| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

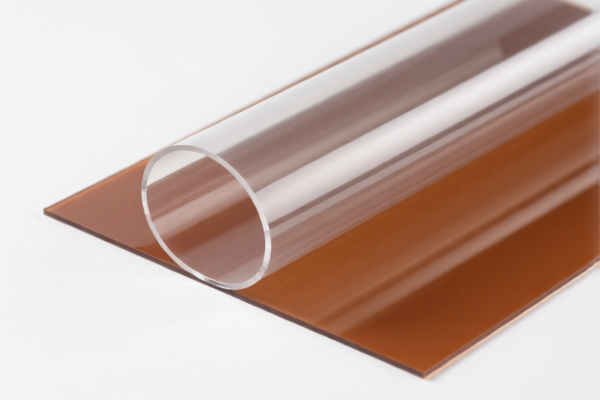

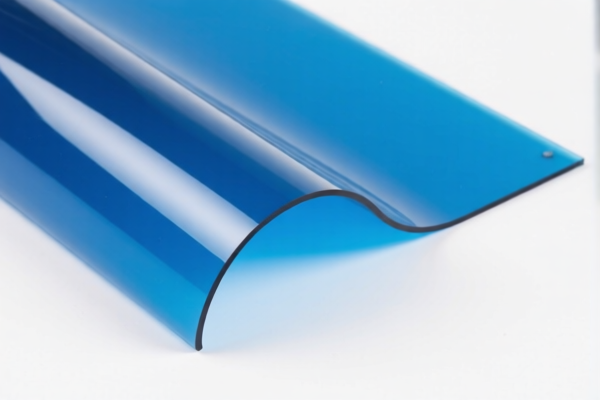

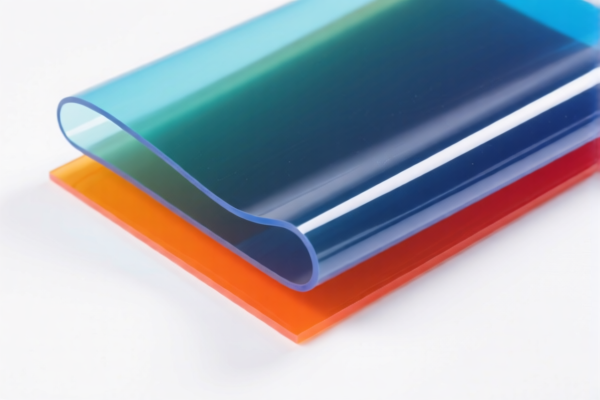

Product Name: Flexible Acrylic Decorative Sheets

Classification HS Codes and Tax Details:

- HS CODE: 3920511000

- Description: Suitable for flexible acrylic decorative materials, such as flexible advertising boards, flexible decorative films, etc.

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code is ideal for products like flexible advertising boards or decorative films.

-

HS CODE: 3920591000

- Description: Suitable for flexible acrylic sheets, flexible acrylic decorative panels, etc.

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code applies to flexible acrylic decorative panels or sheets.

-

HS CODE: 3920598000

- Description: Suitable for acrylic decorative panels based on acrylic polymers.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code is for acrylic decorative panels made from acrylic polymers.

📌 Important Notes and Recommendations:

- Time-Sensitive Policy Alert:

-

Special Tariff after April 2, 2025: A 30.0% additional tariff will be imposed on all three HS codes. Ensure your import timeline accounts for this.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are mentioned for this product category. However, always verify with the latest customs updates or consult a customs broker for confirmation.

-

Proactive Advice:

- Verify Material Composition: Confirm whether the product is made from acrylic polymers or other materials, as this can affect the correct HS code.

- Check Unit Price and Certification: Ensure you have the necessary certifications (e.g., material safety, environmental compliance) required for import.

- Consult a Customs Broker: For complex or high-value shipments, it's advisable to work with a customs expert to avoid classification errors or delays.

Let me know if you need help determining the most appropriate HS code for your specific product.

Product Name: Flexible Acrylic Decorative Sheets

Classification HS Codes and Tax Details:

- HS CODE: 3920511000

- Description: Suitable for flexible acrylic decorative materials, such as flexible advertising boards, flexible decorative films, etc.

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code is ideal for products like flexible advertising boards or decorative films.

-

HS CODE: 3920591000

- Description: Suitable for flexible acrylic sheets, flexible acrylic decorative panels, etc.

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code applies to flexible acrylic decorative panels or sheets.

-

HS CODE: 3920598000

- Description: Suitable for acrylic decorative panels based on acrylic polymers.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code is for acrylic decorative panels made from acrylic polymers.

📌 Important Notes and Recommendations:

- Time-Sensitive Policy Alert:

-

Special Tariff after April 2, 2025: A 30.0% additional tariff will be imposed on all three HS codes. Ensure your import timeline accounts for this.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are mentioned for this product category. However, always verify with the latest customs updates or consult a customs broker for confirmation.

-

Proactive Advice:

- Verify Material Composition: Confirm whether the product is made from acrylic polymers or other materials, as this can affect the correct HS code.

- Check Unit Price and Certification: Ensure you have the necessary certifications (e.g., material safety, environmental compliance) required for import.

- Consult a Customs Broker: For complex or high-value shipments, it's advisable to work with a customs expert to avoid classification errors or delays.

Let me know if you need help determining the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.