| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

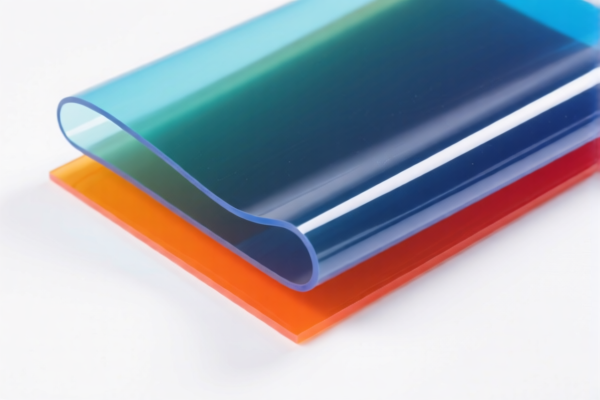

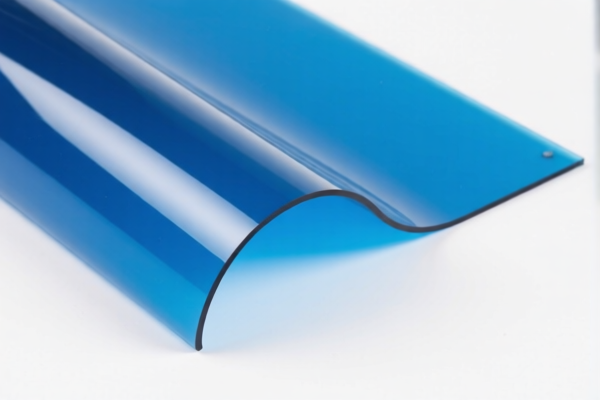

Here is the structured classification and tariff information for Flexible Acrylic Advertising Sheets, based on the provided HS codes and tax details:

✅ HS CODE: 3920511000

Product Description:

- Flexible acrylic advertising sheets, stickers, etc., made of polymethyl methacrylate (PMMA).

- Falls under HS Chapter 3920, which covers thermoplastic plates, sheets, and films.

Tariff Breakdown:

- Base Tariff Rate: 6.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.0%

✅ HS CODE: 3920598000

Product Description:

- Acrylic advertising sheets made of acrylic polymers.

- Also falls under HS Chapter 3920, but with a different subheading.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3920591000

Product Description:

- Flexible acrylic sheets or advertising boards made of acrylic polymers.

- Similar to 3920598000, but with a slightly different classification.

Tariff Breakdown:

- Base Tariff Rate: 6.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.0%

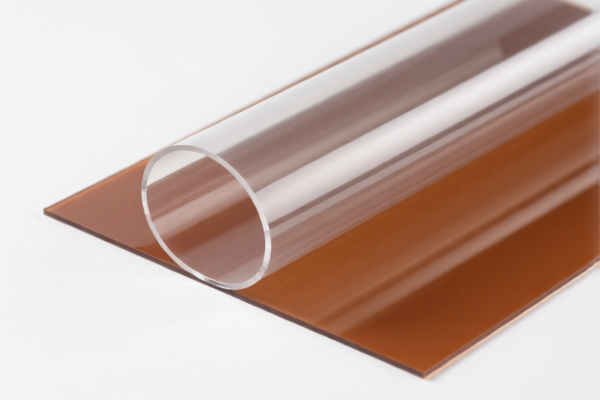

✅ HS CODE: 3920631000

Product Description:

- Flexible advertising printed sheets made of polycarbonate, alkyd resins, acrylates, or other polyesters.

- Falls under a different subheading within HS Chapter 3920.

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning. -

Material Verification:

Ensure the material composition (e.g., PMMA, acrylic polymers, polycarbonate) is clearly defined, as this directly affects the correct HS code classification. -

Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product. -

Anti-Dumping Duties:

While not explicitly mentioned in the data, be aware that anti-dumping duties may apply to certain materials (e.g., iron and aluminum) depending on the country of origin and trade agreements.

🛠️ Proactive Advice:

- Double-check the product specifications and material composition to ensure accurate HS code selection.

- If importing from countries with trade agreements (e.g., China-ASEAN, RCEP), verify if preferential tariffs apply.

- Keep updated records of tariff changes and regulatory updates to avoid unexpected costs at customs.

Let me know if you need help with certification requirements or customs documentation for these products. Here is the structured classification and tariff information for Flexible Acrylic Advertising Sheets, based on the provided HS codes and tax details:

✅ HS CODE: 3920511000

Product Description:

- Flexible acrylic advertising sheets, stickers, etc., made of polymethyl methacrylate (PMMA).

- Falls under HS Chapter 3920, which covers thermoplastic plates, sheets, and films.

Tariff Breakdown:

- Base Tariff Rate: 6.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.0%

✅ HS CODE: 3920598000

Product Description:

- Acrylic advertising sheets made of acrylic polymers.

- Also falls under HS Chapter 3920, but with a different subheading.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3920591000

Product Description:

- Flexible acrylic sheets or advertising boards made of acrylic polymers.

- Similar to 3920598000, but with a slightly different classification.

Tariff Breakdown:

- Base Tariff Rate: 6.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.0%

✅ HS CODE: 3920631000

Product Description:

- Flexible advertising printed sheets made of polycarbonate, alkyd resins, acrylates, or other polyesters.

- Falls under a different subheading within HS Chapter 3920.

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning. -

Material Verification:

Ensure the material composition (e.g., PMMA, acrylic polymers, polycarbonate) is clearly defined, as this directly affects the correct HS code classification. -

Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product. -

Anti-Dumping Duties:

While not explicitly mentioned in the data, be aware that anti-dumping duties may apply to certain materials (e.g., iron and aluminum) depending on the country of origin and trade agreements.

🛠️ Proactive Advice:

- Double-check the product specifications and material composition to ensure accurate HS code selection.

- If importing from countries with trade agreements (e.g., China-ASEAN, RCEP), verify if preferential tariffs apply.

- Keep updated records of tariff changes and regulatory updates to avoid unexpected costs at customs.

Let me know if you need help with certification requirements or customs documentation for these products.

Customer Reviews

No reviews yet.