Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3903190000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3903905000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907400000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902900010 | Doc | 61.5% | CN | US | 2025-05-12 |

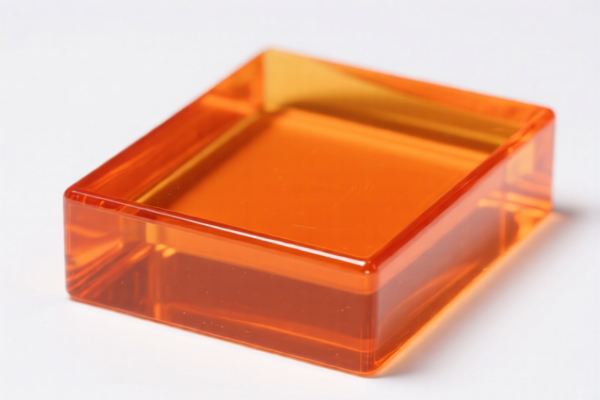

Product Name: Flame Retardant Polystyrene Resin

Classification: Polymers of styrene, modified with flame retardants

✅ HS CODE Classification Overview

Below are the HS codes and corresponding tax details for Flame Retardant Polystyrene Resin:

🔢 HS CODE: 3903190000

- Description: Primary form of styrene polymer, in granular form, matching the HS code definition.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the product is in its primary form and granular in structure.

🔢 HS CODE: 3903905000

- Description: Styrene polymer in its primary form, classified under "Other" within HS Chapter 3903.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is appropriate if the product is a primary form of styrene polymer and not specifically listed under other subheadings.

🔢 HS CODE: 3907400000

- Description: Flame Retardant Polystyrene Resin fits under HS Code 3907, which covers other polyesters.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the product is considered a modified polyester (e.g., with flame retardants).

🔢 HS CODE: 3907995050

- Description: This code falls under "Other polyesters: Other: Other" and is suitable for modified polyesters, including flame-retardant versions.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a more general code and may be used if the product is not clearly defined under more specific subheadings.

🔢 HS CODE: 3902900010

- Description: This code is for polybutene, a polymer of butylene.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is not appropriate for polystyrene. It may be a misclassification if the product is not polybutene.

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after this date. Ensure your import timeline is planned accordingly.

- Anti-Dumping Duties: Not applicable for this product category (no specific anti-dumping duties on polystyrene resins are currently in effect).

- Certifications Required: Confirm if flame retardant certification or material safety data sheets (MSDS) are required for customs clearance.

- Material Verification: Ensure the chemical composition and physical form (e.g., granular, powder, etc.) match the HS code description to avoid misclassification.

- Unit Price: Verify the unit price and quantity for accurate tax calculation, as customs may apply different rates based on these factors.

✅ Proactive Advice

- Double-check the product’s chemical structure and physical form to ensure correct HS code selection.

- Consult with a customs broker or import compliance expert if the product contains multiple components or additives.

- Keep updated documentation (e.g., technical data sheets, certificates of analysis) to support customs declarations.

Let me know if you need help with customs documentation or tariff calculation tools.

Product Name: Flame Retardant Polystyrene Resin

Classification: Polymers of styrene, modified with flame retardants

✅ HS CODE Classification Overview

Below are the HS codes and corresponding tax details for Flame Retardant Polystyrene Resin:

🔢 HS CODE: 3903190000

- Description: Primary form of styrene polymer, in granular form, matching the HS code definition.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the product is in its primary form and granular in structure.

🔢 HS CODE: 3903905000

- Description: Styrene polymer in its primary form, classified under "Other" within HS Chapter 3903.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is appropriate if the product is a primary form of styrene polymer and not specifically listed under other subheadings.

🔢 HS CODE: 3907400000

- Description: Flame Retardant Polystyrene Resin fits under HS Code 3907, which covers other polyesters.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the product is considered a modified polyester (e.g., with flame retardants).

🔢 HS CODE: 3907995050

- Description: This code falls under "Other polyesters: Other: Other" and is suitable for modified polyesters, including flame-retardant versions.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a more general code and may be used if the product is not clearly defined under more specific subheadings.

🔢 HS CODE: 3902900010

- Description: This code is for polybutene, a polymer of butylene.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is not appropriate for polystyrene. It may be a misclassification if the product is not polybutene.

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after this date. Ensure your import timeline is planned accordingly.

- Anti-Dumping Duties: Not applicable for this product category (no specific anti-dumping duties on polystyrene resins are currently in effect).

- Certifications Required: Confirm if flame retardant certification or material safety data sheets (MSDS) are required for customs clearance.

- Material Verification: Ensure the chemical composition and physical form (e.g., granular, powder, etc.) match the HS code description to avoid misclassification.

- Unit Price: Verify the unit price and quantity for accurate tax calculation, as customs may apply different rates based on these factors.

✅ Proactive Advice

- Double-check the product’s chemical structure and physical form to ensure correct HS code selection.

- Consult with a customs broker or import compliance expert if the product contains multiple components or additives.

- Keep updated documentation (e.g., technical data sheets, certificates of analysis) to support customs declarations.

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.