| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920610000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

Here is the structured customs compliance analysis for Flexible Polycarbonate Advertising Boards, based on the provided HS codes and tax details:

✅ Product Classification Overview

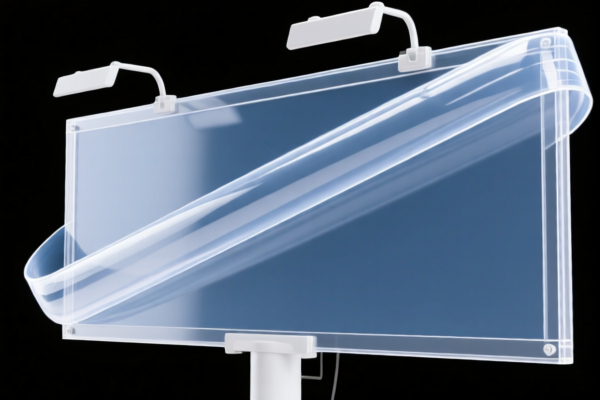

Product Name: Flexible Polycarbonate Advertising Board

Material: Polycarbonate (PC), with variations including polyester and acrylic (PMMA) in some classifications.

📦 Applicable HS Codes and Tax Rates

- HS CODE: 3920632000

- Description: Polycarbonate advertising board

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

-

Note: This is the most common code for flexible polycarbonate advertising boards.

-

HS CODE: 3920610000

- Description: Polycarbonate advertising board

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

-

Note: Similar to 3920632000, but may apply to different product specifications or formats.

-

HS CODE: 3920631000

- Description: Ad printed flexible board (likely polycarbonate)

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

-

Note: May apply if the board is pre-printed or has specific design features.

-

HS CODE: 3920511000

- Description: Acrylic flexible advertising board

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

-

Note: Applies to acrylic-based boards, not polycarbonate.

-

HS CODE: 3920690000

- Description: Polyester advertising board

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: Applies to polyester-based boards, which may be a substitute for polycarbonate.

⚠️ Important Policy Notes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for polycarbonate or polyester advertising boards in the provided data. However, it is advisable to verify if any anti-dumping measures are currently in effect for similar products.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of polycarbonate, polyester, or acrylic, as this will determine the correct HS code.

- Check Unit Price and Certification: Some HS codes may require specific certifications (e.g., safety, environmental compliance) depending on the product's use.

- Monitor Tariff Changes: The April 11, 2025 tariff increase is a key date to note for budgeting and compliance.

- Consult Customs Broker: For accurate classification and to avoid delays, consider working with a customs broker or using a customs compliance tool.

Let me know if you need help determining the most accurate HS code for your specific product. Here is the structured customs compliance analysis for Flexible Polycarbonate Advertising Boards, based on the provided HS codes and tax details:

✅ Product Classification Overview

Product Name: Flexible Polycarbonate Advertising Board

Material: Polycarbonate (PC), with variations including polyester and acrylic (PMMA) in some classifications.

📦 Applicable HS Codes and Tax Rates

- HS CODE: 3920632000

- Description: Polycarbonate advertising board

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

-

Note: This is the most common code for flexible polycarbonate advertising boards.

-

HS CODE: 3920610000

- Description: Polycarbonate advertising board

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

-

Note: Similar to 3920632000, but may apply to different product specifications or formats.

-

HS CODE: 3920631000

- Description: Ad printed flexible board (likely polycarbonate)

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

-

Note: May apply if the board is pre-printed or has specific design features.

-

HS CODE: 3920511000

- Description: Acrylic flexible advertising board

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

-

Note: Applies to acrylic-based boards, not polycarbonate.

-

HS CODE: 3920690000

- Description: Polyester advertising board

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: Applies to polyester-based boards, which may be a substitute for polycarbonate.

⚠️ Important Policy Notes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for polycarbonate or polyester advertising boards in the provided data. However, it is advisable to verify if any anti-dumping measures are currently in effect for similar products.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of polycarbonate, polyester, or acrylic, as this will determine the correct HS code.

- Check Unit Price and Certification: Some HS codes may require specific certifications (e.g., safety, environmental compliance) depending on the product's use.

- Monitor Tariff Changes: The April 11, 2025 tariff increase is a key date to note for budgeting and compliance.

- Consult Customs Broker: For accurate classification and to avoid delays, consider working with a customs broker or using a customs compliance tool.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.