| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920610000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

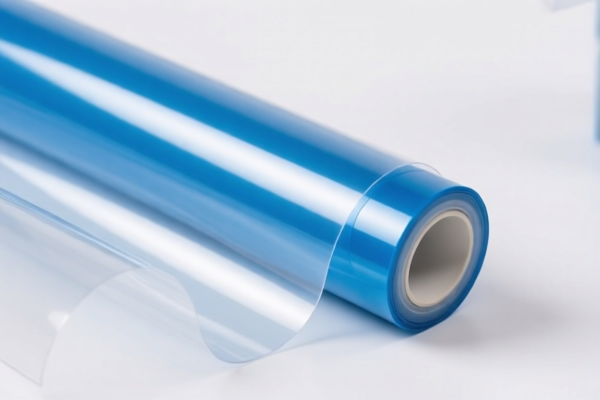

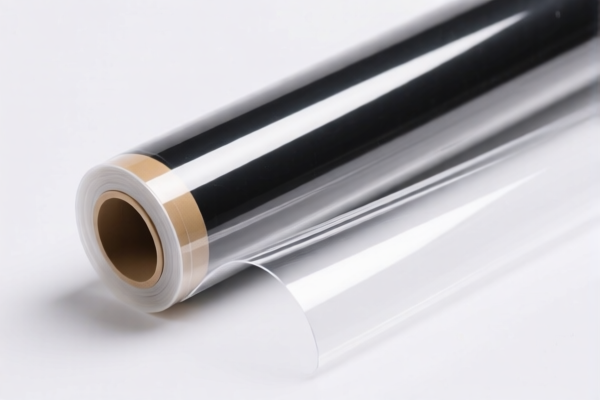

Product Name: Flexible Polycarbonate Protective Film

HS Code Classification Overview:

- HS CODE: 3920631000

- Description: Flexible Polycarbonate Film, Protective Film for Flexible Polyester Film, Polycarbonate Protective Film

- Total Tax Rate: 59.2%

-

Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920610000

- Description: Polycarbonate Protective Film

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920632000

- Description: Polycarbonate Protective Film

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- Tariff Increase Alert:

-

Starting April 11, 2025, an additional 30.0% tariff will be applied to all three HS codes. This is a significant increase and may impact your import costs. Ensure you plan accordingly for this change.

-

Material Verification:

-

Confirm the material composition of the product (e.g., whether it is polycarbonate or polyester-based) to ensure correct HS code classification. Misclassification can lead to penalties or delays.

-

Unit Price and Certification:

-

Check the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

-

Anti-Dumping Duties:

- While not explicitly mentioned in the data, be aware that anti-dumping duties may apply to certain materials (e.g., iron and aluminum) depending on the country of origin and local trade policies. Confirm with customs or a trade compliance expert if applicable.

✅ Proactive Advice:

- Double-check the product description to ensure it aligns with the HS code used (e.g., "flexible" vs. "rigid" or "protective" vs. "general use").

- Consult with customs brokers or trade compliance experts to confirm the most up-to-date classification and tariff rates, especially with the upcoming April 11, 2025, changes.

-

Keep records of product specifications, supplier information, and any certifications to support customs declarations. Product Name: Flexible Polycarbonate Protective Film

HS Code Classification Overview: -

HS CODE: 3920631000

- Description: Flexible Polycarbonate Film, Protective Film for Flexible Polyester Film, Polycarbonate Protective Film

- Total Tax Rate: 59.2%

-

Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920610000

- Description: Polycarbonate Protective Film

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920632000

- Description: Polycarbonate Protective Film

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- Tariff Increase Alert:

-

Starting April 11, 2025, an additional 30.0% tariff will be applied to all three HS codes. This is a significant increase and may impact your import costs. Ensure you plan accordingly for this change.

-

Material Verification:

-

Confirm the material composition of the product (e.g., whether it is polycarbonate or polyester-based) to ensure correct HS code classification. Misclassification can lead to penalties or delays.

-

Unit Price and Certification:

-

Check the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

-

Anti-Dumping Duties:

- While not explicitly mentioned in the data, be aware that anti-dumping duties may apply to certain materials (e.g., iron and aluminum) depending on the country of origin and local trade policies. Confirm with customs or a trade compliance expert if applicable.

✅ Proactive Advice:

- Double-check the product description to ensure it aligns with the HS code used (e.g., "flexible" vs. "rigid" or "protective" vs. "general use").

- Consult with customs brokers or trade compliance experts to confirm the most up-to-date classification and tariff rates, especially with the upcoming April 11, 2025, changes.

- Keep records of product specifications, supplier information, and any certifications to support customs declarations.

Customer Reviews

No reviews yet.