| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

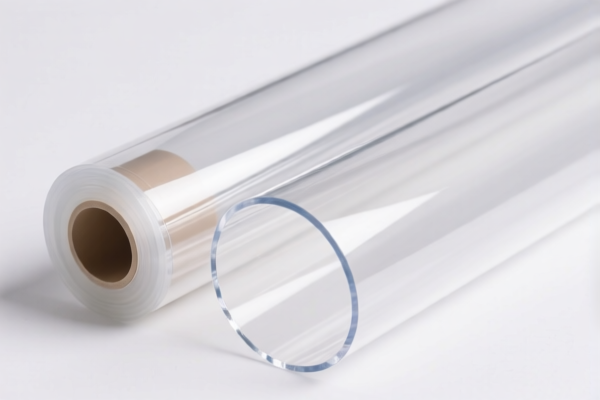

Here is the structured classification and tariff information for Flexible Acrylic Protective Film, based on the provided HS codes and tax details:

✅ HS CODE: 3920591000

Product Description: Flexible Acrylic Protective Film

Total Tax Rate: 61.0%

Breakdown of Tariffs:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

✅ HS CODE: 3920511000

Product Description:

- Flexible Acrylic Packaging Film

- Flexible Acrylic Decorative Film

- Flexible Acrylic Display Screen Protective Film

Total Tax Rate: 61.0%

Breakdown of Tariffs:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

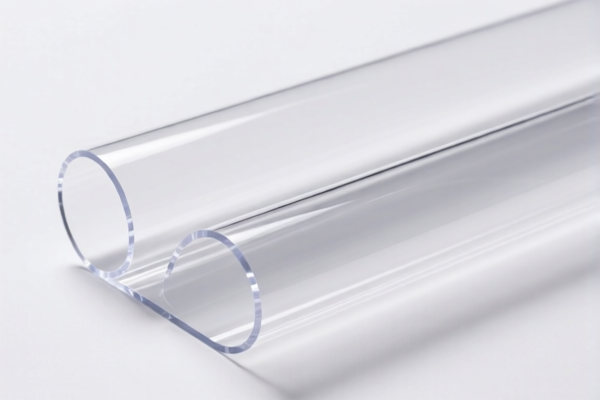

✅ HS CODE: 3920598000

Product Description: Acrylic Protective Film (general)

Total Tax Rate: 61.5%

Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. Ensure your import timeline is planned accordingly.

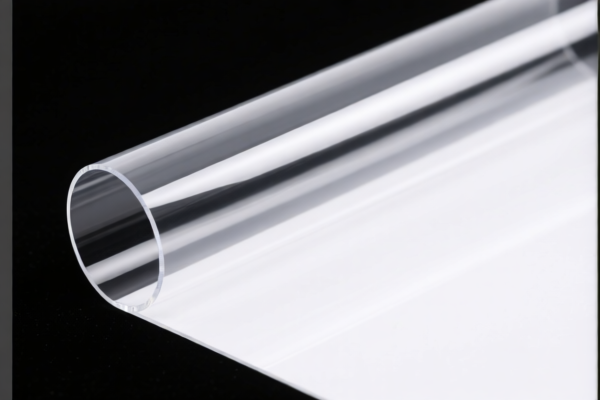

- Material Verification: Confirm the exact composition and thickness of the film, as this may affect the correct HS code classification.

- Certifications Required: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Unit Price and Classification: The final HS code may vary based on the product's intended use (e.g., packaging vs. decorative vs. screen protection). Clarify the product's end-use to ensure accurate classification.

If you have more details about the product (e.g., thickness, intended use, or country of origin), I can help refine the classification further. Here is the structured classification and tariff information for Flexible Acrylic Protective Film, based on the provided HS codes and tax details:

✅ HS CODE: 3920591000

Product Description: Flexible Acrylic Protective Film

Total Tax Rate: 61.0%

Breakdown of Tariffs:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

✅ HS CODE: 3920511000

Product Description:

- Flexible Acrylic Packaging Film

- Flexible Acrylic Decorative Film

- Flexible Acrylic Display Screen Protective Film

Total Tax Rate: 61.0%

Breakdown of Tariffs:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

✅ HS CODE: 3920598000

Product Description: Acrylic Protective Film (general)

Total Tax Rate: 61.5%

Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition and thickness of the film, as this may affect the correct HS code classification.

- Certifications Required: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Unit Price and Classification: The final HS code may vary based on the product's intended use (e.g., packaging vs. decorative vs. screen protection). Clarify the product's end-use to ensure accurate classification.

If you have more details about the product (e.g., thickness, intended use, or country of origin), I can help refine the classification further.

Customer Reviews

No reviews yet.