Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920511000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

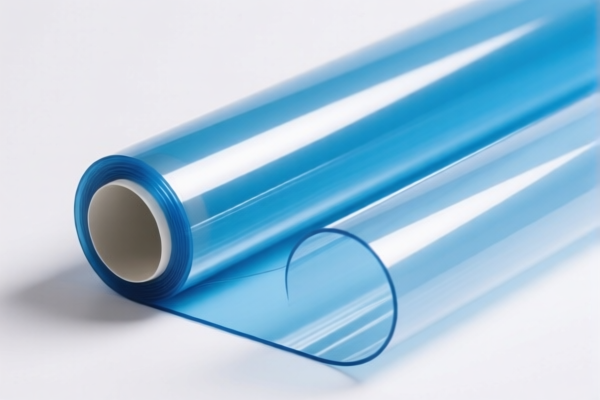

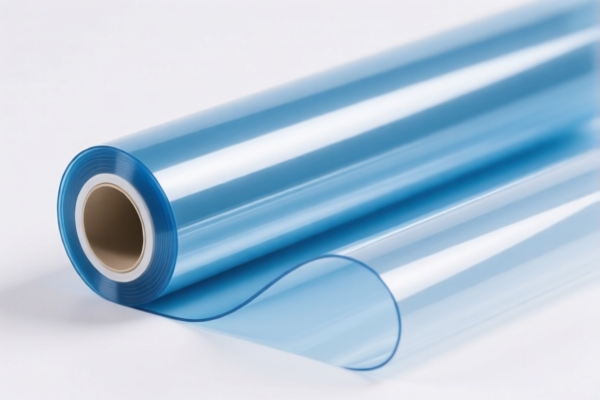

Product Classification and Tax Information for "Flexible Polycarbonate UV Protection Film"

HS CODE: 3920631000

Product Description: Flexible Polycarbonate UV Protection Film

Total Tax Rate: 59.2%

🔍 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff Imposed After April 11, 2025: 30.0%

- Note: This is a time-sensitive policy. Ensure your customs clearance is completed before this date to avoid higher tariffs.

📌 Key Considerations:

- Material Verification: Confirm that the product is indeed made of polycarbonate and not another type of plastic (e.g., polyester or acrylic), as this can affect the HS code and applicable tariffs.

- Unit Price and Certification: Check the unit price for accurate tax calculation. Some customs authorities may require specific certifications (e.g., UV protection standards) to confirm product compliance.

- Alternative HS Codes: If the product is made of materials other than polycarbonate (e.g., acrylic), consider HS code 3920511000 (e.g., "Methacrylic Acid Esters Flexible UV-Resistant Film"), which has a higher total tax rate of 61.0%.

⚠️ Proactive Advice:

- Verify Material Composition: Ensure the product is correctly classified as polycarbonate and not mislabeled or misclassified.

- Check for Additional Tariffs: Be aware of the April 11, 2025 deadline for the special tariff increase. Plan your import schedule accordingly.

- Consult Customs Authority: If in doubt, consult local customs or a customs broker to confirm the most up-to-date classification and tax implications.

Let me know if you need help with customs documentation or tariff calculation tools. Product Classification and Tax Information for "Flexible Polycarbonate UV Protection Film"

HS CODE: 3920631000

Product Description: Flexible Polycarbonate UV Protection Film

Total Tax Rate: 59.2%

🔍 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff Imposed After April 11, 2025: 30.0%

- Note: This is a time-sensitive policy. Ensure your customs clearance is completed before this date to avoid higher tariffs.

📌 Key Considerations:

- Material Verification: Confirm that the product is indeed made of polycarbonate and not another type of plastic (e.g., polyester or acrylic), as this can affect the HS code and applicable tariffs.

- Unit Price and Certification: Check the unit price for accurate tax calculation. Some customs authorities may require specific certifications (e.g., UV protection standards) to confirm product compliance.

- Alternative HS Codes: If the product is made of materials other than polycarbonate (e.g., acrylic), consider HS code 3920511000 (e.g., "Methacrylic Acid Esters Flexible UV-Resistant Film"), which has a higher total tax rate of 61.0%.

⚠️ Proactive Advice:

- Verify Material Composition: Ensure the product is correctly classified as polycarbonate and not mislabeled or misclassified.

- Check for Additional Tariffs: Be aware of the April 11, 2025 deadline for the special tariff increase. Plan your import schedule accordingly.

- Consult Customs Authority: If in doubt, consult local customs or a customs broker to confirm the most up-to-date classification and tax implications.

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.