-dumping duties on iron or aluminum, additional charges may apply.

Let me know if you need help determining the correct HS code based on your product specifications.

Product Classification: Fixed Plastic Windows

HS CODEs and Tax Details:

- HS CODE: 3925200020

- Description: Plastic building components, not otherwise specified or included — windows and window frames.

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Tariff after April 11, 2025: 30.0%

-

Note: This code applies specifically to plastic windows and window frames.

-

HS CODE: 3925200091

- Description: Other plastic building components not classified as plastic doors, door frames, windows, or window frames.

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Tariff after April 11, 2025: 30.0%

-

Note: This code is for plastic building components that are not specifically windows or window frames.

-

HS CODE: 3925305000

- Description: Other plastic building components — window blinds, roller shutters, and parts thereof.

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Tariff after April 11, 2025: 30.0%

-

Note: This code applies to plastic window blinds and roller shutters.

-

HS CODE: 7308305015

- Description: Structural parts of iron or steel — doors, windows, door frames, and thresholds.

- Total Tax Rate: 105.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Additional Tariff for Steel, Aluminum, Copper Products: 50.0%

-

Note: This code applies to metal windows and frames, with higher tariffs for aluminum and copper products.

-

HS CODE: 7308305050

- Description: Doors, windows, door frames, and thresholds of iron or steel.

- Total Tax Rate: 105.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Additional Tariff for Steel, Aluminum, Copper Products: 50.0%

- Note: This code applies to metal windows and frames, with higher tariffs for aluminum and copper products.

✅ Proactive Advice:

- Verify Material and Unit Price: Ensure the product is plastic and not metal (e.g., aluminum or steel), as this will significantly affect the tax rate.

- Check Certification Requirements: Some products may require import permits or certifications (e.g., fire resistance, energy efficiency).

- Monitor Tariff Changes: The April 11, 2025 tariff increase is time-sensitive and could significantly raise costs.

- Consider Anti-Dumping Duties: If the product is imported from countries with anti-dumping duties on iron or aluminum, additional charges may apply.

Let me know if you need help determining the correct HS code based on your product specifications.

Customer Reviews

No reviews yet.