Found 2 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Flexible Polycarbonate Scratch Resistant Sheet, based on the provided HS codes and tax details:

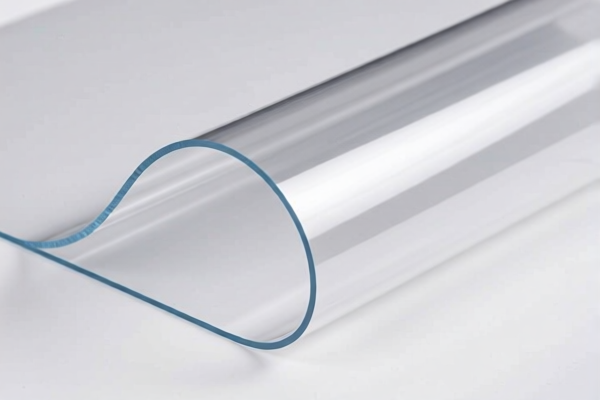

✅ Product Classification: Flexible Polycarbonate Scratch Resistant Sheet

📌 HS Code 3920631000

- Description: Flexible Polycarbonate Scratch Resistant Sheet (flexible polycarbonate plastic sheet)

- Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code applies to flexible polycarbonate sheets that are scratch-resistant.

- The 30.0% additional tariff is applicable after April 11, 2025.

📌 HS Code 3920632000

- Description: Non-cellular and non-reinforced plastic sheets (may include polycarbonate)

- Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for non-cellular and non-reinforced plastic sheets, which may include polycarbonate.

- The 30.0% additional tariff is also applicable after April 11, 2025.

⚠️ Important Reminders for Importers

- Verify Material Composition: Ensure the product is indeed made of polycarbonate and not a different type of plastic, as this will affect the correct HS code.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., safety, environmental compliance) are required for import.

- Monitor Tariff Changes: The 30.0% additional tariff after April 11, 2025, is a time-sensitive policy and may significantly increase the total cost.

- Anti-Dumping Duties: While not explicitly mentioned here, be aware that anti-dumping duties may apply to iron and aluminum products, but not directly to polycarbonate sheets.

📌 Proactive Advice

- Consult a Customs Broker: For accurate classification and to avoid delays in customs clearance.

- Update Product Documentation: Ensure all product descriptions, specifications, and certifications are up-to-date and match the HS code.

- Track Policy Updates: Stay informed about any new trade policies or tariff adjustments, especially after April 11, 2025.

Let me know if you need help determining which HS code applies to your specific product. Here is the structured classification and tariff information for Flexible Polycarbonate Scratch Resistant Sheet, based on the provided HS codes and tax details:

✅ Product Classification: Flexible Polycarbonate Scratch Resistant Sheet

📌 HS Code 3920631000

- Description: Flexible Polycarbonate Scratch Resistant Sheet (flexible polycarbonate plastic sheet)

- Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code applies to flexible polycarbonate sheets that are scratch-resistant.

- The 30.0% additional tariff is applicable after April 11, 2025.

📌 HS Code 3920632000

- Description: Non-cellular and non-reinforced plastic sheets (may include polycarbonate)

- Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for non-cellular and non-reinforced plastic sheets, which may include polycarbonate.

- The 30.0% additional tariff is also applicable after April 11, 2025.

⚠️ Important Reminders for Importers

- Verify Material Composition: Ensure the product is indeed made of polycarbonate and not a different type of plastic, as this will affect the correct HS code.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., safety, environmental compliance) are required for import.

- Monitor Tariff Changes: The 30.0% additional tariff after April 11, 2025, is a time-sensitive policy and may significantly increase the total cost.

- Anti-Dumping Duties: While not explicitly mentioned here, be aware that anti-dumping duties may apply to iron and aluminum products, but not directly to polycarbonate sheets.

📌 Proactive Advice

- Consult a Customs Broker: For accurate classification and to avoid delays in customs clearance.

- Update Product Documentation: Ensure all product descriptions, specifications, and certifications are up-to-date and match the HS code.

- Track Policy Updates: Stay informed about any new trade policies or tariff adjustments, especially after April 11, 2025.

Let me know if you need help determining which HS code applies to your specific product.

Customer Reviews

No reviews yet.