Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920610000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

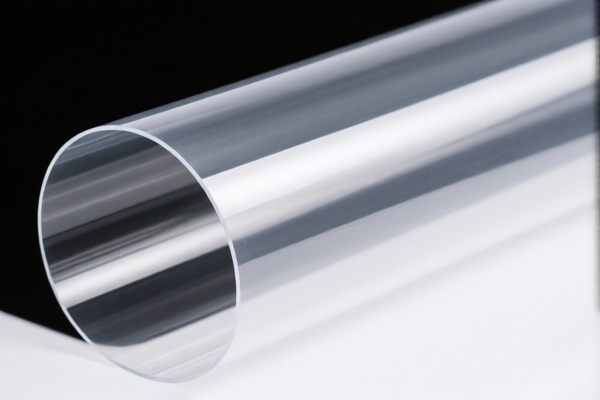

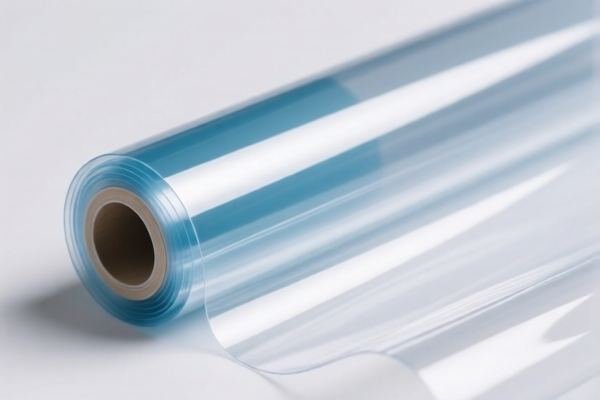

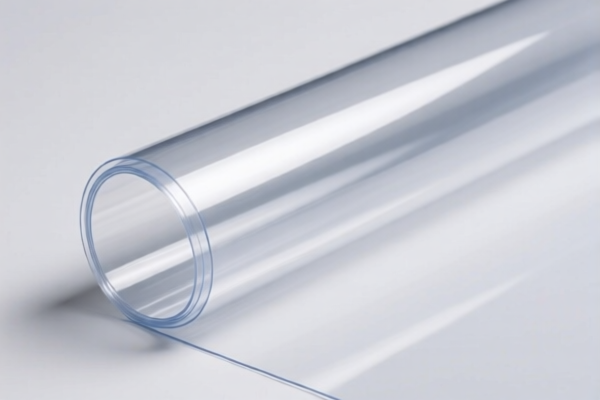

Product Name: Flexible Polycarbonate Transparent Film

Classification HS Code: 3920631000

🔍 HS Code Details:

- Full HS Code: 3920631000

- Description: Flexible polycarbonate transparent film (or similar flexible plastic films)

- Total Tax Rate: 59.2%

📊 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Note: This is a time-sensitive policy. Ensure compliance after April 11, 2025.

⚠️ Important Notes:

- April 11 Special Tariff:

- Starting from April 11, 2025, an additional 30.0% tariff will be applied. This is a significant increase from the standard 25.0% additional tariff.

-

Impact: Total tax rate will jump to 59.2% (4.2% base + 30.0% special).

-

Anti-dumping duties:

- No specific anti-dumping duties are listed for this product in the provided data. However, always verify with the latest customs notices or consult a customs broker for any potential anti-dumping or countervailing duties.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is indeed made of polycarbonate and not a different polymer (e.g., polyester), as this can affect classification.

- Check Unit Price and Packaging: Tariff rates may vary based on the product's unit price and whether it's imported in bulk or retail packaging.

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are needed for the product in the destination country.

- Consult Customs Broker: For accurate classification and to avoid delays in customs clearance, especially with the upcoming April 11, 2025, tariff changes.

📚 Summary Table:

| Tariff Component | Rate |

|---|---|

| Base Tariff | 4.2% |

| General Additional Tariff | 25.0% |

| April 11 Special Tariff | 30.0% |

| Total Tax Rate | 59.2% |

Let me know if you need help with customs documentation or further clarification on the classification.

Product Name: Flexible Polycarbonate Transparent Film

Classification HS Code: 3920631000

🔍 HS Code Details:

- Full HS Code: 3920631000

- Description: Flexible polycarbonate transparent film (or similar flexible plastic films)

- Total Tax Rate: 59.2%

📊 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Note: This is a time-sensitive policy. Ensure compliance after April 11, 2025.

⚠️ Important Notes:

- April 11 Special Tariff:

- Starting from April 11, 2025, an additional 30.0% tariff will be applied. This is a significant increase from the standard 25.0% additional tariff.

-

Impact: Total tax rate will jump to 59.2% (4.2% base + 30.0% special).

-

Anti-dumping duties:

- No specific anti-dumping duties are listed for this product in the provided data. However, always verify with the latest customs notices or consult a customs broker for any potential anti-dumping or countervailing duties.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is indeed made of polycarbonate and not a different polymer (e.g., polyester), as this can affect classification.

- Check Unit Price and Packaging: Tariff rates may vary based on the product's unit price and whether it's imported in bulk or retail packaging.

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are needed for the product in the destination country.

- Consult Customs Broker: For accurate classification and to avoid delays in customs clearance, especially with the upcoming April 11, 2025, tariff changes.

📚 Summary Table:

| Tariff Component | Rate |

|---|---|

| Base Tariff | 4.2% |

| General Additional Tariff | 25.0% |

| April 11 Special Tariff | 30.0% |

| Total Tax Rate | 59.2% |

Let me know if you need help with customs documentation or further clarification on the classification.

Customer Reviews

No reviews yet.