| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921901910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

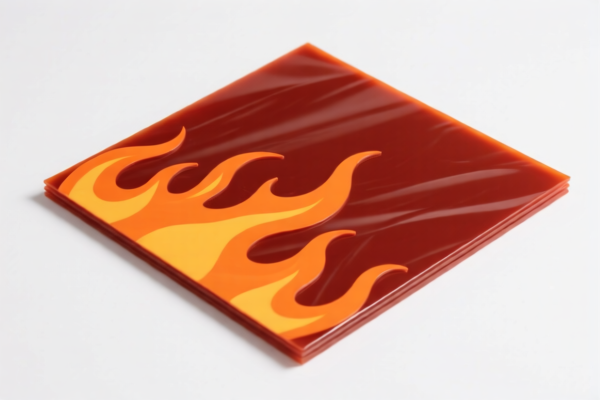

Product Classification: Flame Retardant Textile Plastic Sheets

Based on the provided HS codes and descriptions, the classification of your product depends on specific characteristics such as weight per square meter, material composition, and type of plastic used. Below is a structured breakdown of the applicable HS codes and their associated tariffs:

🔍 HS CODE: 3921902900

Description:

- Applicable to flame retardant textile plastic sheets or boards with a weight exceeding 1.492 kg/m².

- Includes plastic sheets, films, foils, and strips.

Tariff Summary:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.4%

🔍 HS CODE: 3921902550

Description:

- Applicable to flame retardant textile plastic boards combined with textile materials, weight >1.492 kg/m².

- Textile component: Synthetic fiber weight exceeds any other single fiber.

- Plastic component: Weight >70%.

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

🔍 HS CODE: 3921901100

Description:

- Applicable to plastic-textile composite flame retardant fabric combined with other textile materials, weight ≤1.492 kg/m².

- Textile component: Synthetic fiber weight exceeds any other single fiber.

- Plastic component: Weight >70%.

Tariff Summary:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

🔍 HS CODE: 3921901910

Description:

- Applicable to lightweight flame retardant textile plastic boards combined with other materials.

- Textile component: Weight exceeds any single textile fiber.

Tariff Summary:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

🔍 HS CODE: 3921904090

Description:

- Applicable to flame retardant plastic films that are flexible and not reinforced with specific materials.

- Includes plastic sheets, films, foils, and strips.

Tariff Summary:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. Ensure your import timeline aligns with this policy. -

Material Verification:

Confirm the exact composition (e.g., plastic weight percentage, textile fiber type, and total weight per square meter) to ensure correct HS code classification. -

Certifications:

Check if flame retardant certifications or safety compliance documents are required for import into your destination country. -

Unit Price and Packaging:

Be aware that tariff calculations may also depend on unit price and packaging type (e.g., bulk vs. retail).

✅ Proactive Advice:

- Consult a customs broker or HS code expert to confirm the most accurate classification based on your product’s exact specifications.

- Keep documentation on material composition, weight, and flame retardant certifications ready for customs inspection.

Product Classification: Flame Retardant Textile Plastic Sheets

Based on the provided HS codes and descriptions, the classification of your product depends on specific characteristics such as weight per square meter, material composition, and type of plastic used. Below is a structured breakdown of the applicable HS codes and their associated tariffs:

🔍 HS CODE: 3921902900

Description:

- Applicable to flame retardant textile plastic sheets or boards with a weight exceeding 1.492 kg/m².

- Includes plastic sheets, films, foils, and strips.

Tariff Summary:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.4%

🔍 HS CODE: 3921902550

Description:

- Applicable to flame retardant textile plastic boards combined with textile materials, weight >1.492 kg/m².

- Textile component: Synthetic fiber weight exceeds any other single fiber.

- Plastic component: Weight >70%.

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

🔍 HS CODE: 3921901100

Description:

- Applicable to plastic-textile composite flame retardant fabric combined with other textile materials, weight ≤1.492 kg/m².

- Textile component: Synthetic fiber weight exceeds any other single fiber.

- Plastic component: Weight >70%.

Tariff Summary:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

🔍 HS CODE: 3921901910

Description:

- Applicable to lightweight flame retardant textile plastic boards combined with other materials.

- Textile component: Weight exceeds any single textile fiber.

Tariff Summary:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

🔍 HS CODE: 3921904090

Description:

- Applicable to flame retardant plastic films that are flexible and not reinforced with specific materials.

- Includes plastic sheets, films, foils, and strips.

Tariff Summary:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. Ensure your import timeline aligns with this policy. -

Material Verification:

Confirm the exact composition (e.g., plastic weight percentage, textile fiber type, and total weight per square meter) to ensure correct HS code classification. -

Certifications:

Check if flame retardant certifications or safety compliance documents are required for import into your destination country. -

Unit Price and Packaging:

Be aware that tariff calculations may also depend on unit price and packaging type (e.g., bulk vs. retail).

✅ Proactive Advice:

- Consult a customs broker or HS code expert to confirm the most accurate classification based on your product’s exact specifications.

- Keep documentation on material composition, weight, and flame retardant certifications ready for customs inspection.

Customer Reviews

No reviews yet.