| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3903905000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3903190000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907400000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902900010 | Doc | 61.5% | CN | US | 2025-05-12 |

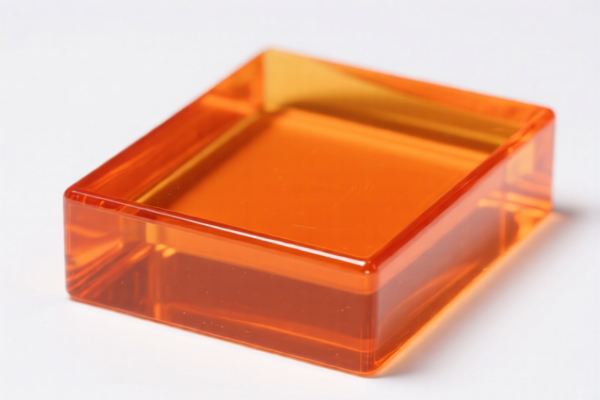

Product Name: Flame Retardant Transparent Polystyrene Resin

Classification Task: HS Code Interpretation and Tariff Analysis

✅ HS Code Interpretation and Tax Summary

Below are the HS codes and corresponding tariff details for the product Flame Retardant Transparent Polystyrene Resin. These codes are based on the Harmonized System (HS) classification for plastics and resins.

🔍 HS Code Analysis

1. HS Code: 3903905000

- Description: Polystyrene granules, in the primary form of styrene polymer, classified under "Other."

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the product is in granular form and is not modified (e.g., flame retardant additives may affect classification).

2. HS Code: 3903190000

- Description: Primary form of styrene polymer in granular form, consistent with the definition.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is also for granular styrene polymer, but may be more specific depending on the exact form and processing.

3. HS Code: 3907400000

- Description: Polycarbonate resin, under HS Code 3907.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is not applicable for polystyrene, but is included for reference.

4. HS Code: 3907995050

- Description: Polyester resin granules, under the category "Other polyesters: Other: Other."

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polyester resins, not polystyrene, and is included for reference.

5. HS Code: 3902900010

- Description: Polymer of propylene or other olefins, in primary form, classified as "Polybutene."

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polybutene, not polystyrene, and is included for reference.

⚠️ Important Notes and Recommendations

-

Tariff Increase Alert:

A special tariff of 30.0% will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is planned accordingly. -

Material Verification:

Confirm the exact chemical composition and form (e.g., granules, pellets, modified with flame retardants) to ensure correct HS code classification. -

Certifications Required:

Flame retardant additives may require safety certifications (e.g., UL, RoHS, REACH) depending on the destination country. -

Unit Price and Tax Calculation:

Verify the unit price and quantity to calculate the total import tax accurately.

📌 Proactive Advice

- Consult a customs broker or HS code expert if the product contains additives or modifications (e.g., flame retardant).

- Check for any additional duties such as anti-dumping duties or import quotas, especially for products from specific countries.

- Keep documentation (e.g., material safety data sheets, product specifications) ready for customs inspection.

Let me know if you need help with HS code confirmation, tariff calculation, or customs documentation.

Product Name: Flame Retardant Transparent Polystyrene Resin

Classification Task: HS Code Interpretation and Tariff Analysis

✅ HS Code Interpretation and Tax Summary

Below are the HS codes and corresponding tariff details for the product Flame Retardant Transparent Polystyrene Resin. These codes are based on the Harmonized System (HS) classification for plastics and resins.

🔍 HS Code Analysis

1. HS Code: 3903905000

- Description: Polystyrene granules, in the primary form of styrene polymer, classified under "Other."

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the product is in granular form and is not modified (e.g., flame retardant additives may affect classification).

2. HS Code: 3903190000

- Description: Primary form of styrene polymer in granular form, consistent with the definition.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is also for granular styrene polymer, but may be more specific depending on the exact form and processing.

3. HS Code: 3907400000

- Description: Polycarbonate resin, under HS Code 3907.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is not applicable for polystyrene, but is included for reference.

4. HS Code: 3907995050

- Description: Polyester resin granules, under the category "Other polyesters: Other: Other."

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polyester resins, not polystyrene, and is included for reference.

5. HS Code: 3902900010

- Description: Polymer of propylene or other olefins, in primary form, classified as "Polybutene."

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polybutene, not polystyrene, and is included for reference.

⚠️ Important Notes and Recommendations

-

Tariff Increase Alert:

A special tariff of 30.0% will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is planned accordingly. -

Material Verification:

Confirm the exact chemical composition and form (e.g., granules, pellets, modified with flame retardants) to ensure correct HS code classification. -

Certifications Required:

Flame retardant additives may require safety certifications (e.g., UL, RoHS, REACH) depending on the destination country. -

Unit Price and Tax Calculation:

Verify the unit price and quantity to calculate the total import tax accurately.

📌 Proactive Advice

- Consult a customs broker or HS code expert if the product contains additives or modifications (e.g., flame retardant).

- Check for any additional duties such as anti-dumping duties or import quotas, especially for products from specific countries.

- Keep documentation (e.g., material safety data sheets, product specifications) ready for customs inspection.

Let me know if you need help with HS code confirmation, tariff calculation, or customs documentation.

Customer Reviews

No reviews yet.