| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 7003190000 | Doc | 56.3% | CN | US | 2025-05-12 |

| 7004902510 | Doc | 0.7¢/kg+55.0% | CN | US | 2025-05-12 |

| 7019694021 | Doc | 62.3% | CN | US | 2025-05-12 |

| 7004905000 | Doc | 60.0% | CN | US | 2025-05-12 |

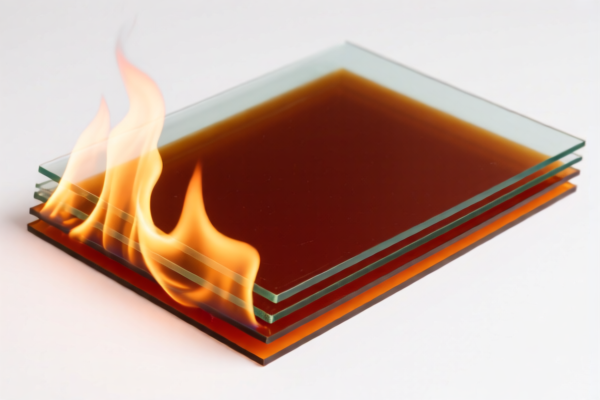

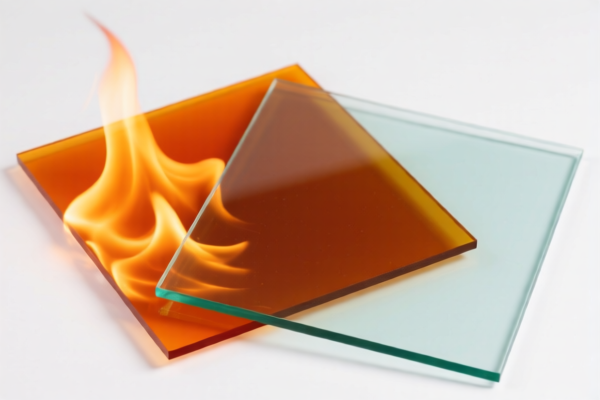

Here is the structured classification and tariff information for Flame Retardant Organic Glass Sheets, based on the provided HS codes and tax details:

🔍 HS CODE: 7003190000

Product Description: Flame retardant cast or rolled glass sheets, falling under the category of pressed or cast glass.

Total Tax Rate: 56.3%

Tax Breakdown:

- Base Tariff: 1.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to cast or rolled glass sheets with flame retardant properties.

- No specific anti-dumping duties mentioned for this category.

- Proactive Advice: Confirm the manufacturing process (cast vs. rolled) and flame retardant certification if required for export/import compliance.

🔍 HS CODE: 7004902510

Product Description: Flame retardant rectangular glass sheets, made by drawing or blowing, and in rectangular shape.

Total Tax Rate: 0.7¢/kg + 55.0%

Tax Breakdown:

- Base Tariff: 0.7¢/kg (specific duty)

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for rectangular glass sheets made by drawing or blowing.

- Specific duty applies (0.7¢/kg), which may vary depending on weight and dimensions.

- Proactive Advice: Verify shape and dimensions of the product to ensure correct classification. Also, check if flame retardant certification is required.

🔍 HS CODE: 7019694021

Product Description: Flame retardant heavy or non-woven glass fiber sheets, made of glass fiber, mechanically bonded fabric, uncolored, with weight over 215g/m².

Total Tax Rate: 62.3%

Tax Breakdown:

- Base Tariff: 7.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to glass fiber products, specifically non-woven or heavy fabric with mechanical bonding.

- Weight threshold is critical (must be over 215g/m²).

- Proactive Advice: Confirm material composition, weight, and certifications (e.g., flame retardancy, safety standards) for compliance.

🔍 HS CODE: 7004905000

Product Description: Flame retardant borosilicate glass sheets, made by pressing or blowing, in sheet form and not otherwise worked.

Total Tax Rate: 60.0%

Tax Breakdown:

- Base Tariff: 5.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for borosilicate glass sheets made by pressing or blowing, and not further processed.

- Borosilicate glass is known for its heat resistance, which may be relevant for flame retardant applications.

- Proactive Advice: Ensure the glass type is correctly identified (e.g., borosilicate vs. soda-lime) and confirm processing method (pressed or blown).

📌 General Reminders:

- April 11, 2025 is a critical date for additional tariffs. Ensure compliance with updated regulations after this date.

- Flame retardant certification may be required depending on the end-use and destination country.

- Material composition and manufacturing process are key to correct HS code classification.

- Check with customs authorities or a qualified customs broker for the most up-to-date and accurate classification. Here is the structured classification and tariff information for Flame Retardant Organic Glass Sheets, based on the provided HS codes and tax details:

🔍 HS CODE: 7003190000

Product Description: Flame retardant cast or rolled glass sheets, falling under the category of pressed or cast glass.

Total Tax Rate: 56.3%

Tax Breakdown:

- Base Tariff: 1.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to cast or rolled glass sheets with flame retardant properties.

- No specific anti-dumping duties mentioned for this category.

- Proactive Advice: Confirm the manufacturing process (cast vs. rolled) and flame retardant certification if required for export/import compliance.

🔍 HS CODE: 7004902510

Product Description: Flame retardant rectangular glass sheets, made by drawing or blowing, and in rectangular shape.

Total Tax Rate: 0.7¢/kg + 55.0%

Tax Breakdown:

- Base Tariff: 0.7¢/kg (specific duty)

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for rectangular glass sheets made by drawing or blowing.

- Specific duty applies (0.7¢/kg), which may vary depending on weight and dimensions.

- Proactive Advice: Verify shape and dimensions of the product to ensure correct classification. Also, check if flame retardant certification is required.

🔍 HS CODE: 7019694021

Product Description: Flame retardant heavy or non-woven glass fiber sheets, made of glass fiber, mechanically bonded fabric, uncolored, with weight over 215g/m².

Total Tax Rate: 62.3%

Tax Breakdown:

- Base Tariff: 7.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to glass fiber products, specifically non-woven or heavy fabric with mechanical bonding.

- Weight threshold is critical (must be over 215g/m²).

- Proactive Advice: Confirm material composition, weight, and certifications (e.g., flame retardancy, safety standards) for compliance.

🔍 HS CODE: 7004905000

Product Description: Flame retardant borosilicate glass sheets, made by pressing or blowing, in sheet form and not otherwise worked.

Total Tax Rate: 60.0%

Tax Breakdown:

- Base Tariff: 5.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for borosilicate glass sheets made by pressing or blowing, and not further processed.

- Borosilicate glass is known for its heat resistance, which may be relevant for flame retardant applications.

- Proactive Advice: Ensure the glass type is correctly identified (e.g., borosilicate vs. soda-lime) and confirm processing method (pressed or blown).

📌 General Reminders:

- April 11, 2025 is a critical date for additional tariffs. Ensure compliance with updated regulations after this date.

- Flame retardant certification may be required depending on the end-use and destination country.

- Material composition and manufacturing process are key to correct HS code classification.

- Check with customs authorities or a qualified customs broker for the most up-to-date and accurate classification.

Customer Reviews

No reviews yet.