| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4412523161 | Doc | 63.0% | CN | US | 2025-05-12 |

| 4412395050 | Doc | 60.1% | CN | US | 2025-05-12 |

| 4412343275 | Doc | 63.0% | CN | US | 2025-05-12 |

| 4412524100 | Doc | 63.0% | CN | US | 2025-05-12 |

| 4412523175 | Doc | 63.0% | CN | US | 2025-05-12 |

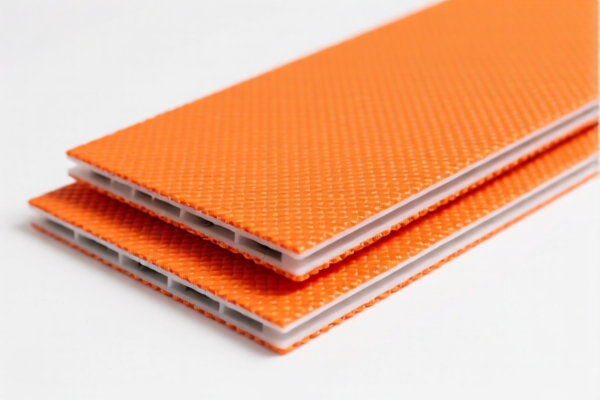

Product Name: Flame Retardant Composite Boards

Classification: HS Code (Harmonized System Code) for Flame Retardant Plywood

Below is the detailed classification and tariff information for the declared product:

🔍 HS Code Classification Overview

- HS Code 4412.52.31.61 – Flame Retardant Plywood

- HS Code 4412.39.50.50 – Flame Retardant Plywood

- HS Code 4412.34.32.75 – Flame Retardant Plywood

- HS Code 4412.52.41.00 – Flame Retardant Plywood

- HS Code 4412.52.31.75 – Flame Retardant Plywood

All of the above HS codes fall under Chapter 44 of the HS system, which covers "Wood and articles of wood; wood charcoal." Specifically, 4412 refers to "Plywood, laminated wood, and similar laminated wood products."

📊 Tariff Breakdown (as of now)

All listed HS codes share the following tariff structure:

- Base Tariff Rate: 5.1% to 8.0% (varies by HS code)

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.1% to 63.0% (varies by HS code)

⏰ Time-Sensitive Policy Alert

Additional tariffs of 30.0% will be imposed after April 11, 2025.

This is a critical date for customs clearance and cost estimation. Ensure your import timeline accounts for this change.

🛑 Anti-Dumping Duties (if applicable)

- Iron and aluminum products may be subject to anti-dumping duties, but wood products like flame retardant composite boards are generally not subject to these duties.

- However, always verify with customs or a trade compliance expert if the product contains non-wood components or is imported from a country under anti-dumping investigations.

📌 Proactive Advice for Importers

- Verify Material Composition: Confirm that the product is indeed wood-based and flame retardant, as this affects classification and applicable tariffs.

- Check Unit Price and Certification: Ensure that the product meets flame retardant standards (e.g., GB, UL, etc.) and that the necessary certifications are included for customs clearance.

- Review HS Code Accuracy: Double-check the HS code with customs or a classification expert to avoid misclassification penalties.

- Plan for Tariff Changes: If importing after April 11, 2025, budget for the 30.0% additional tariff to avoid unexpected costs.

✅ Summary Table

| HS Code | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|

| 4412.52.31.61 | 8.0% | 25.0% | 30.0% | 63.0% |

| 4412.39.50.50 | 5.1% | 25.0% | 30.0% | 60.1% |

| 4412.34.32.75 | 8.0% | 25.0% | 30.0% | 63.0% |

| 4412.52.41.00 | 8.0% | 25.0% | 30.0% | 63.0% |

| 4412.52.31.75 | 8.0% | 25.0% | 30.0% | 63.0% |

If you need further assistance with customs documentation, certification requirements, or tariff calculation tools, feel free to ask.

Product Name: Flame Retardant Composite Boards

Classification: HS Code (Harmonized System Code) for Flame Retardant Plywood

Below is the detailed classification and tariff information for the declared product:

🔍 HS Code Classification Overview

- HS Code 4412.52.31.61 – Flame Retardant Plywood

- HS Code 4412.39.50.50 – Flame Retardant Plywood

- HS Code 4412.34.32.75 – Flame Retardant Plywood

- HS Code 4412.52.41.00 – Flame Retardant Plywood

- HS Code 4412.52.31.75 – Flame Retardant Plywood

All of the above HS codes fall under Chapter 44 of the HS system, which covers "Wood and articles of wood; wood charcoal." Specifically, 4412 refers to "Plywood, laminated wood, and similar laminated wood products."

📊 Tariff Breakdown (as of now)

All listed HS codes share the following tariff structure:

- Base Tariff Rate: 5.1% to 8.0% (varies by HS code)

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.1% to 63.0% (varies by HS code)

⏰ Time-Sensitive Policy Alert

Additional tariffs of 30.0% will be imposed after April 11, 2025.

This is a critical date for customs clearance and cost estimation. Ensure your import timeline accounts for this change.

🛑 Anti-Dumping Duties (if applicable)

- Iron and aluminum products may be subject to anti-dumping duties, but wood products like flame retardant composite boards are generally not subject to these duties.

- However, always verify with customs or a trade compliance expert if the product contains non-wood components or is imported from a country under anti-dumping investigations.

📌 Proactive Advice for Importers

- Verify Material Composition: Confirm that the product is indeed wood-based and flame retardant, as this affects classification and applicable tariffs.

- Check Unit Price and Certification: Ensure that the product meets flame retardant standards (e.g., GB, UL, etc.) and that the necessary certifications are included for customs clearance.

- Review HS Code Accuracy: Double-check the HS code with customs or a classification expert to avoid misclassification penalties.

- Plan for Tariff Changes: If importing after April 11, 2025, budget for the 30.0% additional tariff to avoid unexpected costs.

✅ Summary Table

| HS Code | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|

| 4412.52.31.61 | 8.0% | 25.0% | 30.0% | 63.0% |

| 4412.39.50.50 | 5.1% | 25.0% | 30.0% | 60.1% |

| 4412.34.32.75 | 8.0% | 25.0% | 30.0% | 63.0% |

| 4412.52.41.00 | 8.0% | 25.0% | 30.0% | 63.0% |

| 4412.52.31.75 | 8.0% | 25.0% | 30.0% | 63.0% |

If you need further assistance with customs documentation, certification requirements, or tariff calculation tools, feel free to ask.

Customer Reviews

No reviews yet.