Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

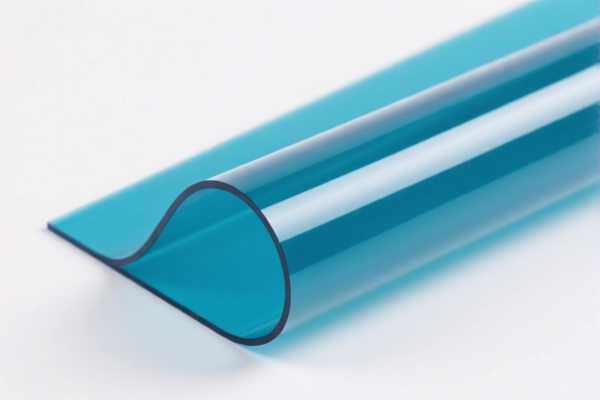

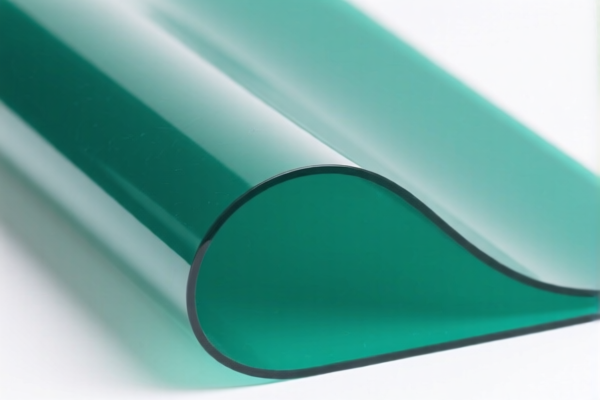

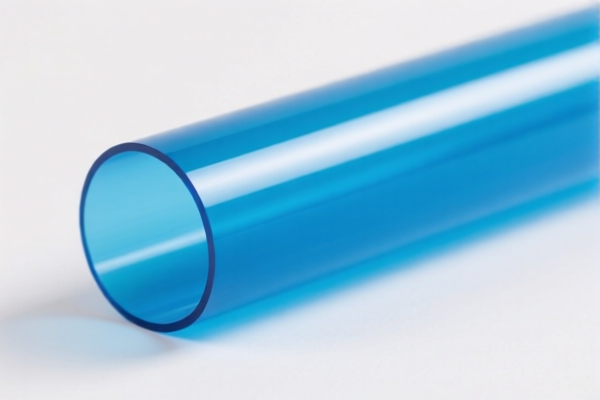

Product Name: Flexible Polycarbonate Resin Sheet

HS CODE: 3920631000

🔍 Classification Summary:

- Product Type: Flexible polycarbonate resin sheets, films, plates, etc.

- HS Code: 3920631000 (10-digit code)

- Tariff Summary: 59.2% total tax rate

📊 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

⚠️ Important Policy Notes:

- April 11 Special Tariff: Not applicable for this HS code.

- Anti-dumping duties on iron and aluminum: Not applicable for this product category.

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm that the product is indeed made of polycarbonate resin and not a different polymer (e.g., polyester).

- Check Unit Price and Quantity: Tariff calculations may vary based on the declared value and quantity.

- Certifications Required: Ensure that the product complies with any relevant import certifications or standards (e.g., RoHS, REACH, etc.).

- Monitor Tariff Updates: Be aware of the April 2, 2025 deadline for the special tariff increase. Adjust your import strategy accordingly.

📚 Example:

If you import 100 kg of flexible polycarbonate resin sheets with a unit price of $10/kg, the total tax would be calculated as follows:

- Total Value: $1,000

- Base Tariff (4.2%): $42

- Additional Tariff (25%): $250

- Special Tariff (30% after April 2, 2025): $300

- Total Tax (after April 2, 2025): $592 (59.2% of $1,000)

Let me know if you need help with customs documentation or further classification details.

Product Name: Flexible Polycarbonate Resin Sheet

HS CODE: 3920631000

🔍 Classification Summary:

- Product Type: Flexible polycarbonate resin sheets, films, plates, etc.

- HS Code: 3920631000 (10-digit code)

- Tariff Summary: 59.2% total tax rate

📊 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

⚠️ Important Policy Notes:

- April 11 Special Tariff: Not applicable for this HS code.

- Anti-dumping duties on iron and aluminum: Not applicable for this product category.

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm that the product is indeed made of polycarbonate resin and not a different polymer (e.g., polyester).

- Check Unit Price and Quantity: Tariff calculations may vary based on the declared value and quantity.

- Certifications Required: Ensure that the product complies with any relevant import certifications or standards (e.g., RoHS, REACH, etc.).

- Monitor Tariff Updates: Be aware of the April 2, 2025 deadline for the special tariff increase. Adjust your import strategy accordingly.

📚 Example:

If you import 100 kg of flexible polycarbonate resin sheets with a unit price of $10/kg, the total tax would be calculated as follows:

- Total Value: $1,000

- Base Tariff (4.2%): $42

- Additional Tariff (25%): $250

- Special Tariff (30% after April 2, 2025): $300

- Total Tax (after April 2, 2025): $592 (59.2% of $1,000)

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.