| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

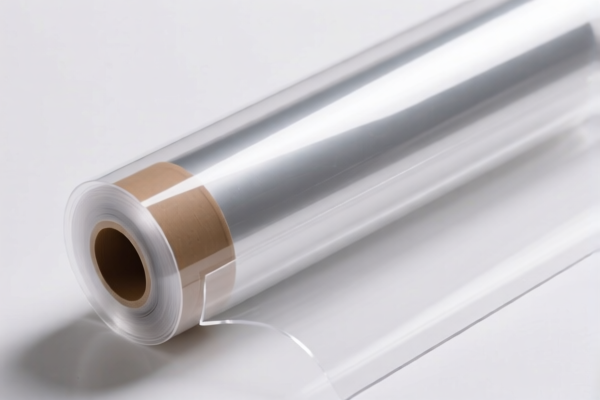

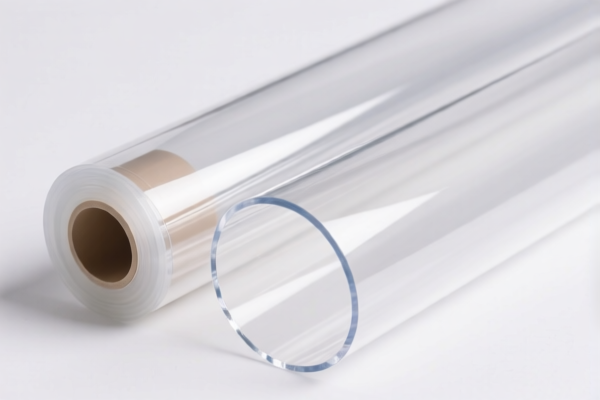

Product Name: Flexible Acrylic Transparent Protective Film

HS CODE: 3920511000 or 3920591000 (depending on specific product description)

🔍 HS Code Classification Overview

- HS CODE 3920511000

- Product Types: Flexible acrylic decorative film, flexible acrylic packaging film, flexible acrylic scratch-resistant film

- HS CODE 3920591000

- Product Types: Flexible acrylic film, acrylic transparent film

Both codes fall under Chapter 39 (Plastics and articles thereof), and more specifically under Heading 3920 (Plastics and articles thereof, of plastics, other than those of heading 3917, 3918 or 3919), with further classification based on the type of plastic and product use.

📊 Tariff Breakdown (as of current regulations)

- Base Tariff Rate: 6.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.0% (6.0% + 25.0% + 30.0%)

⚠️ Important Note: The additional 30.0% tariff applies after April 11, 2025. Ensure your customs clearance is completed before this date to avoid the higher rate.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm that the product is made of acrylic (PMMA) and not another type of plastic (e.g., PVC or polystyrene), as this affects HS code classification.

- Product Use: The classification may vary based on the intended use (e.g., decorative, packaging, or protective). Ensure the product description aligns with the HS code.

- Unit Price: Customs may assess the product based on unit price, so ensure accurate pricing documentation is provided.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

📢 Proactive Advice

- Double-check the product description to ensure it matches the HS code used (e.g., "transparent" or "scratch-resistant" may influence classification).

- Consult with a customs broker or local customs authority if the product is used in a specialized application (e.g., industrial or medical).

- Monitor policy updates after April 11, 2025, as the additional tariff may be extended or modified.

Let me know if you need help with a specific product description or customs documentation!

Product Name: Flexible Acrylic Transparent Protective Film

HS CODE: 3920511000 or 3920591000 (depending on specific product description)

🔍 HS Code Classification Overview

- HS CODE 3920511000

- Product Types: Flexible acrylic decorative film, flexible acrylic packaging film, flexible acrylic scratch-resistant film

- HS CODE 3920591000

- Product Types: Flexible acrylic film, acrylic transparent film

Both codes fall under Chapter 39 (Plastics and articles thereof), and more specifically under Heading 3920 (Plastics and articles thereof, of plastics, other than those of heading 3917, 3918 or 3919), with further classification based on the type of plastic and product use.

📊 Tariff Breakdown (as of current regulations)

- Base Tariff Rate: 6.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.0% (6.0% + 25.0% + 30.0%)

⚠️ Important Note: The additional 30.0% tariff applies after April 11, 2025. Ensure your customs clearance is completed before this date to avoid the higher rate.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm that the product is made of acrylic (PMMA) and not another type of plastic (e.g., PVC or polystyrene), as this affects HS code classification.

- Product Use: The classification may vary based on the intended use (e.g., decorative, packaging, or protective). Ensure the product description aligns with the HS code.

- Unit Price: Customs may assess the product based on unit price, so ensure accurate pricing documentation is provided.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

📢 Proactive Advice

- Double-check the product description to ensure it matches the HS code used (e.g., "transparent" or "scratch-resistant" may influence classification).

- Consult with a customs broker or local customs authority if the product is used in a specialized application (e.g., industrial or medical).

- Monitor policy updates after April 11, 2025, as the additional tariff may be extended or modified.

Let me know if you need help with a specific product description or customs documentation!

Customer Reviews

No reviews yet.