| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907400000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3907400000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3907400000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920610000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

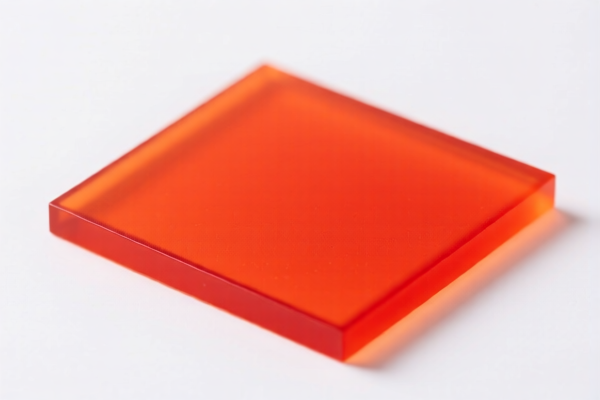

Product Name: Flame Retardant Polycarbonate Resin

Classification: Based on the provided HS codes and descriptions, the product falls under several categories depending on its form and composition. Below is a detailed breakdown of the HS codes and associated tariffs.

🔍 HS CODE: 3907400000

Description:

- Flame Retardant Polycarbonate Resin

- Flame Retardant Polycarbonate Composite Material

- Flame Retardant Polycarbonate Board

Tariff Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

Key Notes:

- This code applies to various forms of polycarbonate materials with flame retardant properties, including resins, composites, and boards.

- The same tax rate applies to all three product types listed under this HS code.

- April 11 Special Tariff is a time-sensitive policy that increases the tariff rate after the specified date.

🔍 HS CODE: 3920610000

Description:

- Flame Retardant Polycarbonate Film

Tariff Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

Key Notes:

- This code is specific to polycarbonate films with flame retardant properties.

- The same tax structure applies as with the 3907400000 code.

🔍 HS CODE: 3907995050

Description:

- Flame Retardant Polyester Resin

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for polyester resins with flame retardant properties, not polycarbonate.

- The base tariff is slightly higher than the polycarbonate category.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is correctly classified based on its chemical composition and form (e.g., resin, film, board, composite).

- Check Unit Price and Certification: Confirm whether any certifications (e.g., flame retardancy, safety standards) are required for import compliance.

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for the special tariff increase.

- Consult Customs Broker: For complex classifications or large shipments, seek professional customs advice to avoid delays or penalties.

Let me know if you need help with classification based on specific product specifications or documentation.

Product Name: Flame Retardant Polycarbonate Resin

Classification: Based on the provided HS codes and descriptions, the product falls under several categories depending on its form and composition. Below is a detailed breakdown of the HS codes and associated tariffs.

🔍 HS CODE: 3907400000

Description:

- Flame Retardant Polycarbonate Resin

- Flame Retardant Polycarbonate Composite Material

- Flame Retardant Polycarbonate Board

Tariff Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

Key Notes:

- This code applies to various forms of polycarbonate materials with flame retardant properties, including resins, composites, and boards.

- The same tax rate applies to all three product types listed under this HS code.

- April 11 Special Tariff is a time-sensitive policy that increases the tariff rate after the specified date.

🔍 HS CODE: 3920610000

Description:

- Flame Retardant Polycarbonate Film

Tariff Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

Key Notes:

- This code is specific to polycarbonate films with flame retardant properties.

- The same tax structure applies as with the 3907400000 code.

🔍 HS CODE: 3907995050

Description:

- Flame Retardant Polyester Resin

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for polyester resins with flame retardant properties, not polycarbonate.

- The base tariff is slightly higher than the polycarbonate category.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is correctly classified based on its chemical composition and form (e.g., resin, film, board, composite).

- Check Unit Price and Certification: Confirm whether any certifications (e.g., flame retardancy, safety standards) are required for import compliance.

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for the special tariff increase.

- Consult Customs Broker: For complex classifications or large shipments, seek professional customs advice to avoid delays or penalties.

Let me know if you need help with classification based on specific product specifications or documentation.

Customer Reviews

No reviews yet.