| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907400000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

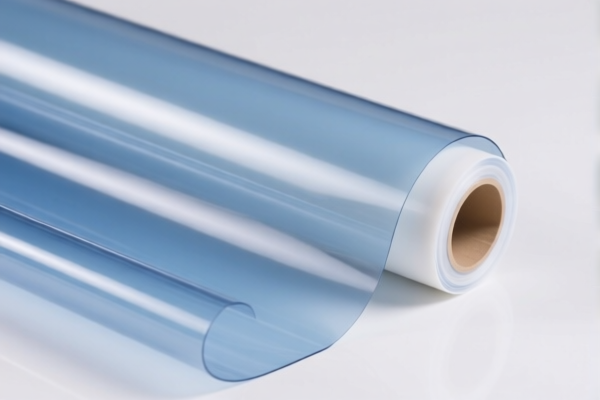

Product Name: Flexible Polycarbonate Resin Film

Classification HS Code Analysis:

- HS CODE: 3907400000

- Product Description: Polycarbonate Resin Film

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is specifically for polycarbonate resin film, which is a rigid classification. Ensure the product is indeed made of polycarbonate and not a blend or composite.

-

HS CODE: 3920631000

- Product Description: Polycarbonate Flexible Film

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for flexible polycarbonate film. Confirm the product is flexible and not rigid.

-

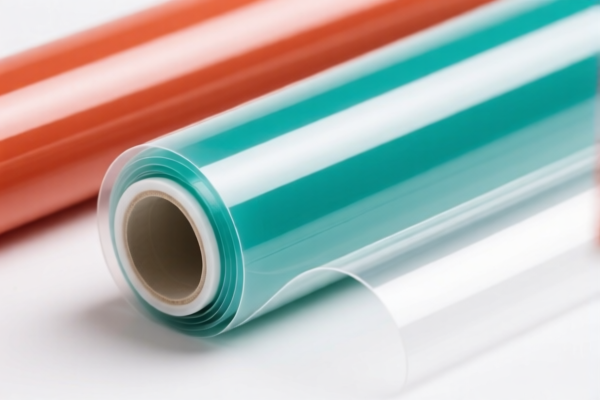

HS CODE: 3920992000

- Product Description: Polyester Flexible Film / Polystyrene Flexible Film

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for flexible films made of polyester or polystyrene. Ensure the product is not polycarbonate, as it would fall under a different HS code.

📌 Key Tax Rate Changes (April 11, 2025 onwards):

- All listed HS codes will see an increase in the additional tariff from 25.0% to 30.0% after April 11, 2025.

- This is a time-sensitive policy, so importers must plan accordingly to avoid unexpected costs.

🛠️ Proactive Advice for Importers:

- Verify Material Composition: Confirm whether the product is made of polycarbonate, polyester, or polystyrene, as this determines the correct HS code.

- Check Unit Price and Specifications: Ensure the product description matches the HS code classification (e.g., "flexible" vs. "rigid").

- Certifications Required: Some HS codes may require specific certifications (e.g., RoHS, REACH) depending on the destination country.

- Consult Customs Broker: For accurate classification and to avoid penalties, it is recommended to work with a customs broker or compliance expert.

Let me know if you need help determining the correct HS code based on your product's specifications.

Product Name: Flexible Polycarbonate Resin Film

Classification HS Code Analysis:

- HS CODE: 3907400000

- Product Description: Polycarbonate Resin Film

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is specifically for polycarbonate resin film, which is a rigid classification. Ensure the product is indeed made of polycarbonate and not a blend or composite.

-

HS CODE: 3920631000

- Product Description: Polycarbonate Flexible Film

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for flexible polycarbonate film. Confirm the product is flexible and not rigid.

-

HS CODE: 3920992000

- Product Description: Polyester Flexible Film / Polystyrene Flexible Film

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for flexible films made of polyester or polystyrene. Ensure the product is not polycarbonate, as it would fall under a different HS code.

📌 Key Tax Rate Changes (April 11, 2025 onwards):

- All listed HS codes will see an increase in the additional tariff from 25.0% to 30.0% after April 11, 2025.

- This is a time-sensitive policy, so importers must plan accordingly to avoid unexpected costs.

🛠️ Proactive Advice for Importers:

- Verify Material Composition: Confirm whether the product is made of polycarbonate, polyester, or polystyrene, as this determines the correct HS code.

- Check Unit Price and Specifications: Ensure the product description matches the HS code classification (e.g., "flexible" vs. "rigid").

- Certifications Required: Some HS codes may require specific certifications (e.g., RoHS, REACH) depending on the destination country.

- Consult Customs Broker: For accurate classification and to avoid penalties, it is recommended to work with a customs broker or compliance expert.

Let me know if you need help determining the correct HS code based on your product's specifications.

Customer Reviews

No reviews yet.