Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 8534000070 | Doc | 55.0% | CN | US | 2025-05-12 |

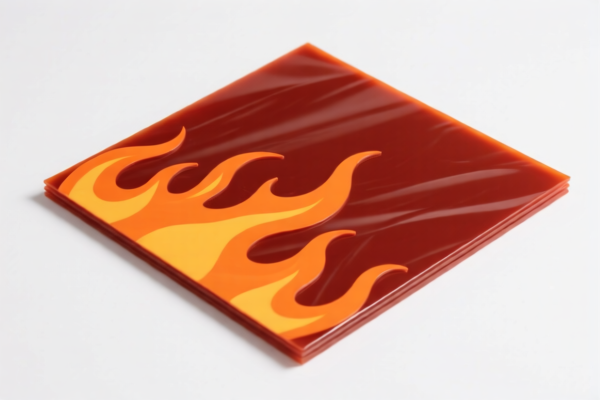

Here is the structured classification and tariff information for Flame Retardant Plastic Sheets, based on the provided HS codes and tax details:

🔍 Product Classification Overview: Flame Retardant Plastic Sheets

✅ HS CODE: 3921904090

- Description: Flexible plastic sheets, plates, films, foils, and strips, not specially reinforced

- Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code applies to flexible plastic sheets that are not reinforced.

- Flame retardant treatment may not be explicitly mentioned in the description, but it may still fall under this category depending on the material and processing.

✅ HS CODE: 3920992000

- Description: Non-cellular and non-reinforced plastic sheets, plates, films, foils, and strips

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for non-reinforced, non-cellular plastic sheets.

- Flame retardant treatment may be considered as a "combination with other materials" under this category.

✅ HS CODE: 3921905050

- Description: Plastic and its products, consistent with the description of HS CODE 3921

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is similar to 3921904090 but may include slightly different specifications or processing.

- Ensure the product description aligns with the HS CODE 3921 classification.

✅ HS CODE: 3920995000

- Description: Plastic sheets within the scope of Chapter 3920, flame retardant treatment may be interpreted as "combined with other materials in a similar way"

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for plastic sheets in Chapter 3920.

- Flame retardant treatment may be considered as a modification or combination with other materials.

✅ HS CODE: 8534000070

- Description: Printed circuits, impregnated with plastic, non-flexible type, other

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for printed circuits with plastic impregnation.

- Not directly applicable to flame retardant plastic sheets unless the product is a circuit board with plastic components.

📌 Proactive Advice for Importers

- Verify Material and Unit Price: Confirm the exact composition and processing of the plastic sheets (e.g., flame retardant treatment, reinforcement, etc.) to ensure correct HS code classification.

- Check Required Certifications: Flame retardant products may require specific certifications (e.g., UL, GB, etc.) depending on the destination country.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed codes, increasing the total tax by 30.0%. Ensure your import planning accounts for this.

- Consult Customs Authorities: For complex or borderline cases, seek clarification from customs or a qualified customs broker to avoid misclassification and penalties.

Let me know if you need help determining the most accurate HS code for your specific product. Here is the structured classification and tariff information for Flame Retardant Plastic Sheets, based on the provided HS codes and tax details:

🔍 Product Classification Overview: Flame Retardant Plastic Sheets

✅ HS CODE: 3921904090

- Description: Flexible plastic sheets, plates, films, foils, and strips, not specially reinforced

- Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code applies to flexible plastic sheets that are not reinforced.

- Flame retardant treatment may not be explicitly mentioned in the description, but it may still fall under this category depending on the material and processing.

✅ HS CODE: 3920992000

- Description: Non-cellular and non-reinforced plastic sheets, plates, films, foils, and strips

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for non-reinforced, non-cellular plastic sheets.

- Flame retardant treatment may be considered as a "combination with other materials" under this category.

✅ HS CODE: 3921905050

- Description: Plastic and its products, consistent with the description of HS CODE 3921

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is similar to 3921904090 but may include slightly different specifications or processing.

- Ensure the product description aligns with the HS CODE 3921 classification.

✅ HS CODE: 3920995000

- Description: Plastic sheets within the scope of Chapter 3920, flame retardant treatment may be interpreted as "combined with other materials in a similar way"

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for plastic sheets in Chapter 3920.

- Flame retardant treatment may be considered as a modification or combination with other materials.

✅ HS CODE: 8534000070

- Description: Printed circuits, impregnated with plastic, non-flexible type, other

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for printed circuits with plastic impregnation.

- Not directly applicable to flame retardant plastic sheets unless the product is a circuit board with plastic components.

📌 Proactive Advice for Importers

- Verify Material and Unit Price: Confirm the exact composition and processing of the plastic sheets (e.g., flame retardant treatment, reinforcement, etc.) to ensure correct HS code classification.

- Check Required Certifications: Flame retardant products may require specific certifications (e.g., UL, GB, etc.) depending on the destination country.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed codes, increasing the total tax by 30.0%. Ensure your import planning accounts for this.

- Consult Customs Authorities: For complex or borderline cases, seek clarification from customs or a qualified customs broker to avoid misclassification and penalties.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.